Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6961

Top 3 Stocks Estimated To Be Undervalued On The Japanese Exchange In July 2024

Reviewed by Simply Wall St

As of late, Japan's stock markets have shown notable resilience, with the Nikkei 225 Index and the broader TOPIX Index experiencing gains amid a depreciating yen and expectations of monetary policy adjustments. This environment may present opportunities for investors to identify potentially undervalued stocks that could benefit from current economic conditions. In assessing what constitutes a good investment in this context, it is crucial to consider companies with robust fundamentals that are trading below their intrinsic values, especially those that stand to gain from Japan's export-driven market dynamics and potential shifts in monetary policy.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥464.00 | ¥922.48 | 49.7% |

| Hibino (TSE:2469) | ¥2677.00 | ¥5131.73 | 47.8% |

| Cyber Security Cloud (TSE:4493) | ¥2208.00 | ¥4351.66 | 49.3% |

| Hamee (TSE:3134) | ¥1130.00 | ¥2149.87 | 47.4% |

| S-Pool (TSE:2471) | ¥321.00 | ¥623.20 | 48.5% |

| Macromill (TSE:3978) | ¥833.00 | ¥1653.64 | 49.6% |

| NIHON CHOUZAILtd (TSE:3341) | ¥1494.00 | ¥2818.00 | 47% |

| Bushiroad (TSE:7803) | ¥378.00 | ¥716.57 | 47.2% |

| Money Forward (TSE:3994) | ¥5295.00 | ¥10441.06 | 49.3% |

| LibertaLtd (TSE:4935) | ¥512.00 | ¥983.64 | 47.9% |

Let's take a closer look at a couple of our picks from the screened companies

Sumitomo Chemical Company (TSE:4005)

Overview: Sumitomo Chemical Company, Limited operates globally in sectors including chemicals and plastics, energy and functional materials, IT-related chemicals, health and crop sciences, pharmaceuticals, among others, with a market capitalization of approximately ¥568.65 billion.

Operations: The company operates across various sectors such as chemicals and plastics, energy and functional materials, IT-related chemicals, health and crop sciences, and pharmaceuticals.

Estimated Discount To Fair Value: 16.2%

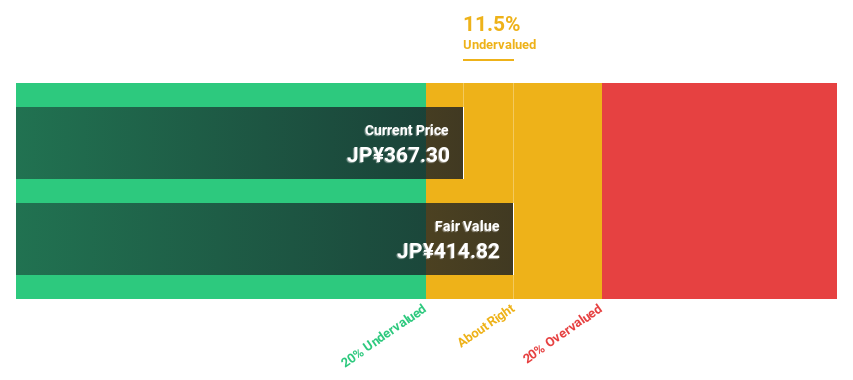

Sumitomo Chemical Company is recognized as undervalued based on cash flow analysis, trading at ¥347.6 against a fair value estimate of ¥414.82. Despite recent market index adjustments and a substantial impairment loss in Q4 2023, the company is poised for profitability with expected annual earnings growth substantially above the market average. Strategic alliances aim to enhance its global technology footprint, although dividends are currently not well covered by earnings or cash flows, reflecting some financial strain.

- In light of our recent growth report, it seems possible that Sumitomo Chemical Company's financial performance will exceed current levels.

- Dive into the specifics of Sumitomo Chemical Company here with our thorough financial health report.

Japan Business Systems (TSE:5036)

Overview: Japan Business Systems, Inc. operates in cloud integration and related services with a market capitalization of approximately ¥47.72 billion.

Operations: The firm specializes in cloud integration and associated services.

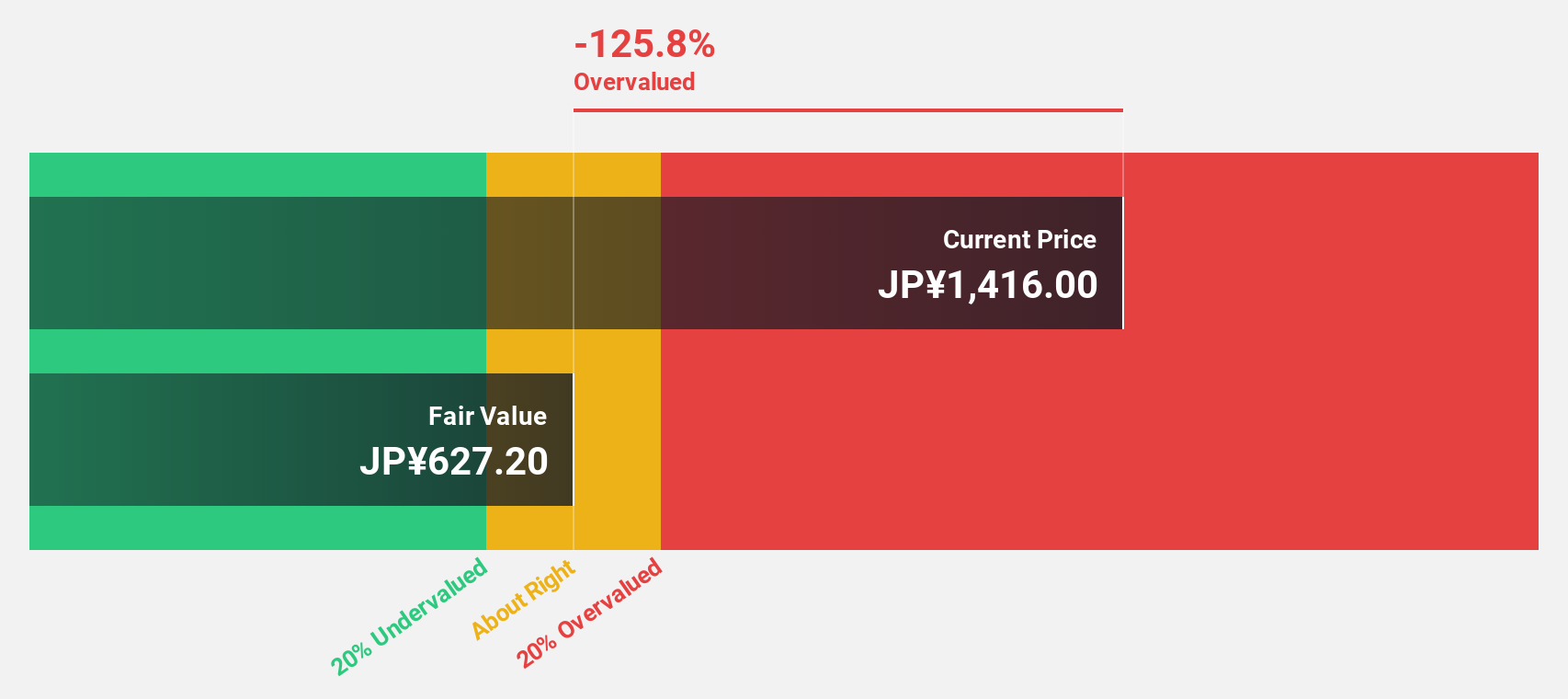

Estimated Discount To Fair Value: 22.3%

Japan Business Systems is currently priced at ¥1047, which is 22.3% below our fair value estimate of ¥1346.81, suggesting it is undervalued based on discounted cash flow analysis. Despite a dividend yield of 2.29% not being well-supported by cash flows, the company's earnings are expected to grow significantly at 38.7% annually over the next three years, outpacing the Japanese market average growth of 8.9%. However, its revenue growth projection of 8% per year lags behind more aggressive market segments and its share price has shown high volatility recently.

- Our earnings growth report unveils the potential for significant increases in Japan Business Systems' future results.

- Unlock comprehensive insights into our analysis of Japan Business Systems stock in this financial health report.

Enplas (TSE:6961)

Overview: Enplas Corporation, operating globally, specializes in the manufacturing and sale of semiconductor and automobile parts, optical communication devices, and life science related products with a market capitalization of ¥71.86 billion.

Operations: The company generates revenue through the sales of semiconductor and automobile parts, optical communication devices, and life science related products.

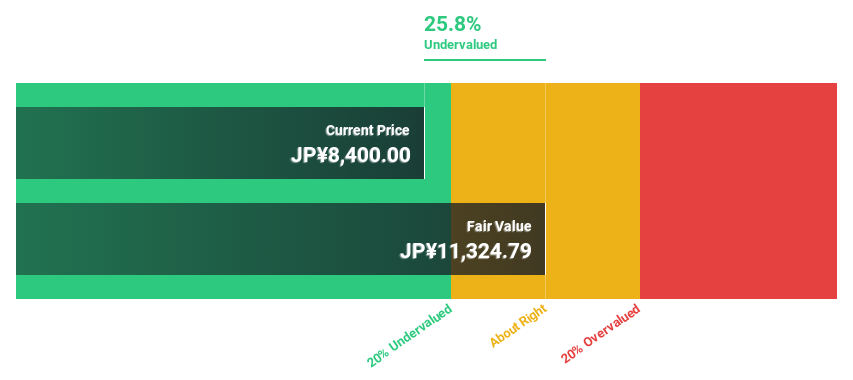

Estimated Discount To Fair Value: 27%

Enplas, priced at ¥8140, is valued below its estimated fair value of ¥11151.83, reflecting a potential undervaluation in the market. Despite its share price volatility over the past three months, Enplas is poised for substantial earnings growth, projected at 23.16% annually over the next three years—outperforming the Japanese market's average. However, its revenue growth rate of 9.2% per year remains modest compared to broader market expectations. Recent board decisions to dispose of treasury stock could impact future valuations and investor perceptions.

- Our growth report here indicates Enplas may be poised for an improving outlook.

- Take a closer look at Enplas' balance sheet health here in our report.

Key Takeaways

- Access the full spectrum of 93 Undervalued Japanese Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Enplas is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6961

Enplas

Manufactures and sells semiconductor, automobile parts, optical communication devices, and life science related products in Japan and internationally.

Flawless balance sheet with reasonable growth potential.