- Japan

- /

- Interactive Media and Services

- /

- TSE:3901

3 Japanese Growth Companies Insiders Own With Up To 75% Earnings Growth

Reviewed by Simply Wall St

As Japan's stock markets show signs of recovery, with the Nikkei 225 Index and TOPIX Index gaining ground, investors are increasingly looking for growth opportunities amidst a volatile economic landscape. In this context, companies with high insider ownership often signal strong confidence from those closest to the business, making them attractive options for growth-focused portfolios.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 32.7% |

| Hottolink (TSE:3680) | 27% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| SHIFT (TSE:3697) | 35.4% | 32.1% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 63% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Astroscale Holdings (TSE:186A) | 21.3% | 90% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Let's uncover some gems from our specialized screener.

Fujio Food Group (TSE:2752)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujio Food Group Inc. operates restaurants both in Japan and internationally, with a market cap of ¥60.87 billion.

Operations: Fujio Food Group's revenue is primarily derived from its Directly Managed Business segment, which generated ¥28.77 billion, and the FC Business segment, contributing ¥1.60 billion.

Insider Ownership: 29.5%

Earnings Growth Forecast: 75.6% p.a.

Fujio Food Group, with significant insider ownership, is trading at 28.3% below its estimated fair value, indicating potential undervaluation. While its revenue growth forecast of 6.5% annually is modest compared to high-growth benchmarks, it surpasses the Japanese market average of 4.3%. Notably, earnings are expected to grow substantially at 75.57% per year and the company is projected to become profitable within three years, suggesting strong future performance prospects despite limited recent insider trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Fujio Food Group.

- The valuation report we've compiled suggests that Fujio Food Group's current price could be inflated.

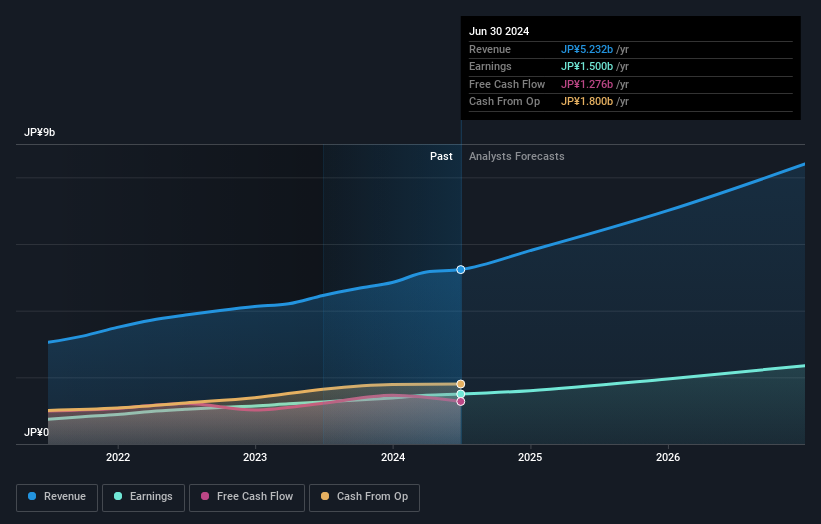

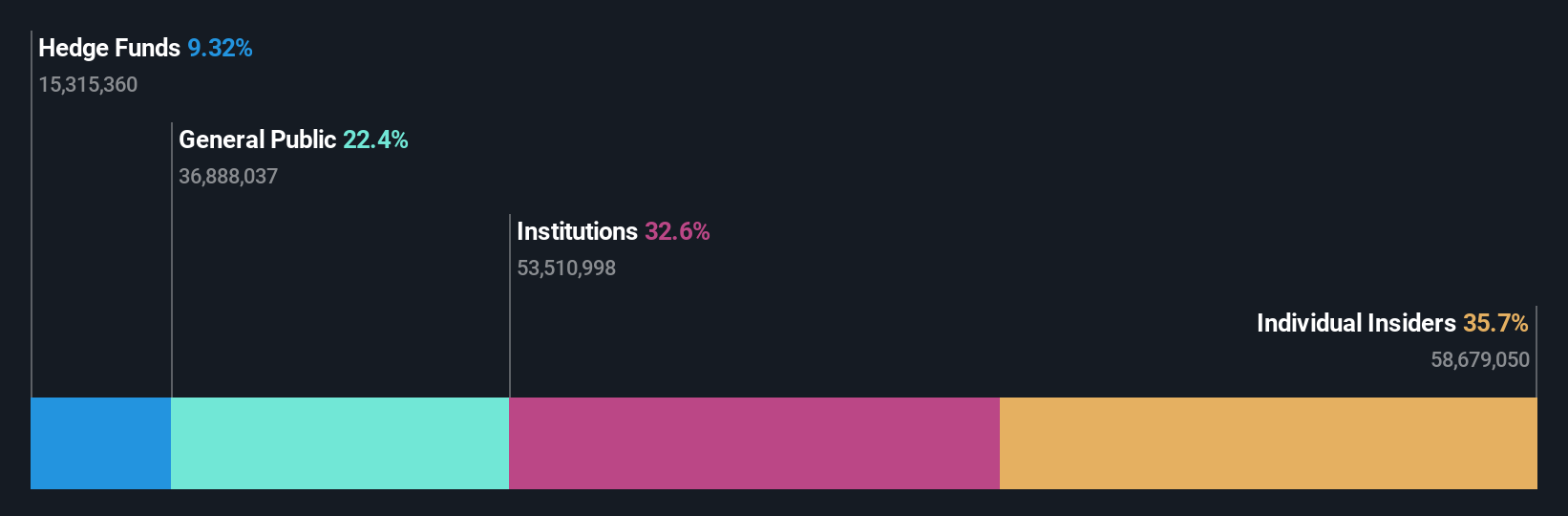

MarkLines (TSE:3901)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MarkLines Co., Ltd. operates an automotive industry portal in Japan with a market cap of ¥41.18 billion.

Operations: The company's revenue segments include the Information Platform Business at ¥3.39 billion, Vehicle/Parts Procurement Agency Business at ¥484.46 million, Consulting Business at ¥554.29 million, Market Forecast Information Sales Business at ¥263.84 million, Teardown Survey Data Sales Business at ¥188.65 million, Promotional Advertising Business at ¥107.23 million, Recruitment Segment at ¥115.36 million, and Automobile Fund Business at ¥39.25 million.

Insider Ownership: 13.9%

Earnings Growth Forecast: 20.9% p.a.

MarkLines, with high insider ownership, is positioned for significant growth. Its revenue is forecast to grow at 19.9% annually, outpacing the Japanese market's 4.3%. Earnings are expected to rise by 20.9% per year, indicating robust future performance potential despite no recent insider trading activity. Last year’s earnings grew by 18.8%, and upcoming Q2 results will be reported on Aug 05, 2024, which could provide further insights into its trajectory.

- Unlock comprehensive insights into our analysis of MarkLines stock in this growth report.

- Our valuation report unveils the possibility MarkLines' shares may be trading at a premium.

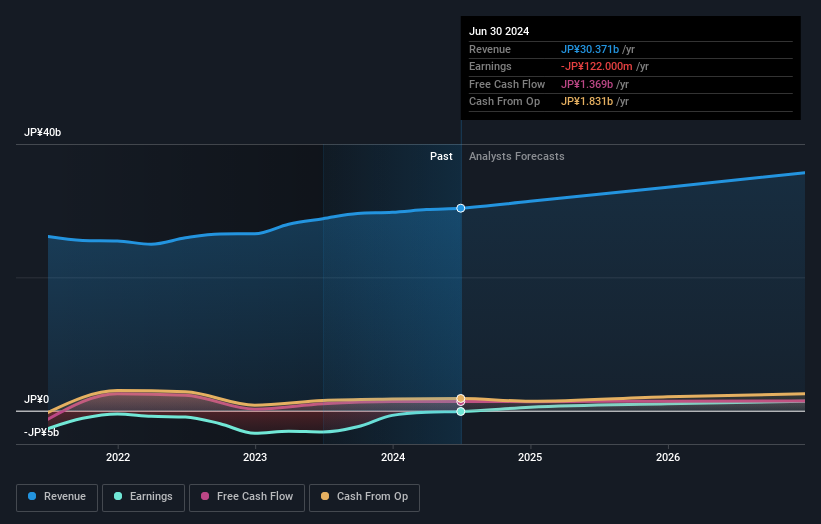

Mercari (TSE:4385)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. plans, develops, and operates marketplace applications in Japan and the United States with a market cap of ¥384.13 billion.

Operations: Mercari generates revenue of ¥43.65 billion from its operations in the United States and ¥138.11 billion from its activities in Japan.

Insider Ownership: 36%

Earnings Growth Forecast: 19.6% p.a.

Mercari, with substantial insider ownership, is poised for growth. Its earnings are forecast to grow at 19.59% annually, surpassing the Japanese market's 8.7%. Revenue is expected to increase by 8% per year, faster than the market's 4.3%. Despite recent volatility in its share price and no significant insider trading activity in the past three months, Mercari’s consolidated earnings guidance projects revenue between ¥200 billion and ¥210 billion for FY2025.

- Take a closer look at Mercari's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Mercari's share price might be too optimistic.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing Japanese Companies With High Insider Ownership list of 101 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3901

Flawless balance sheet with solid track record and pays a dividend.