Could NEC's (TSE:6701) Digital ID Bet Hint at a Broader Shift in Innovation Strategy?

Reviewed by Sasha Jovanovic

- NEC X, backed by NEC Corporation, announced in early November 2025 that it has invested in Indicio to boost user-controlled digital identity technology, supporting Indicio’s participation in the NEC X Elev X! Boost program.

- This move highlights NEC’s intention to expand its influence in secure digital ID and biometric authentication, with a focus on trusted AI, travel, and access management solutions.

- Now, we'll assess how NEC’s partnership with Indicio to advance digital identity solutions could influence its broader investment outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

NEC Investment Narrative Recap

Shareholders in NEC need to believe in the company’s ability to grow beyond its mature domestic markets by capitalizing on digital transformation and innovative security solutions. The recent NEC X investment in Indicio underlines intent to strengthen digital identity offerings, but the announcement does not directly impact the primary short-term catalyst, order growth for advanced IT and public sector solutions, or immediately address the biggest risk: declining domestic and telecom hardware revenues as older business lines wind down.

Of the company’s recent announcements, NEC’s updated earnings guidance for fiscal 2026 stands out, with revenue projected at ¥3,420,000 million. While this underscores management’s confidence in near-term demand, it also reiterates pressure on the traditional revenue base and the need for emerging technology partnerships like Indicio to offset headwinds.

On the other hand, investors should be aware that NEC’s exposure to falling domestic IT and telecom hardware revenues could challenge overall growth if next-generation solutions are slow to scale...

Read the full narrative on NEC (it's free!)

NEC's narrative projects ¥3,787.0 billion in revenue and ¥291.3 billion in earnings by 2028. This requires 3.2% yearly revenue growth and a ¥91.0 billion earnings increase from ¥200.3 billion currently.

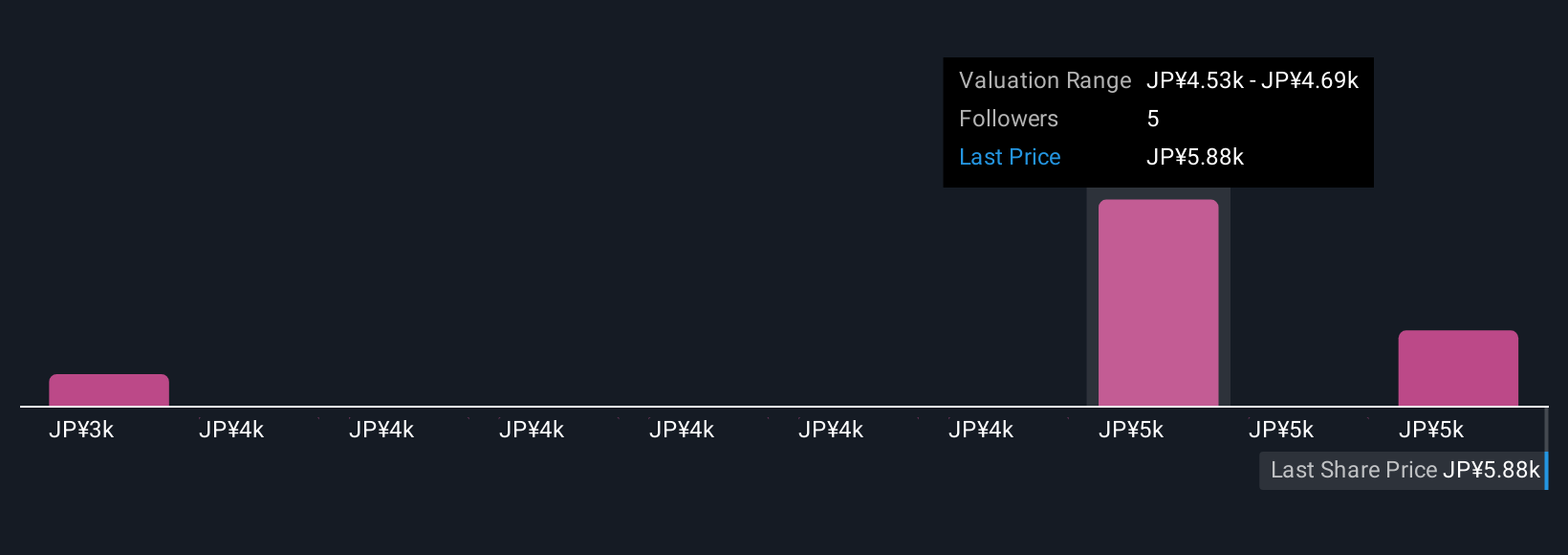

Uncover how NEC's forecasts yield a ¥5000 fair value, a 17% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published three fair value estimates for NEC ranging from ¥3,436.64 to ¥5,000. While perspectives differ widely, it is important to remember that sustaining growth in higher-value IT and digital services is seen as key for the company’s outlook. Explore how other community members frame these expectations and risks for a fuller view.

Explore 3 other fair value estimates on NEC - why the stock might be worth 43% less than the current price!

Build Your Own NEC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NEC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NEC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NEC's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6701

NEC

Provides information technology services and social infrastructure in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives