NEC (TSE:6701) Margin Expansion Reinforces Bullish Narrative Despite Premium Valuation

Reviewed by Simply Wall St

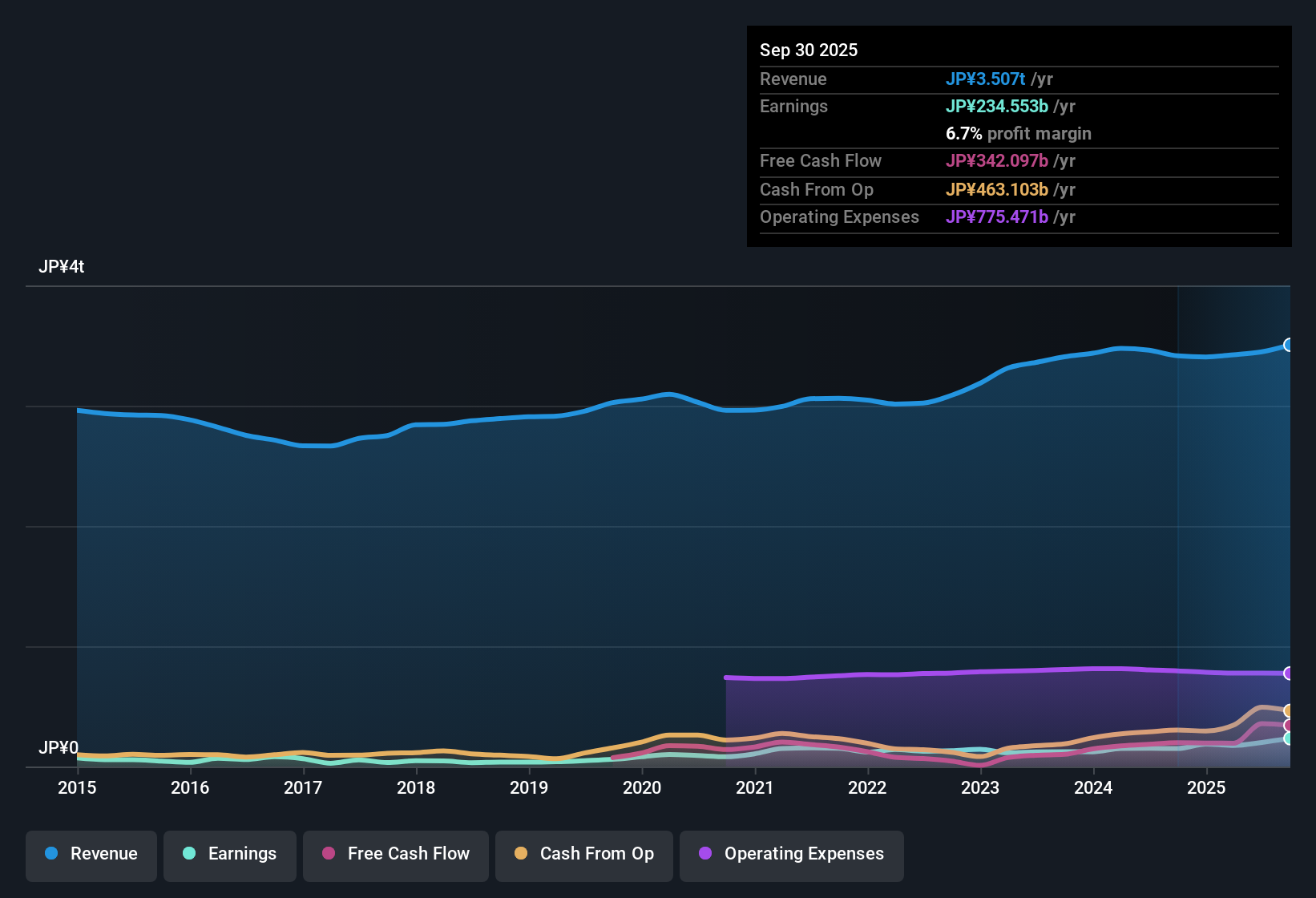

NEC (TSE:6701) posted a striking 56.3% earnings growth over the past year, far outpacing its five-year average of 10.6% and highlighting a surge in momentum. Net profit margins improved to 6.7% from 4.4% year-over-year, underscoring a significant boost in profitability as the bottom line expanded. With forward earnings expected to grow at 9.29% per year, ahead of the Japanese market’s 7.9% average, recent results position NEC as a growth leader even as its price-to-earnings ratio sits above both the industry and peer group averages and a minor risk lingers over near-term price stability.

See our full analysis for NEC.The next section takes these headline numbers and weighs them against the current narratives shaping investor sentiment. Expect to see which storylines get fresh support and which come under the microscope.

See what the community is saying about NEC

High-Margin Services Outpace Revenue Growth

- NEC’s 6.7% net profit margin not only marks a significant step up from 4.4% last year, but it highlights the quality of earnings derived from value-added services. This improvement comes even as overall revenue growth of 3.6% per year falls behind the Japanese market’s 4.5% average.

- According to the analysts' consensus view, this margin expansion is heavily supported by strong demand for digital transformation and smart city solutions.

- Operating margin improvements are being driven across high-value business units such as BluStellar and digital consulting, anchoring earnings growth even as traditional IT revenue faces headwinds.

- Operational efficiency initiatives, including cost reductions and a pivot to higher value-added services, are expected to continue fostering sustainable margin gains.

- Momentum in consulting and digital services is also notable, with ABeam Consulting’s bookings up 14% year-on-year. This reinforces the case that NEC’s business mix is tilting towards higher-margin offerings in line with analysts’ forecasts.

- While headline revenue growth remains modest, these high-margin units help diversify income streams and bolster net margins.

- This points to a more resilient earnings profile even as the company juggles the risks tied to international expansion and R&D spending.

What will really move the needle for NEC, according to analysts, is how these margin gains hold up as the company increases investment and navigates international scaling. See how consensus views stack up in the full narrative. 📊 Read the full NEC Consensus Narrative.

Premium Valuation Far Above Peers

- NEC is trading at a lofty 32.8x price-to-earnings ratio, well above both the industry average of 17.2x and its peer group’s 29.9x. Its current share price of ¥5,775.0 notably exceeds both the DCF fair value of ¥4,516.76 and the analyst target price of ¥5,000.00.

- Analysts' consensus view recognizes this premium valuation and flags potential risk due to the slight gap between current pricing and upside forecast.

- The current share price reflects optimism about future earnings growth and margin expansion.

- The comparatively small 7.8% difference between market price and analyst target indicates limited headroom unless upside surprises materialize in next year’s results.

Risks Loom as Investments and International Focus Ramp Up

- Increasing R&D and personnel expenses, coupled with ongoing investments in advanced technologies and international business, may outpace NEC’s revenue gains and put pressure on profitability over the medium term.

- Analysts' consensus view calls out this rising cost base as a genuine risk.

- Declines have already been seen in Telecom Services revenue and adjusted operating profit due to the business shifting from hardware to software.

- Macroeconomic uncertainties, along with tariffs and global scaling challenges, pose further headwinds for both top-line and earnings trajectories.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NEC on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? Share your perspective by building a personal narrative in just minutes and let your analysis shape the story. Do it your way

A great starting point for your NEC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

NEC’s premium valuation, modest revenue growth, and rising investment costs raise concerns about its near-term upside and ongoing financial sustainability.

If you’re seeking companies with lower valuation risk and stronger upside, check out these 856 undervalued stocks based on cash flows for investment ideas that could offer better value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6701

NEC

Provides information technology services and social infrastructure in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives