- Japan

- /

- Consumer Services

- /

- TSE:7366

Visional And 2 Other Japanese Stocks That Might Be Trading Below Fair Value

Reviewed by Simply Wall St

As Japan's stock markets show signs of recovery, with the Nikkei 225 Index gaining 0.7% and the broader TOPIX Index up 1.0%, investors are increasingly on the lookout for undervalued opportunities. In this context, identifying stocks that may be trading below their fair value can offer potential for significant returns amidst a stabilizing economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3495.00 | ¥6794.51 | 48.6% |

| Kotobuki Spirits (TSE:2222) | ¥1764.00 | ¥3434.73 | 48.6% |

| Hottolink (TSE:3680) | ¥341.00 | ¥639.45 | 46.7% |

| KeePer Technical Laboratory (TSE:6036) | ¥3940.00 | ¥7875.52 | 50% |

| Kadokawa (TSE:9468) | ¥2957.00 | ¥5631.95 | 47.5% |

| West Holdings (TSE:1407) | ¥2667.00 | ¥5139.80 | 48.1% |

| Ohara (TSE:5218) | ¥1362.00 | ¥2607.30 | 47.8% |

| Fudo Tetra (TSE:1813) | ¥2377.00 | ¥4735.80 | 49.8% |

| Adventure (TSE:6030) | ¥3935.00 | ¥7520.56 | 47.7% |

| CIRCULATIONLtd (TSE:7379) | ¥664.00 | ¥1282.41 | 48.2% |

Let's explore several standout options from the results in the screener.

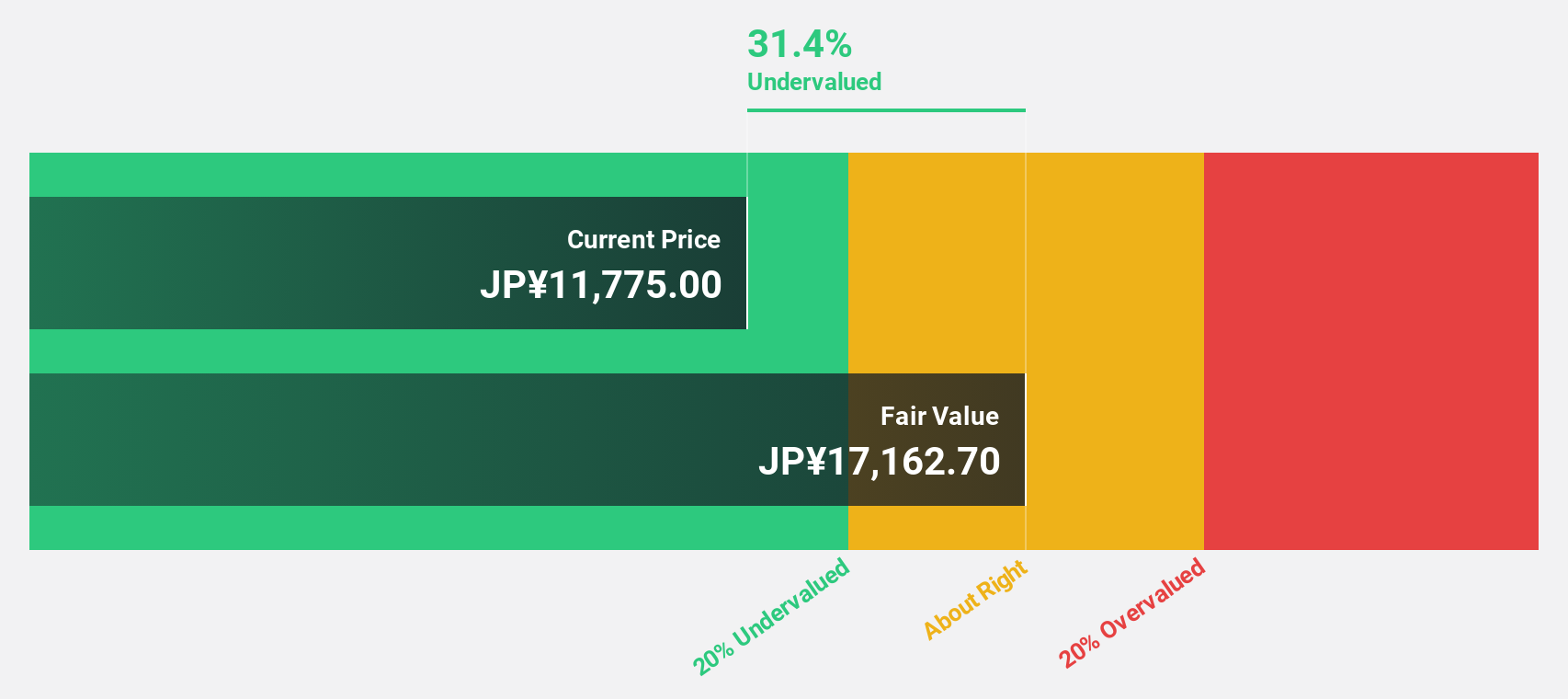

Visional (TSE:4194)

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥364.31 billion.

Operations: Visional's revenue segments include providing human resources platform solutions in Japan.

Estimated Discount To Fair Value: 46.1%

Visional is trading at ¥9190, significantly below its estimated fair value of ¥17041.88, making it highly undervalued based on discounted cash flow analysis. The company's earnings are forecast to grow at 11% annually, outpacing the JP market's 8.7%. Revenue growth is also strong at 12.5% per year compared to the market's 4.3%. Recent board discussions on revising consolidated earnings forecasts could further impact valuation positively.

- Our growth report here indicates Visional may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Visional.

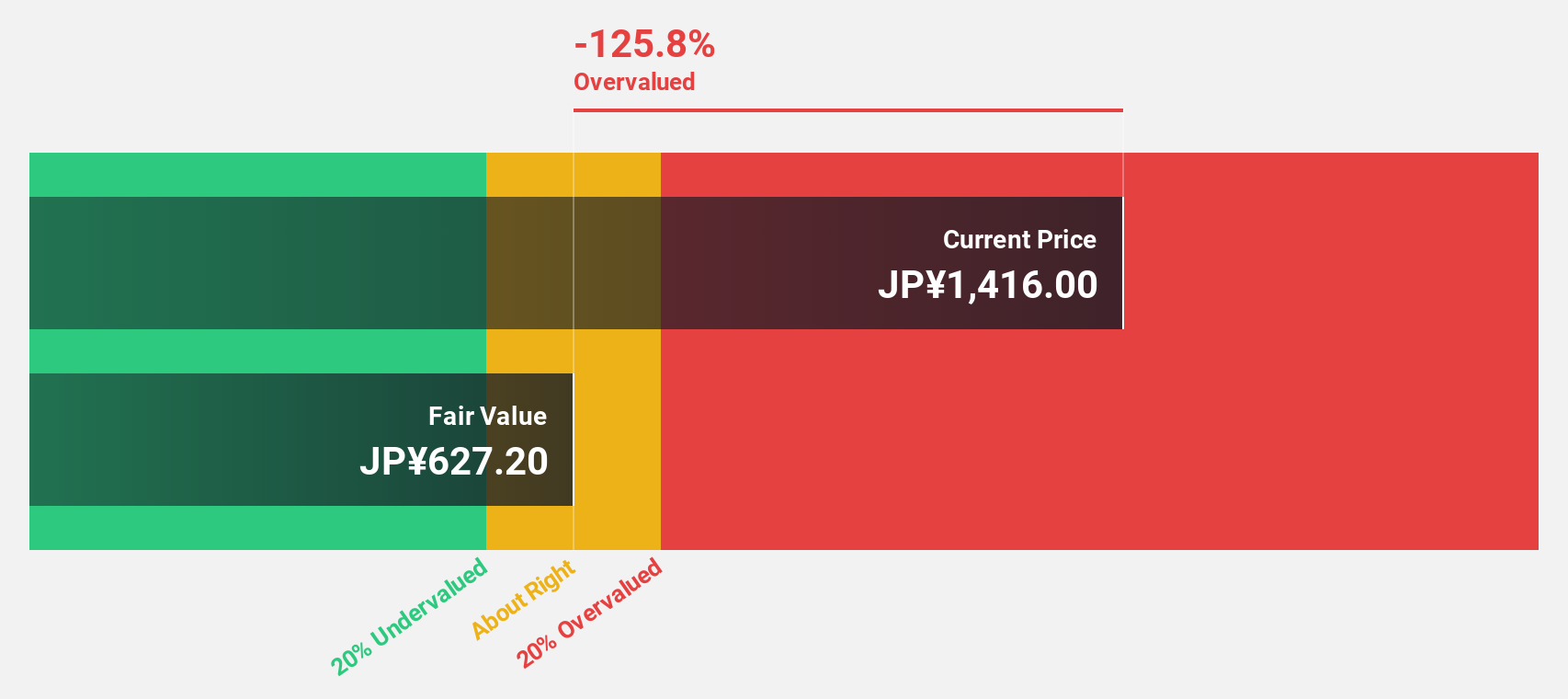

Japan Business Systems (TSE:5036)

Overview: Japan Business Systems, Inc. provides cloud integration and related services with a market cap of ¥44.91 billion.

Operations: The company's revenue segments include cloud integration and related services, totaling ¥44.91 billion.

Estimated Discount To Fair Value: 29.9%

Japan Business Systems is trading at ¥985, significantly below its estimated fair value of ¥1405.34. The company's earnings are expected to grow 45.79% annually over the next three years, far outpacing the JP market's 8.7%. Revenue growth is forecasted at 8.5% per year, also surpassing the market average of 4.3%. Despite high debt levels and a volatile share price, these factors make it highly undervalued based on discounted cash flow analysis.

- In light of our recent growth report, it seems possible that Japan Business Systems' financial performance will exceed current levels.

- Dive into the specifics of Japan Business Systems here with our thorough financial health report.

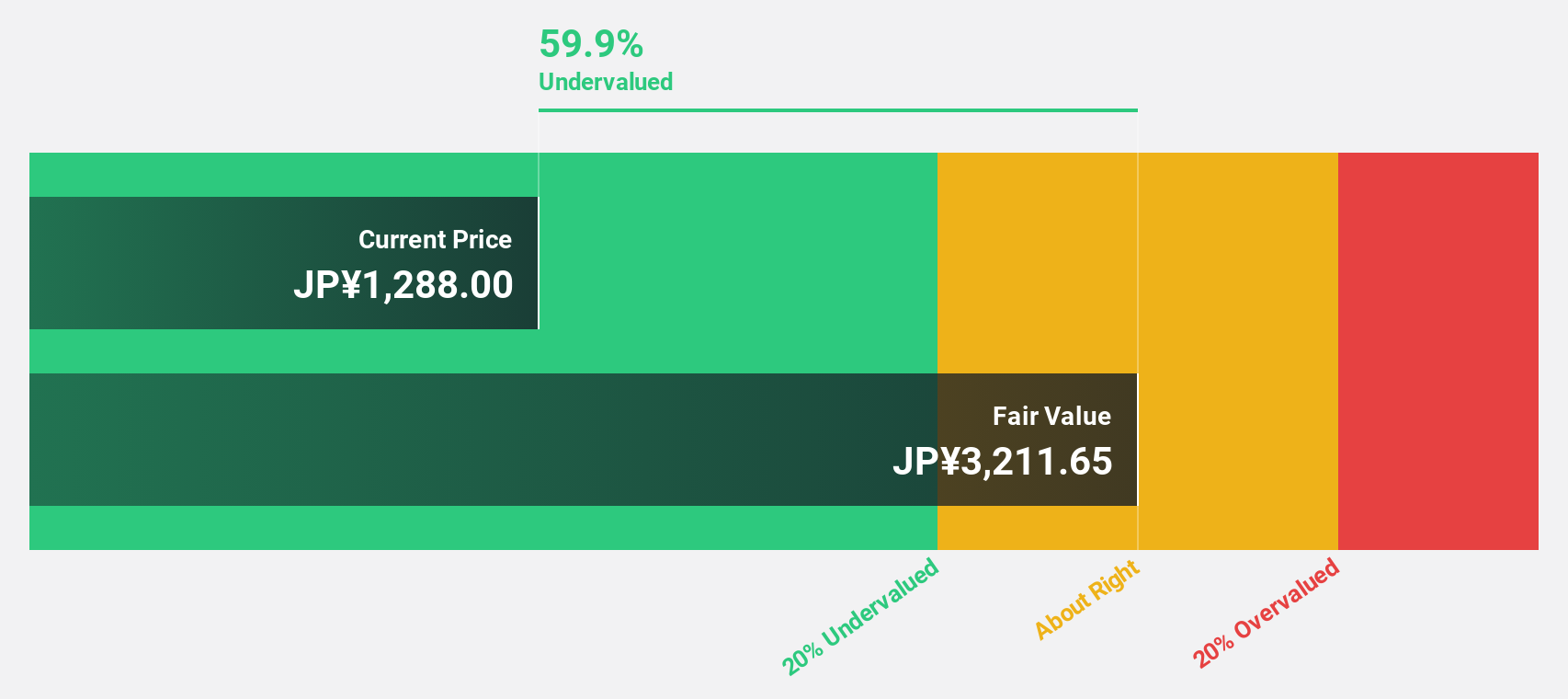

LITALICO (TSE:7366)

Overview: LITALICO Inc. operates schools for learning and preschool in Japan, with a market cap of ¥46.28 billion.

Operations: The company's revenue segments include ¥11.08 billion from Employment Support Business, ¥9.39 billion from Child Welfare Business, and ¥4.05 billion from Platform Business.

Estimated Discount To Fair Value: 31.1%

LITALICO Inc. is trading at ¥1,296, well below its estimated fair value of ¥1,879.89, making it highly undervalued based on discounted cash flow analysis. Despite a high level of debt and recent volatility in its share price, the company’s revenue is forecasted to grow 13.8% annually—faster than the JP market average of 4.3%. Recent private placements raised approximately ¥6 billion to support future growth initiatives.

- Upon reviewing our latest growth report, LITALICO's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of LITALICO.

Summing It All Up

- Click this link to deep-dive into the 79 companies within our Undervalued Japanese Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7366

Reasonable growth potential slight.