As global markets navigate a choppy start to 2025, small-cap stocks have been particularly impacted, with the Russell 2000 Index slipping into correction territory amid inflation concerns and political uncertainty. Despite this volatility, the resilient U.S. labor market and ongoing economic data releases provide a backdrop for identifying potential opportunities among lesser-known companies that may offer unique value propositions in these uncertain times. In this context, discovering stocks with strong fundamentals and growth potential can be key to uncovering hidden gems in an unpredictable market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Yunnan Nantian Electronics InformationLtd (SZSE:000948)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yunnan Nantian Electronics Information Co., Ltd. operates in the software and information technology services sector, with a market capitalization of CN¥6.37 billion.

Operations: The primary revenue stream for Yunnan Nantian Electronics Information Co., Ltd. is from its software and information technology services, generating CN¥9.28 billion. The company's market capitalization stands at CN¥6.37 billion.

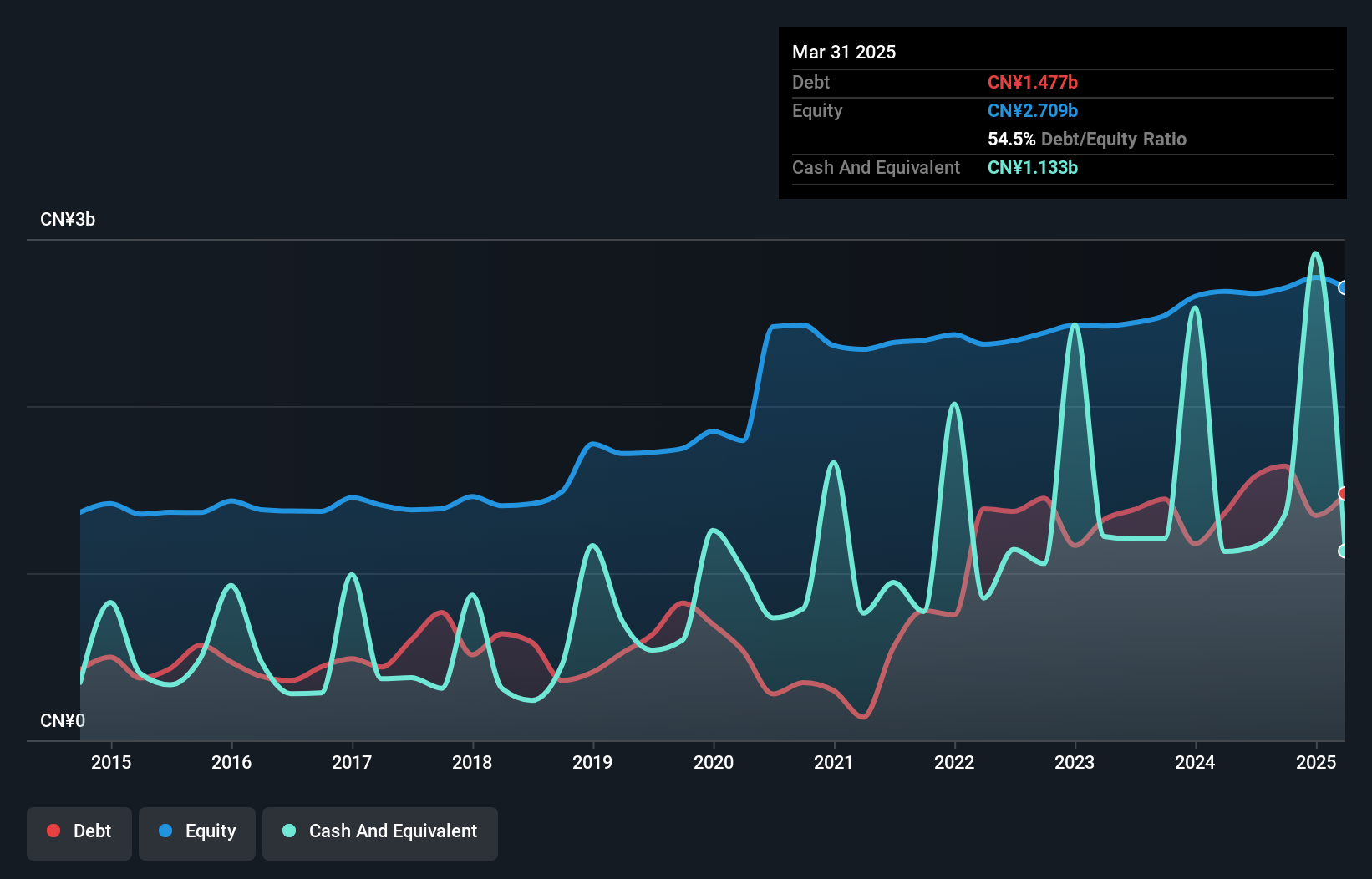

Yunnan Nantian Electronics is making waves with its earnings growth of 7.9% over the past year, outpacing the IT industry's -8.1%. Despite a net debt to equity ratio rising from 47% to 60.6% in five years, it remains satisfactory at 10.5%. The company reported a notable one-off gain of CN¥68 million, impacting recent financial results. With sales climbing to CN¥5.82 billion and net income reaching CN¥55.93 million for nine months ending September 2024, this small player shows potential despite challenges like negative free cash flow and executive changes approved in December's meeting.

- Click here to discover the nuances of Yunnan Nantian Electronics InformationLtd with our detailed analytical health report.

Understand Yunnan Nantian Electronics InformationLtd's track record by examining our Past report.

BBK Test Systems (SZSE:301598)

Simply Wall St Value Rating: ★★★★★★

Overview: BBK Test Systems Co., Ltd. manufactures and sells automotive and structural testing equipment in China and internationally, with a market capitalization of CN¥4.11 billion.

Operations: BBK Test Systems generates revenue primarily through its Solution of Automobile Test and Test System segment, contributing CN¥279.76 million, followed by the Solution of Servo Hydraulic Test System at CN¥225.29 million. The company also earns from Agency Services, which add CN¥4.51 million to its revenue streams.

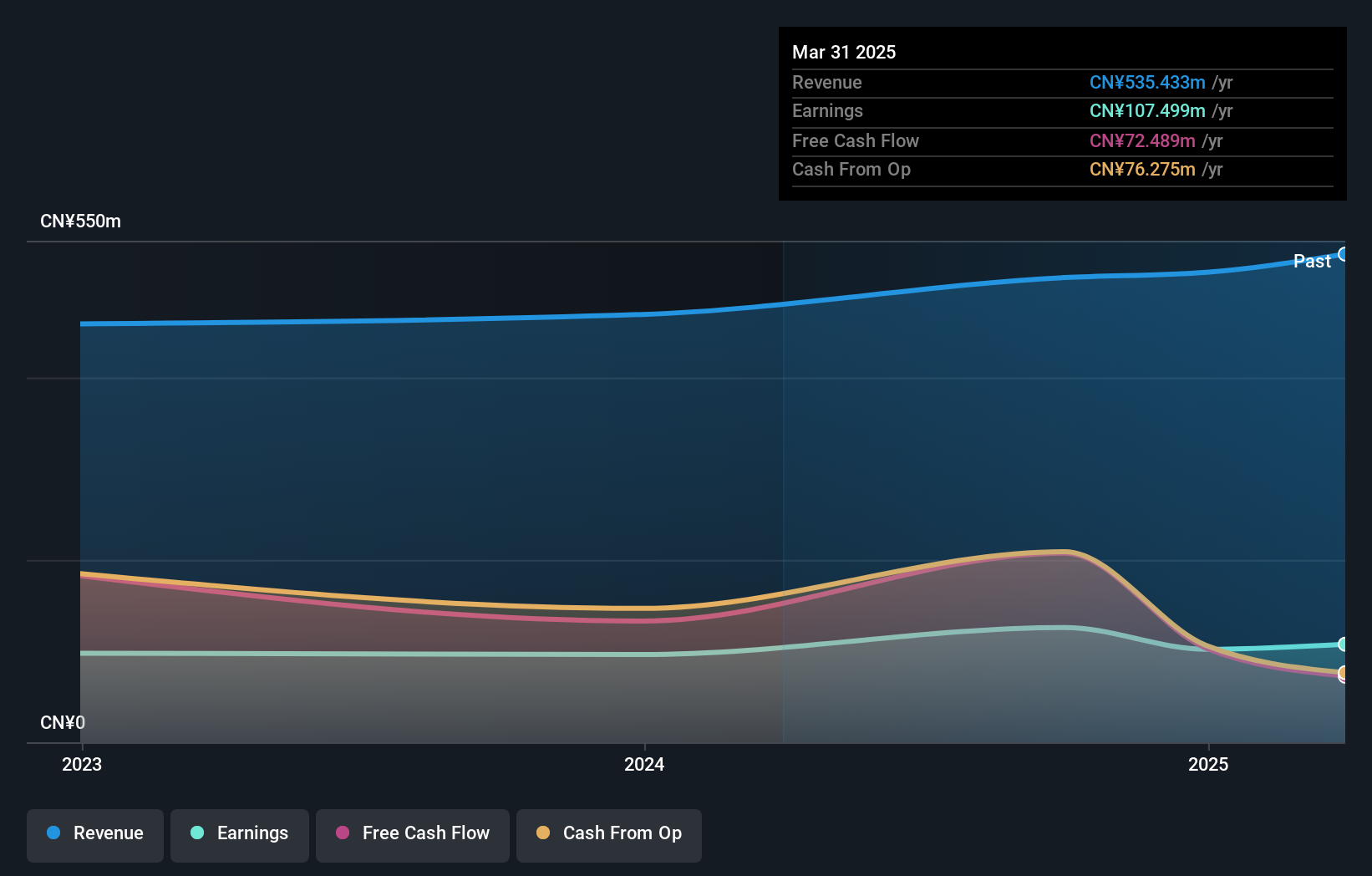

BBK Test Systems, a nimble player in its sector, recently completed an IPO raising CNY 566.3 million and was added to key indices like the Shenzhen Stock Exchange Composite Index. The company's earnings for the nine months ended September 2024 showed impressive growth with sales reaching CNY 322.15 million and net income climbing to CNY 65.2 million from CNY 35.53 million a year earlier. Trading at an attractive discount of about 32% below estimated fair value, BBK boasts debt-free operations and high-quality earnings, while its recent performance outpaced industry averages significantly with a robust earnings growth rate of over 30%.

- Click to explore a detailed breakdown of our findings in BBK Test Systems' health report.

Explore historical data to track BBK Test Systems' performance over time in our Past section.

Zuken (TSE:6947)

Simply Wall St Value Rating: ★★★★★★

Overview: Zuken Inc. is a software company specializing in advanced design solutions for PCB designs, electrical and fluid systems, and 3D cabinet and wire harness layouts across Japan, Asia, the United States, and Europe with a market cap of ¥94.10 billion.

Operations: Revenue primarily comes from Japan, contributing ¥29.01 billion, followed by Europe at ¥8.97 billion and Asia at ¥2.12 billion.

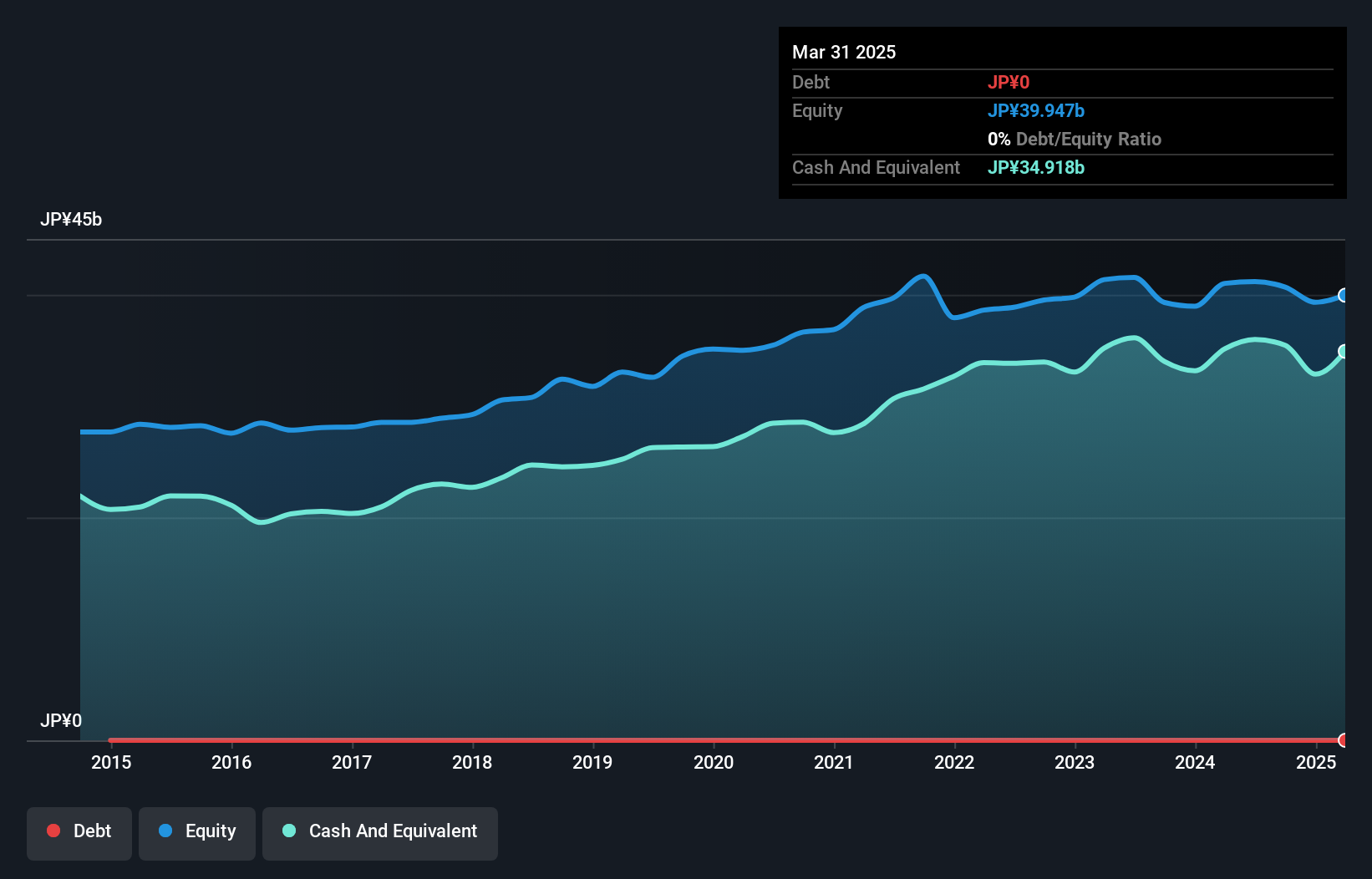

Zuken, a dynamic player in the tech industry, has shown impressive financial health with earnings growth of 12.8% over the past year, outpacing the IT sector's 11.4%. The company stands debt-free for five years and boasts high-quality earnings, reflecting its robust operational framework. Recent strategic moves include a share buyback program where 404,600 shares were repurchased for ¥1.72 billion from November to December 2024, enhancing capital efficiency and shareholder returns. This initiative is part of a broader plan to repurchase up to 750,000 shares by March 2025 for ¥2.5 billion (approx US$17 million), indicating strong management confidence in future prospects.

- Delve into the full analysis health report here for a deeper understanding of Zuken.

Review our historical performance report to gain insights into Zuken's's past performance.

Where To Now?

- Dive into all 4628 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zuken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6947

Zuken

A software company, provides advanced design solutions for the creation and management of printed circuit board (PCB) designs, electrical and fluid systems, and 3D cabinet and wire harness layouts in Japan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion