Dentsu Soken (TSE:4812): Examining Valuation After a Period of Steady Share Price Movement

Reviewed by Simply Wall St

Dentsu Soken (TSE:4812) has turned a few heads recently, not because of any dramatic announcement or shock headline, but simply due to a period of modest but persistent movement in its share price. Sometimes, these quieter stretches are when the real questions start to surface. Is the market signaling something about the company’s true worth, or are investors just riding the broader market mood?

Looking over the past year, the stock has delivered a solid 20% return, with momentum gathering in the earlier part of the year before settling into a more muted pattern. Despite a dip in the past three months, the longer-term performance over three and five years remains strong. The company has also continued posting steady revenue and net income growth recently, which may hint at underlying business resilience even if near-term excitement feels limited.

With Dentsu Soken’s strong track record but a cooling pace lately, some investors may be wondering if this represents an opportunity or if the market has already factored in its growth outlook.

Price-to-Earnings of 27.4x: Is it justified?

Dentsu Soken is currently trading at a Price-to-Earnings (P/E) ratio of 27.4x, which is considered expensive compared to both the industry average of 17.8x and the estimated fair P/E ratio of 27.1x. This valuation suggests the market is assigning a premium to its earnings relative to other IT companies in Japan.

The P/E ratio measures how much investors are willing to pay for each yen of the company’s earnings. For technology and software firms like Dentsu Soken, higher multiples can reflect anticipated growth and perceived business quality. However, a premium P/E also raises the bar for future performance expectations.

Given that Dentsu Soken’s P/E ratio is above industry norms, the market may be overpricing the company’s expected earnings. This could be influenced by its historical growth and financial stability. The current multiple appears justified only if future results continue to support elevated expectations.

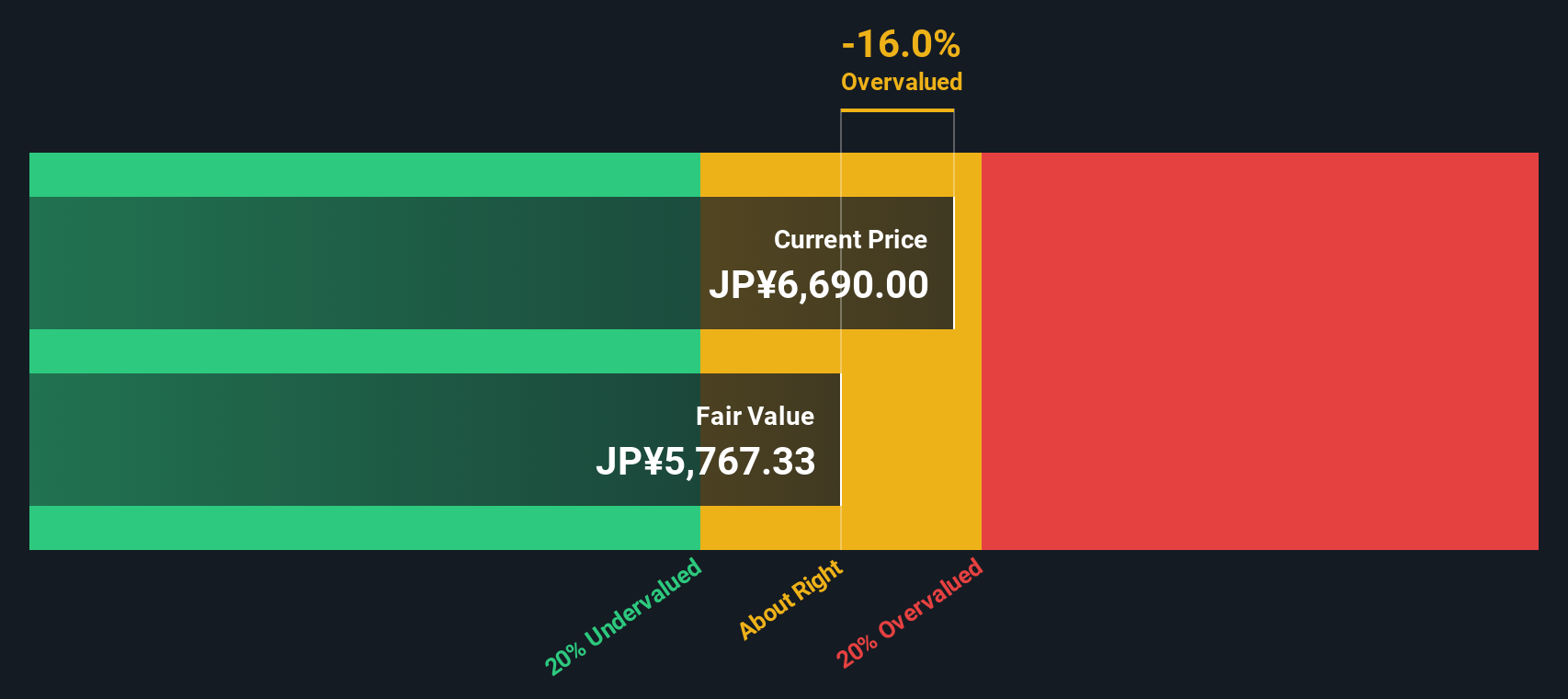

Result: Fair Value of ¥5,758.57 (OVERVALUED)

See our latest analysis for Dentsu Soken.However, any unexpected slowdown in Dentsu Soken’s revenue growth or a broader market correction could quickly challenge its premium valuation and recent momentum.

Find out about the key risks to this Dentsu Soken narrative.Another Perspective: What Does Our DCF Model Say?

While the market’s pricing seems lofty compared to sector averages, our DCF model points in the same direction. This suggests that even when accounting for long-term cash flows, the shares look expensive. So does this mean overvaluation is certain, or is there something being missed in the bigger picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dentsu Soken Narrative

If you see things differently, or want to investigate the numbers for yourself, you can put together your own perspective in just a few minutes. Do it your way.

A great starting point for your Dentsu Soken research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for better opportunities. Give yourself the edge by finding investment themes you might otherwise miss and get ahead of the curve with these tailored approaches:

- Spot potential gems before the crowd by chasing gains with penny stocks with strong financials. These up-and-comers stand out for solid financials at an attractive price point.

- Capture the momentum of cutting-edge healthcare innovation by tracking companies making breakthroughs in medical AI, powered by healthcare AI stocks.

- Boost your income potential by targeting dependable picks offering strong and consistent payouts using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4812

Flawless balance sheet with solid track record.

Market Insights

Community Narratives