- Japan

- /

- Communications

- /

- TSE:6820

Tomoe Engineering And 2 Other Undiscovered Gems in Japan

Reviewed by Simply Wall St

As Japan's stock markets recover from recent volatility, both the Nikkei 225 and TOPIX indices have shown resilience, regaining much of the ground lost earlier in the month. This backdrop presents an opportune moment to explore lesser-known small-cap stocks that could offer unique investment opportunities. In light of current market conditions, identifying a good stock often involves looking for companies with solid fundamentals and growth potential that may not yet be fully recognized by the broader market. Here are three such undiscovered gems in Japan, starting with Tomoe Engineering.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Kondotec | 11.75% | 6.85% | 2.62% | ★★★★★☆ |

| Toho | 82.16% | 1.83% | 47.38% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Tomoe Engineering (TSE:6309)

Simply Wall St Value Rating: ★★★★★★

Overview: Tomoe Engineering Co., Ltd. operates in the chemical and machinery and equipment sectors across Japan, Asia, and internationally, with a market cap of ¥40.16 billion.

Operations: Tomoe Engineering Co., Ltd. generates revenue from its chemical and machinery and equipment businesses in various regions. The company's market cap stands at ¥40.16 billion.

Tomoe Engineering, a small-cap company, has shown impressive earnings growth of 39.3% over the past year, outpacing the Trade Distributors industry average of 6.2%. The firm stands out with its high-quality earnings and a favorable price-to-earnings ratio of 11.6x compared to the JP market's 13.7x. Additionally, Tomoe is debt-free and has been consistently profitable, with forecasts indicating an annual earnings growth rate of 11.87%.

- Get an in-depth perspective on Tomoe Engineering's performance by reading our health report here.

Evaluate Tomoe Engineering's historical performance by accessing our past performance report.

Icom (TSE:6820)

Simply Wall St Value Rating: ★★★★★★

Overview: Icom Incorporated, with a market cap of ¥39.17 billion, manufactures and sells telecommunications equipment to individual and corporate customers in various countries including Japan, the United States, Canada, Germany, Spain, Australia, China, and Vietnam.

Operations: Icom generates revenue primarily from Japan (¥32.33 billion) and North America (¥13.64 billion), with additional contributions from Europe and Asia/Oceania.

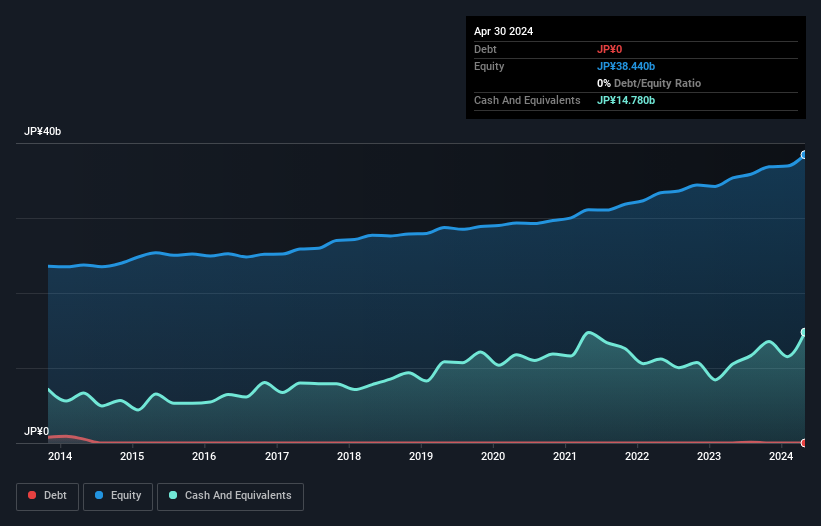

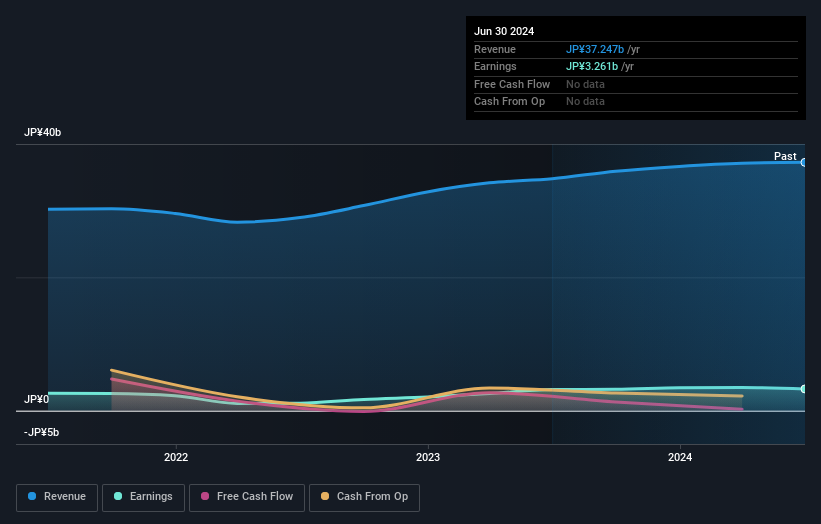

Icom, a small cap player in Japan's communications sector, has shown solid performance with earnings growth of 3.1% over the past year, outpacing the industry average of -3.1%. The firm boasts a price-to-earnings ratio of 12x, which is attractive compared to the JP market's 13.7x. Notably, Icom has been debt-free for five years and enjoys high-quality earnings, providing a stable foundation for future growth.

- Dive into the specifics of Icom here with our thorough health report.

Explore historical data to track Icom's performance over time in our Past section.

eGuarantee (TSE:8771)

Simply Wall St Value Rating: ★★★★★★

Overview: eGuarantee, Inc., along with its subsidiaries, operates in the credit risk entrustment and securitization sector in Japan and has a market cap of ¥67.66 billion.

Operations: eGuarantee generates revenue primarily from its credit guarantee segment, which reported ¥9.33 billion. The company's net profit margin is 27.50%.

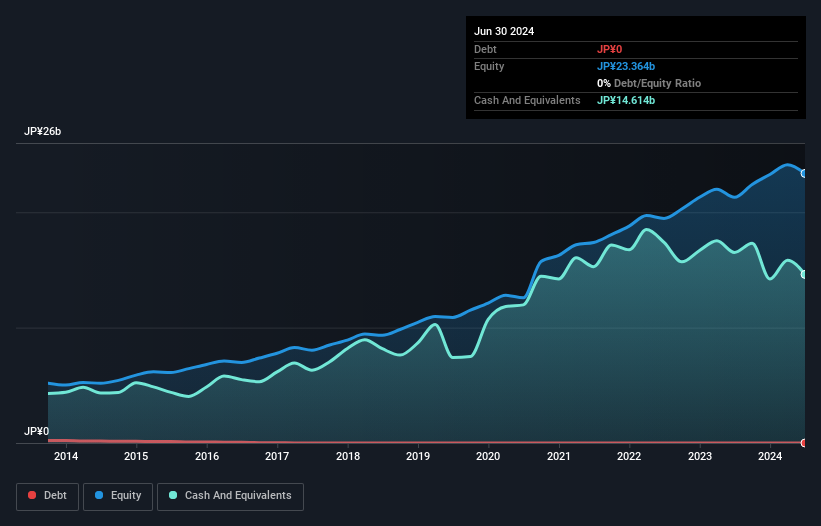

eGuarantee, Inc. is trading 10.1% below its estimated fair value and boasts high-quality earnings. Over the past five years, earnings have grown at an average rate of 10.6% annually, although recent growth of 11.6% lagged behind the Diversified Financial industry’s 27.1%. The company remains debt-free and forecasts a robust annual earnings growth of 12.39%. Recent guidance projects consolidated net sales of ¥20 billion and ordinary profit of ¥10 billion by fiscal year 2028.

- Click here and access our complete health analysis report to understand the dynamics of eGuarantee.

Examine eGuarantee's past performance report to understand how it has performed in the past.

Taking Advantage

- Embark on your investment journey to our 750 Japanese Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6820

Icom

Manufactures and sells telecommunications equipment to individual and corporate customers primarily in Japan, the United States, Canada, Germany, Spain, Australia, China, and Vietnam.

Flawless balance sheet with acceptable track record.