As global markets respond positively to new trade deals, pushing indices like the S&P 500 and Nasdaq Composite to record highs, Asian markets are also experiencing a surge in investor optimism. This environment highlights the potential of dividend stocks in Asia as they offer a combination of income and stability, which can be particularly appealing amid fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.71% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.23% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.14% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.55% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.97% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.91% | ★★★★★★ |

Click here to see the full list of 1154 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

PAX Global Technology (SEHK:327)

Simply Wall St Dividend Rating: ★★★★★★

Overview: PAX Global Technology Limited is an investment holding company that develops and sells electronic funds transfer point-of-sale products across Hong Kong, the People’s Republic of China, the United States, and Italy, with a market capitalization of approximately HK$7.21 billion.

Operations: PAX Global Technology Limited generates revenue primarily from its e-Payment Terminal Solutions Business, which amounted to HK$6.04 billion.

Dividend Yield: 7.3%

PAX Global Technology offers a high dividend yield of 7.34%, placing it in the top 25% of Hong Kong dividend payers. Its dividends are reliably covered by earnings and cash flows, with a stable payout history over the past decade. The stock trades at a favorable price-to-earnings ratio compared to the market, enhancing its appeal as a value investment. Recent executive changes may influence strategic direction but do not directly impact its strong dividend profile.

- Dive into the specifics of PAX Global Technology here with our thorough dividend report.

- According our valuation report, there's an indication that PAX Global Technology's share price might be on the cheaper side.

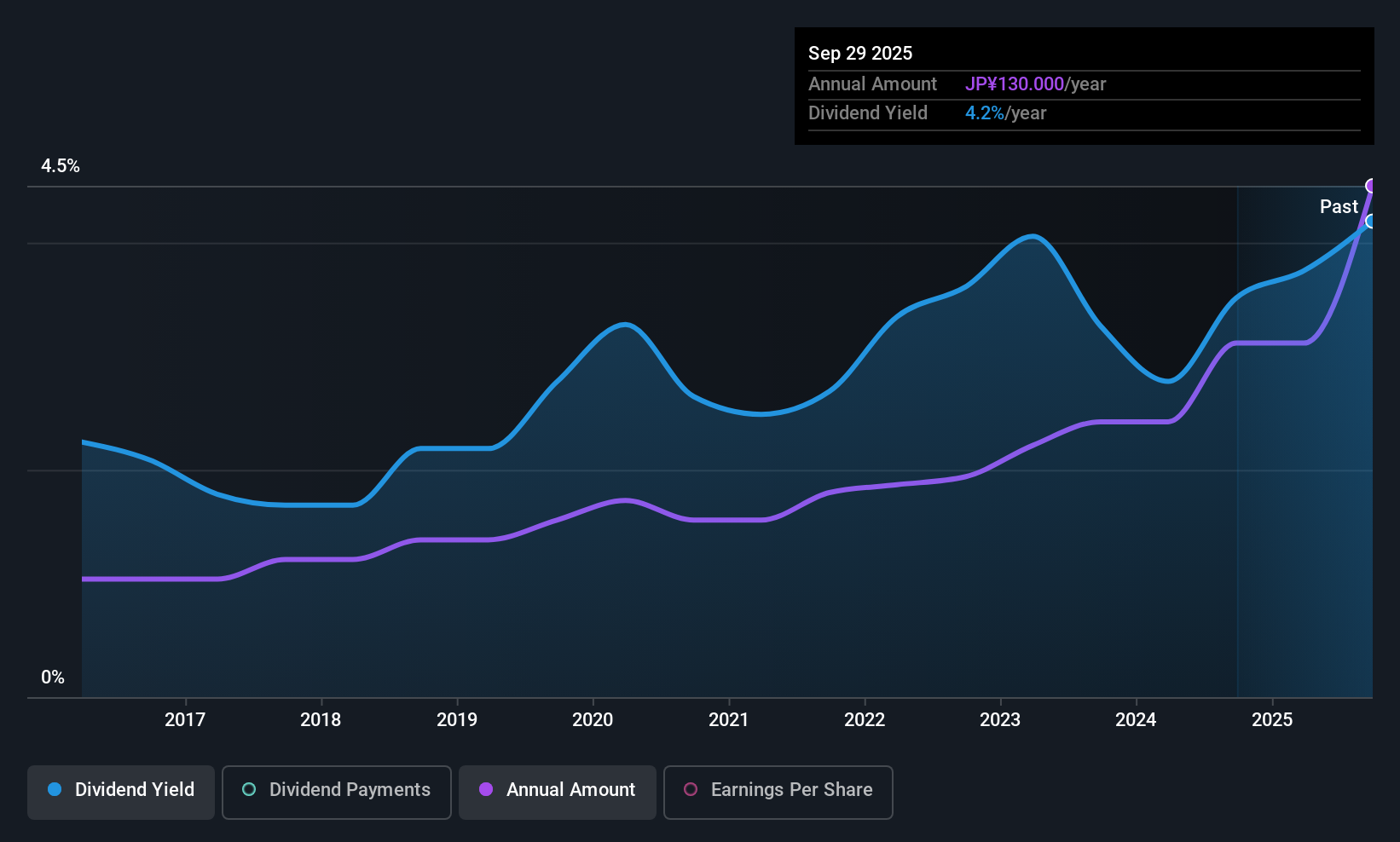

Tomoku (TSE:3946)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tomoku Co., Ltd. operates in the corrugated container and display carton, housing, and transportation and logistics sectors both in Japan and internationally, with a market cap of ¥54.26 billion.

Operations: Tomoku Co., Ltd.'s revenue is primarily derived from its Cardboard segment at ¥119.79 billion, followed by the Homes segment at ¥57.86 billion, and the Transportation Warehouse segment contributing ¥48.20 billion.

Dividend Yield: 3.9%

Tomoku's dividend yield of 3.95% ranks in the top 25% of Japanese dividend payers, supported by a low payout ratio of 25.3%, ensuring coverage by earnings and cash flows. Despite recent increases, dividends have been volatile over the past decade, with a history of significant annual drops. The company's financial position shows high debt levels, which may impact future payouts. Recent board decisions included approving surplus dividends and treasury share disposal for stock-based remuneration.

- Take a closer look at Tomoku's potential here in our dividend report.

- Our valuation report unveils the possibility Tomoku's shares may be trading at a discount.

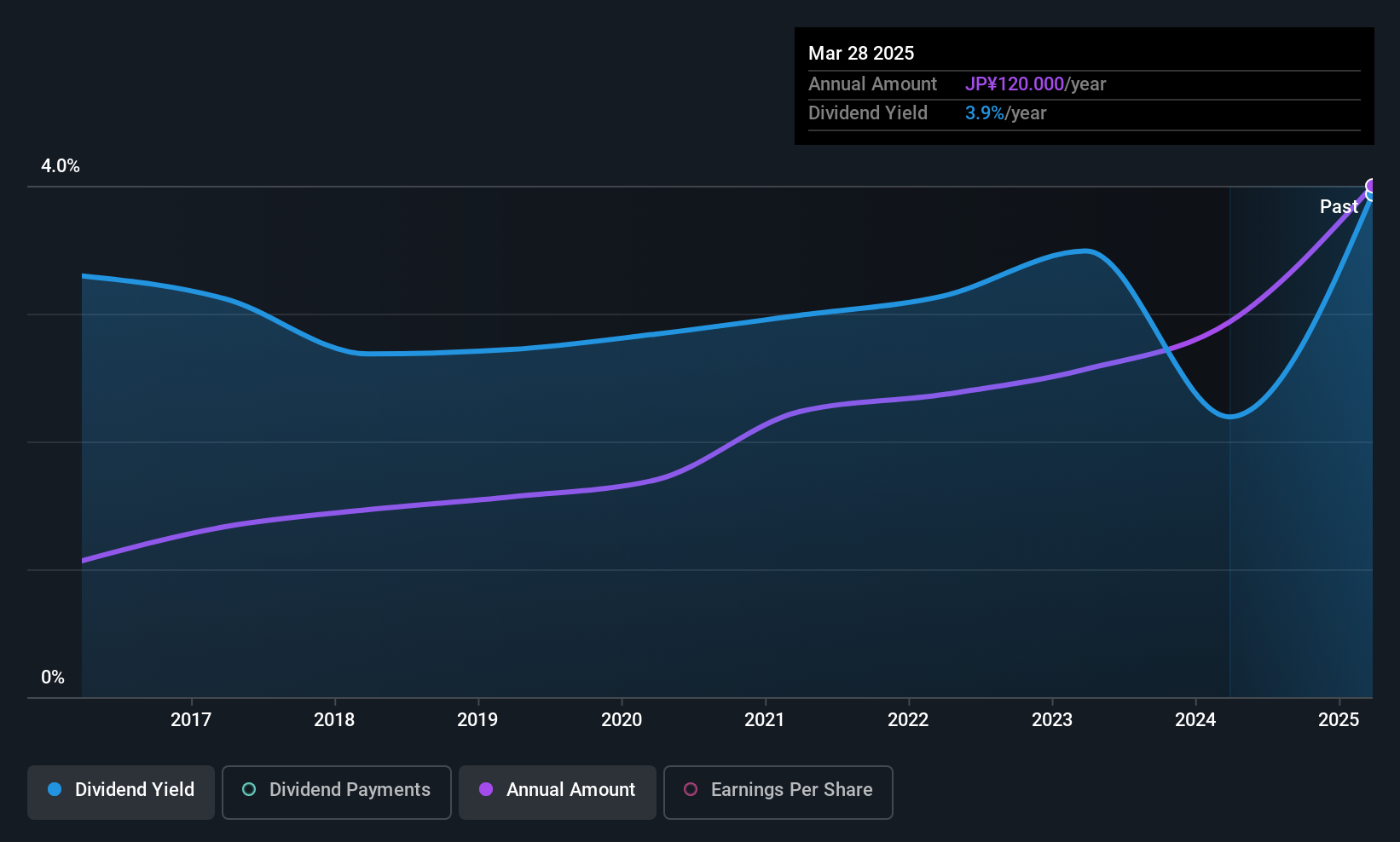

KSKLtd (TSE:9687)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KSK Co., Ltd. operates in the LSI, software, hardware, customer service, and data entry sectors, with a market cap of ¥26.93 billion.

Operations: KSK Co., Ltd.'s revenue is derived from its operations in the LSI, software, hardware, customer service, and data entry sectors.

Dividend Yield: 3.7%

KSK Co.,Ltd. maintains a stable and growing dividend history, supported by a low payout ratio of 30.8%, ensuring coverage by earnings and cash flows, with the latter having a cash payout ratio of 59%. While its dividend yield of 3.66% is slightly below Japan's top quartile, it remains reliable over the past decade. Recent leadership changes may influence future strategies but have not disrupted its consistent dividend performance to date.

- Navigate through the intricacies of KSKLtd with our comprehensive dividend report here.

- Our valuation report unveils the possibility KSKLtd's shares may be trading at a premium.

Taking Advantage

- Delve into our full catalog of 1154 Top Asian Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:327

PAX Global Technology

An investment holding company, develops and sells electronic funds transfer point-of-sale products in Hong Kong, the People’s Republic of China, the United States, and Italy.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives