Slowing Rates Of Return At Laboro.AI (TSE:5586) Leave Little Room For Excitement

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after investigating Laboro.AI (TSE:5586), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

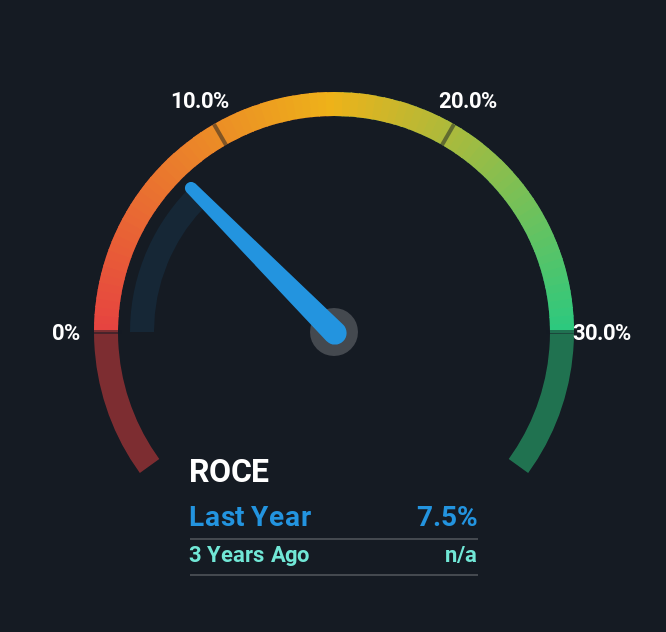

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Laboro.AI is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.075 = JP¥192m ÷ (JP¥2.8b - JP¥265m) (Based on the trailing twelve months to September 2025).

Therefore, Laboro.AI has an ROCE of 7.5%. Ultimately, that's a low return and it under-performs the IT industry average of 15%.

Check out our latest analysis for Laboro.AI

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Laboro.AI.

So How Is Laboro.AI's ROCE Trending?

Things have been pretty stable at Laboro.AI, with its capital employed and returns on that capital staying somewhat the same for the last . This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. So unless we see a substantial change at Laboro.AI in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger.

In Conclusion...

In summary, Laboro.AI isn't compounding its earnings but is generating stable returns on the same amount of capital employed. Additionally, the stock's total return to shareholders over the last year has been flat, which isn't too surprising. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

One more thing, we've spotted 3 warning signs facing Laboro.AI that you might find interesting.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5586

Laboro.AI

Develops and provides custom-made AI solutions using machine learning.

Excellent balance sheet with low risk.

Market Insights

Community Narratives