Amid a backdrop of easing U.S.-China trade tensions and rising investor optimism, Asian markets have shown resilience with key indices like the CSI 300 reaching multi-year highs. In this environment, dividend stocks in Asia offer an attractive proposition for investors seeking stable income streams, particularly as they navigate the complexities of global economic shifts.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.25% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.73% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.96% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.81% | ★★★★★★ |

| NCD (TSE:4783) | 4.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.57% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.37% | ★★★★★★ |

Click here to see the full list of 1019 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

China BlueChemical (SEHK:3983)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China BlueChemical Ltd. operates in the processing of natural gas and the development, production, and sale of chemical fertilizers and products both within China and internationally, with a market cap of HK$12.17 billion.

Operations: China BlueChemical Ltd.'s revenue is primarily derived from the sale of Urea (CN¥3.27 billion), Methanol (CN¥3.20 billion), Acrylonitrile (CN¥2.26 billion), and Phosphorus and Compound Fertiliser (CN¥2.66 billion).

Dividend Yield: 5%

China BlueChemical's dividend payments are covered by earnings and cash flows, with a payout ratio of 54.3% and a cash payout ratio of 73.9%. Despite this coverage, dividends have been volatile over the past decade, lacking stability and reliability. Recent earnings showed a slight decline in sales to CNY 5.85 billion and net income to CNY 640.56 million for the half year ended June 2025. The price-to-earnings ratio is favorable at 10.9x compared to the Hong Kong market average of 12.6x, although its dividend yield of 4.96% is below the top tier in the region.

- Unlock comprehensive insights into our analysis of China BlueChemical stock in this dividend report.

- According our valuation report, there's an indication that China BlueChemical's share price might be on the expensive side.

Tsumura (TSE:4540)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsumura & Co. produces and sells Kampo extract intermediates and granular Kampo formulations in Japan and internationally, with a market cap of ¥294.72 billion.

Operations: Tsumura & Co.'s revenue primarily comes from its Pharmaceutical Products segment, which generated ¥180.50 billion.

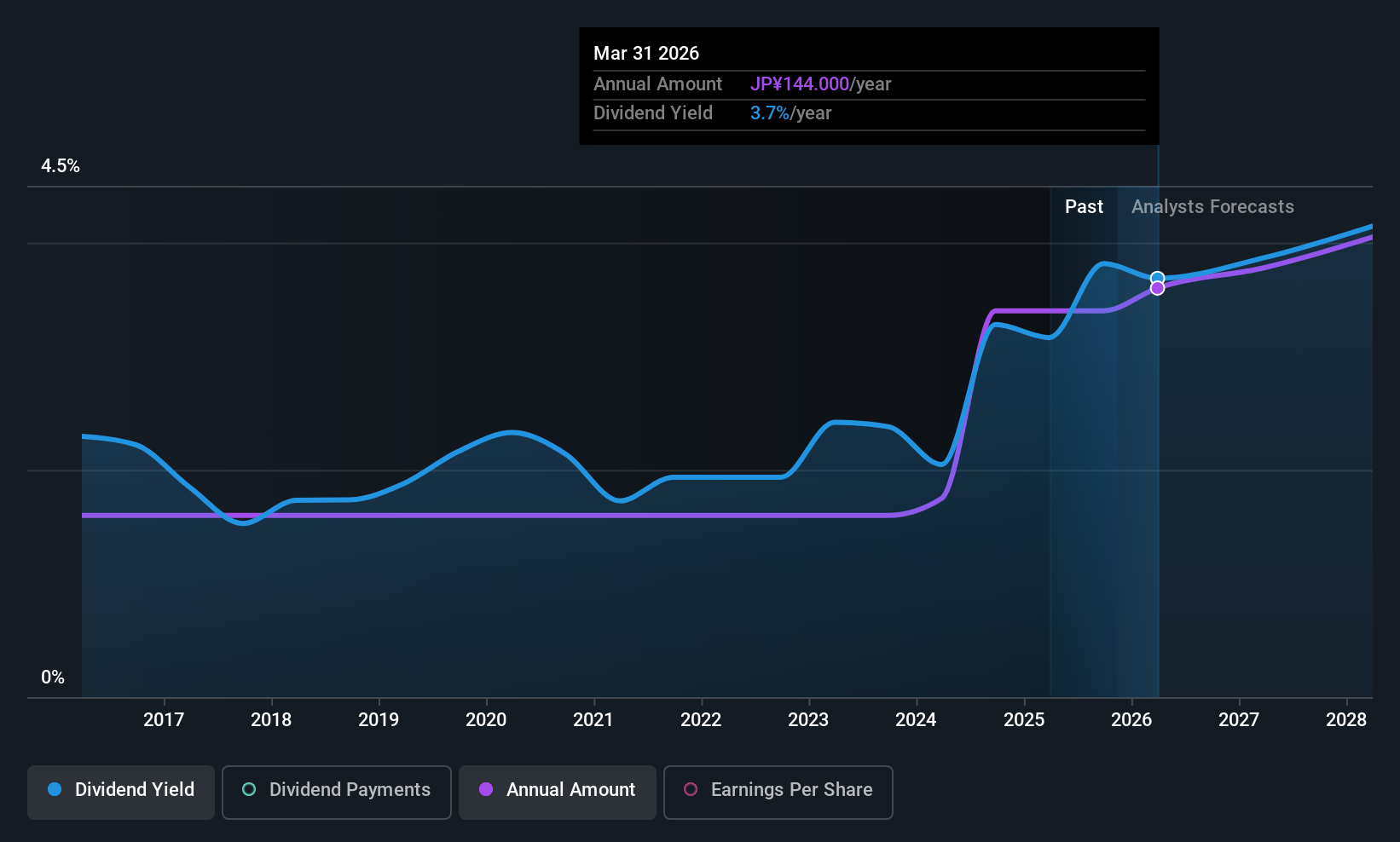

Dividend Yield: 3.4%

Tsumura's dividend yield of 3.45% is lower than the top 25% of payers in Japan, and its high cash payout ratio (232.1%) indicates dividends are not well covered by free cash flow. Despite this, dividends have been stable and growing over the past decade. The company trades at a favorable P/E ratio of 11.5x against the market average, suggesting good relative value, although sustainability concerns remain due to insufficient coverage by earnings or cash flows.

- Delve into the full analysis dividend report here for a deeper understanding of Tsumura.

- In light of our recent valuation report, it seems possible that Tsumura is trading behind its estimated value.

Computer Institute of Japan (TSE:4826)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computer Institute of Japan, Ltd. offers system development and related services in Japan with a market cap of ¥30.86 billion.

Operations: Computer Institute of Japan, Ltd. generates revenue primarily through its System Development and Services segment, which accounts for ¥27.25 billion.

Dividend Yield: 3%

Computer Institute of Japan offers a reliable dividend yield of 3.02%, although it falls short compared to the top 25% in Japan's market. The company's dividends are well-covered by both earnings and cash flows, with payout ratios around 52%. Despite recent share price volatility, its dividends have been stable and growing over the past decade. Current trading at a discount to estimated fair value suggests potential for investors seeking stability in dividend payments amidst market fluctuations.

- Navigate through the intricacies of Computer Institute of Japan with our comprehensive dividend report here.

- According our valuation report, there's an indication that Computer Institute of Japan's share price might be on the cheaper side.

Turning Ideas Into Actions

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1016 more companies for you to explore.Click here to unveil our expertly curated list of 1019 Top Asian Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsumura might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4540

Tsumura

Engages in the production and sale of Kampo extract intermediates and granular Kampo formulations in Japan and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives