In recent weeks, global markets have been buoyed by optimism surrounding potential trade deals and AI investments, with major indices like the S&P 500 reaching record highs. Despite large-cap stocks generally outperforming their smaller-cap peers, small-cap companies remain a focal point for investors seeking opportunities amid economic shifts such as manufacturing rebounds and consumer sentiment changes. In this context, discovering stocks with solid fundamentals and growth potential can be particularly rewarding. As we explore three promising small-cap companies that may not yet be on everyone's radar, it's important to consider how these firms might leverage current market dynamics to enhance their value proposition.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nippon Denko | 20.08% | 5.07% | 47.43% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Toyo Kanetsu K.K | 32.74% | 2.71% | 17.49% | ★★★★★☆ |

| Alembic | 0.72% | 21.20% | -6.80% | ★★★★★☆ |

| Piccadily Agro Industries | 34.60% | 14.20% | 46.61% | ★★★★★☆ |

| Sichuan Haite High-techLtd | 49.88% | 6.40% | -10.22% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

GRAINTURK Holding (IBSE:GRTHO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Grainturk Tarim Anonim Sirketi is engaged in agricultural commodity trading on both national and international platforms, with a market capitalization of TRY22.64 billion.

Operations: Grainturk's primary revenue streams come from its agricultural commodity trading activities on both national and international platforms. The company has a market capitalization of TRY22.64 billion.

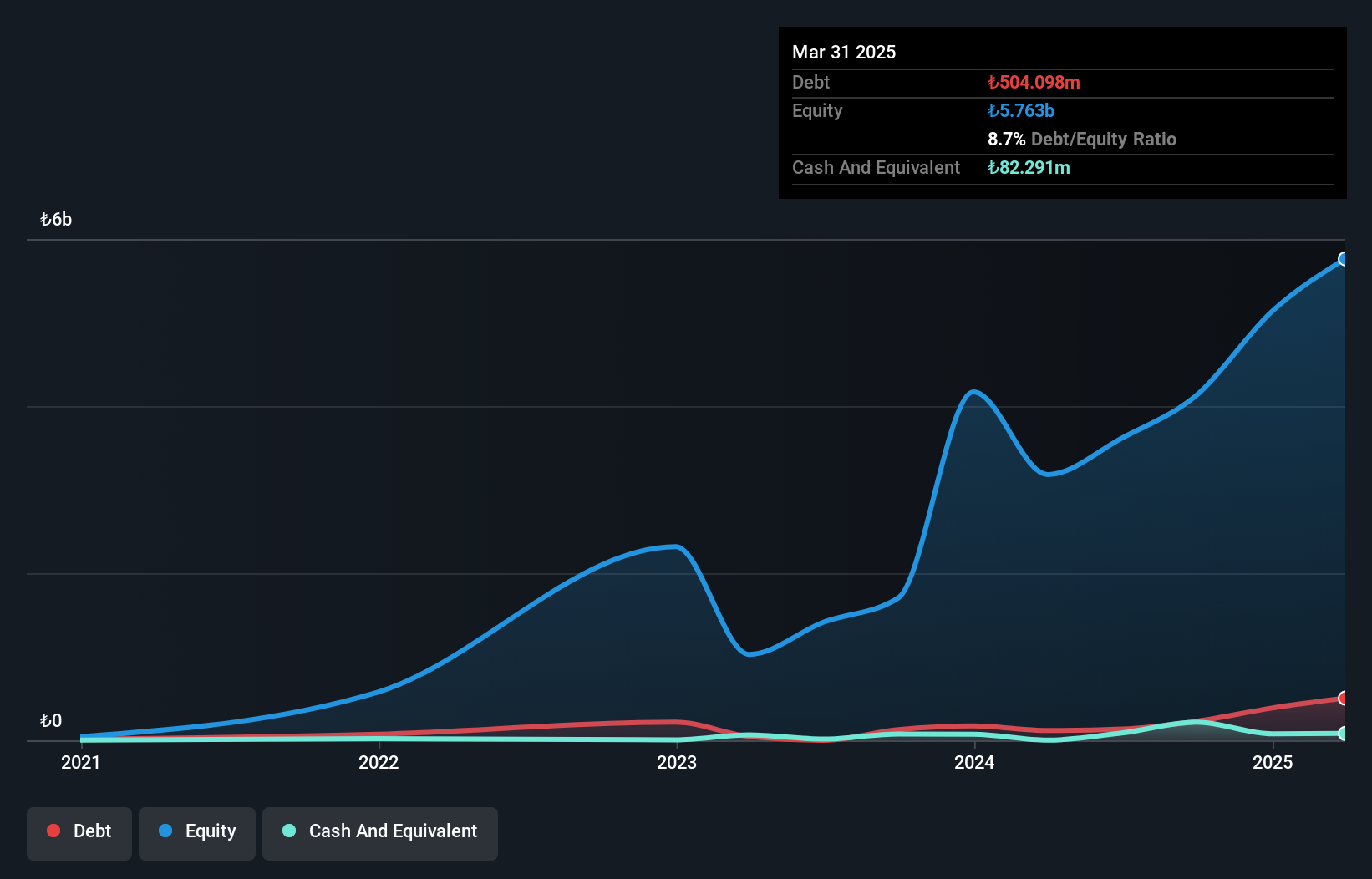

GRAINTURK Holding, a nimble player in its sector, has shown impressive earnings growth of 51.7% over the past year, outpacing the Consumer Retailing industry average of 11.1%. Despite a volatile share price recently, it boasts a satisfactory net debt to equity ratio of 0.3%, ensuring financial stability. The company reported TRY 373 million in net income for Q3 2024 compared to TRY 22 million the previous year, largely influenced by a one-off gain of TRY 251 million. With free cash flow turning positive at TRY 360 million as of September 2024, GRAINTURK seems poised for potential future gains.

Baida GroupLtd (SHSE:600865)

Simply Wall St Value Rating: ★★★★★★

Overview: Baida Group Co., Ltd primarily operates department stores under the Hangzhou Department Store name in China, with a market capitalization of CN¥3.63 billion.

Operations: Baida Group generates revenue primarily from its commodity retail business, amounting to CN¥207.42 million.

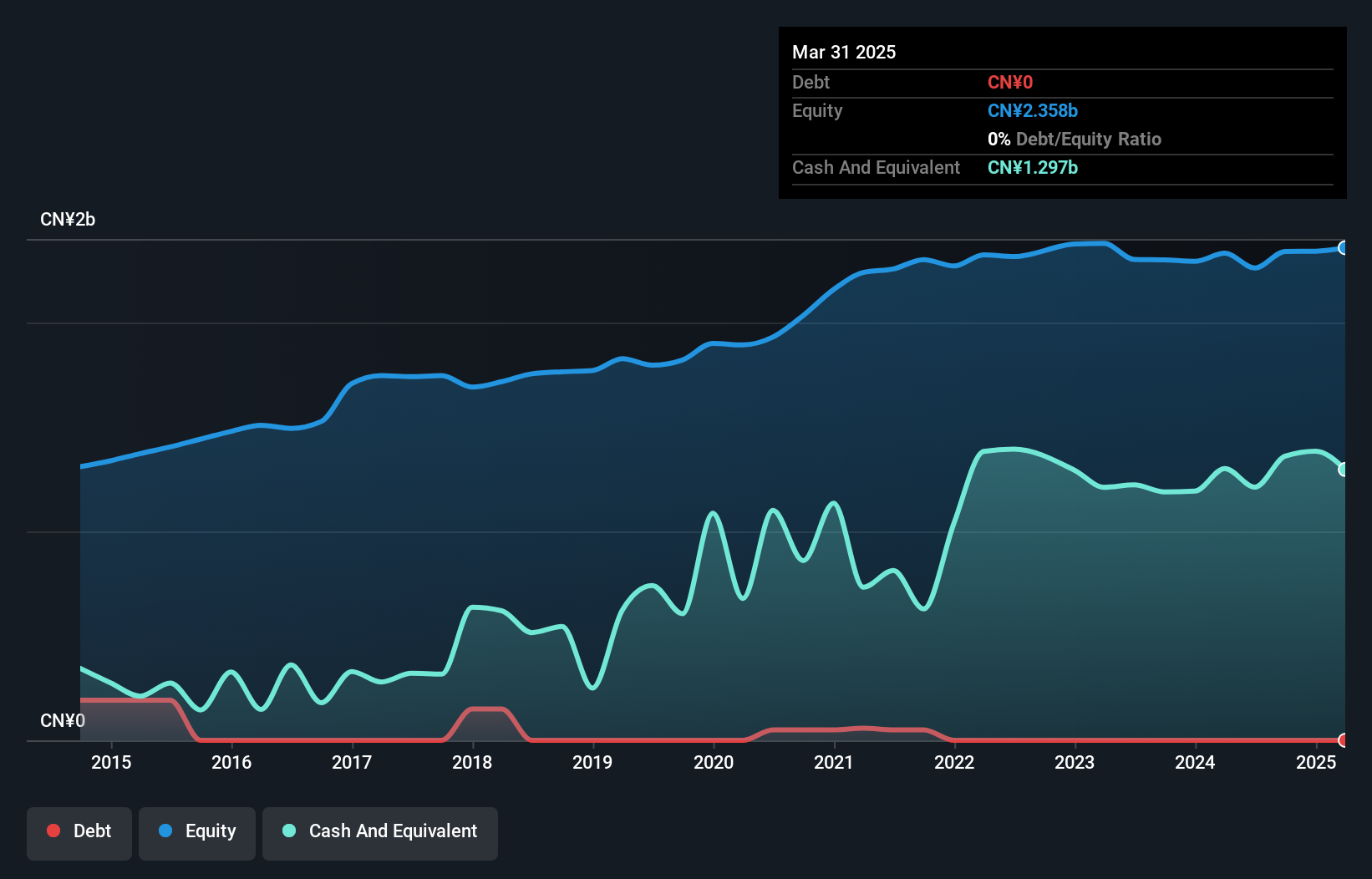

Baida Group Ltd, a relatively small player in its sector, has shown notable earnings growth of 69.3% over the past year, outpacing the broader Multiline Retail industry. Despite this impressive performance, earnings have seen a yearly decline of 24.7% over five years, highlighting some volatility in its financial journey. The company remains debt-free and boasts a price-to-earnings ratio of 29.2x, which is favorable compared to the CN market average of 35.1x. A significant one-off gain of CN¥33 million impacted recent results but hasn't overshadowed their free cash flow positivity and stable profitability outlooks.

- Take a closer look at Baida GroupLtd's potential here in our health report.

Examine Baida GroupLtd's past performance report to understand how it has performed in the past.

ARGO GRAPHICS (TSE:7595)

Simply Wall St Value Rating: ★★★★★★

Overview: ARGO GRAPHICS Inc. offers technical solutions in Japan and has a market cap of ¥103.22 billion.

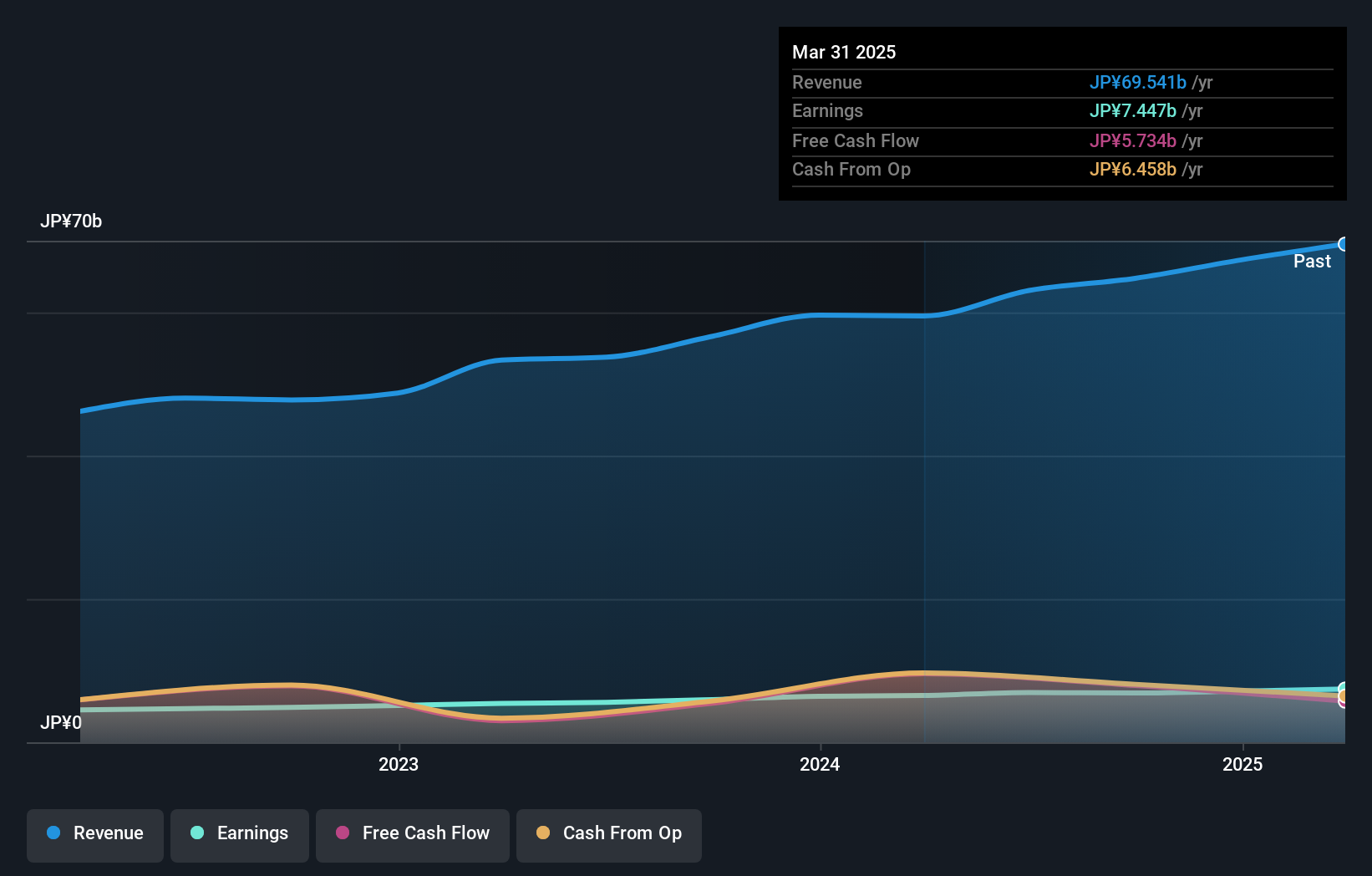

Operations: ARGO GRAPHICS generates revenue primarily from its PLM Business, which accounts for ¥43.07 billion, and the EDA Business contributing ¥2.13 billion.

Argo Graphics, a nimble player in the IT sector, is trading at 25.6% below its estimated fair value, suggesting potential undervaluation. With earnings growth of 15.4% last year outpacing the industry average of 11.4%, it seems to be on a solid upward trajectory. The company enjoys high-quality earnings and operates debt-free, eliminating concerns over interest coverage or financial strain from liabilities. Positive free cash flow further underscores its robust financial health. Despite these strengths, investors should consider market conditions and competitive pressures that could impact future performance in this dynamic industry landscape.

- Click to explore a detailed breakdown of our findings in ARGO GRAPHICS' health report.

Assess ARGO GRAPHICS' past performance with our detailed historical performance reports.

Make It Happen

- Explore the 4666 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7595

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion