Will Fujitsu's (TSE:6702) Supercomputer Partnerships Define Its Next Chapter in Advanced Computing?

Reviewed by Sasha Jovanovic

- In recent developments, NVIDIA announced that Japan's RIKEN research institute will integrate NVIDIA GB200 NVL4 systems and Blackwell GPUs into two new supercomputers, with one for AI-driven scientific research and the other for quantum computing, while continuing the codesign partnership with Fujitsu for the next-generation FugakuNEXT supercomputer.

- This milestone highlights Fujitsu's expanding technological collaborations in Japan's high-performance computing sector, as the company moves deeper into enabling advanced scientific and quantum computing innovation alongside global industry leaders.

- We'll examine how Fujitsu's strengthened partnership with NVIDIA and RIKEN for next-gen supercomputers could reshape its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Fujitsu Investment Narrative Recap

For shareholders, the central thesis relies on Fujitsu executing a shift from legacy hardware to next-generation cloud, AI, and supercomputing services, anchored by demand for modernization in Japan. The recent collaboration with NVIDIA and RIKEN signals deeper alignment with future scientific computing and AI, but its immediate impact on offsetting short-term volatility from public sector contract timing is likely limited; earnings still hinge on the stability and scale of core transformation projects. Among recent announcements, the expanded alliance with NVIDIA to codesign the FugakuNEXT supercomputer directly ties into Fujitsu’s investment narrative, reinforcing the push into high-margin, advanced computing, which complements efforts to grow beyond traditional IT infrastructure. But risks still remain, especially as...

Read the full narrative on Fujitsu (it's free!)

Fujitsu's narrative projects ¥3,829.0 billion in revenue and ¥339.8 billion in earnings by 2028. This implies a 2.6% annual revenue growth and a ¥129.4 billion increase in earnings from the current ¥210.4 billion.

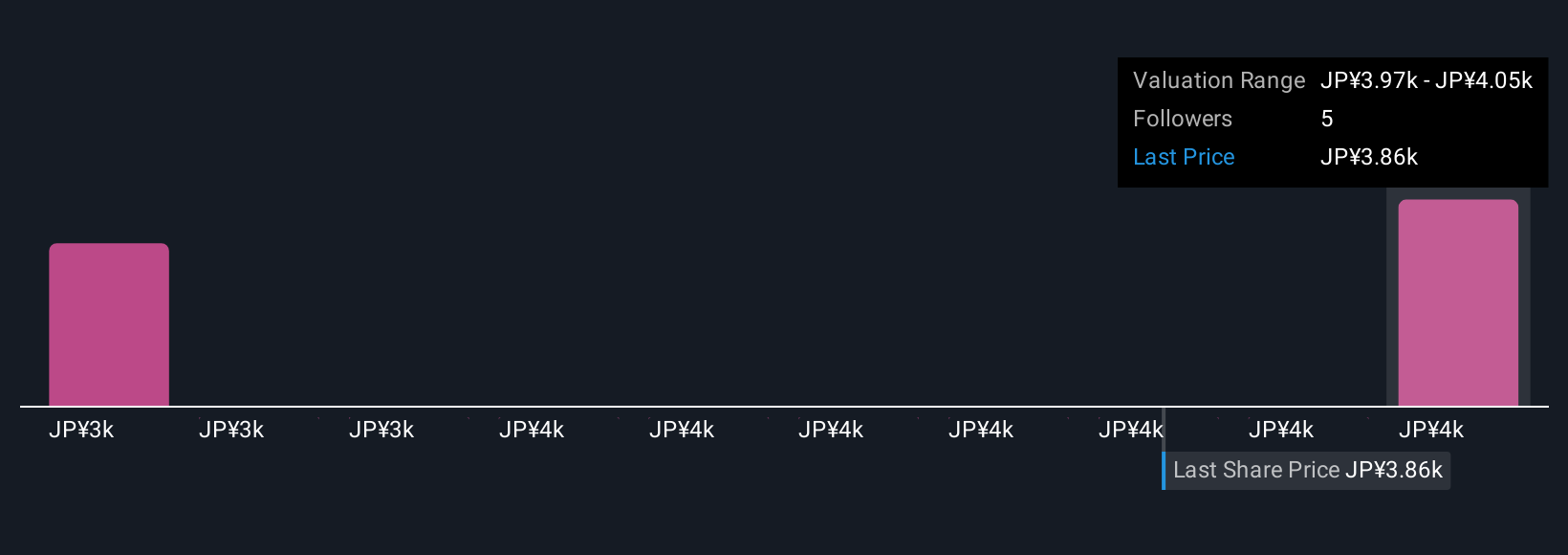

Uncover how Fujitsu's forecasts yield a ¥4125 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Two community members on Simply Wall St value Fujitsu between ¥3,431 and ¥4,125 per share, reflecting varied growth expectations. While stronger modernization demand underpins the current outlook, opinions differ, consider reviewing alternative projections and discussing what might surprise the market.

Explore 2 other fair value estimates on Fujitsu - why the stock might be worth 14% less than the current price!

Build Your Own Fujitsu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fujitsu research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Fujitsu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fujitsu's overall financial health at a glance.

No Opportunity In Fujitsu?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6702

Fujitsu

Engages in providing digital services in Japan, Europe, Americas, the Asia Pacific, East Asia, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives