- Japan

- /

- Capital Markets

- /

- TSE:8698

Discovering Undiscovered Gems on None in January 2025

Reviewed by Simply Wall St

As global markets continue to react to political developments and economic indicators, major indexes like the S&P 500 have reached record highs, driven by optimism surrounding potential trade deals and AI investments. While large-cap stocks have generally outperformed their smaller-cap counterparts, small-cap companies still present unique opportunities for investors seeking growth in a dynamic market environment. Identifying promising small-cap stocks often involves looking for strong fundamentals and innovative business models that can thrive despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITE Tech | NA | 8.91% | 16.50% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Donpon Precision | 35.22% | -2.30% | 36.96% | ★★★★★★ |

| Jiin Ming Industry | 9.39% | -8.97% | -9.24% | ★★★★☆☆ |

| ILSEUNG | 39.02% | -4.46% | 33.48% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

| MNtech | 65.44% | 16.96% | -17.92% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Alpha Systems (TSE:4719)

Simply Wall St Value Rating: ★★★★★★

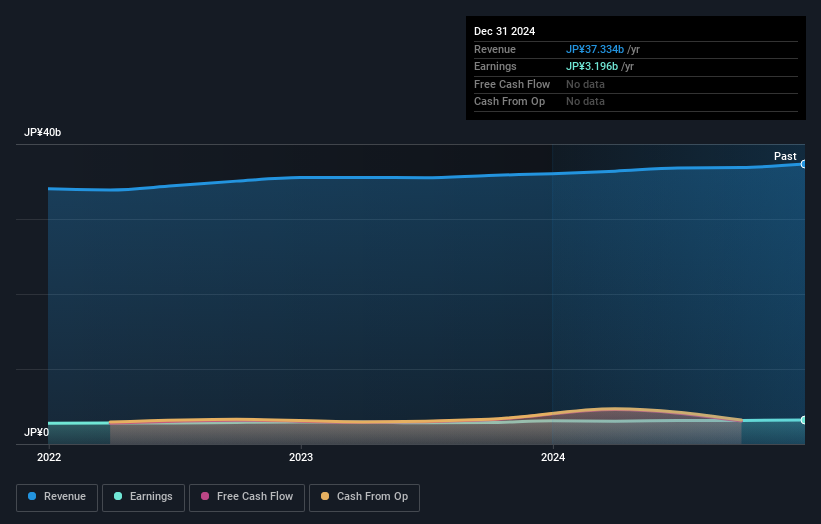

Overview: Alpha Systems Inc. develops software for backbone communications systems in Japan and has a market cap of ¥47.71 billion.

Operations: Alpha Systems generates revenue primarily from software development for backbone communications systems. The company has a market cap of ¥47.71 billion.

Alpha Systems, a smaller player in the tech industry, shines with its debt-free status and high-quality earnings. Over the past five years, earnings have grown at an annual rate of 8.1%, although recent growth of 9.3% lagged behind the broader software industry's 12.1%. The company trades at a notable discount of 12.3% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. With consistent free cash flow generation and no interest payment concerns due to zero debt, Alpha Systems presents a stable financial picture amidst competitive market dynamics in the software sector.

Noevir Holdings (TSE:4928)

Simply Wall St Value Rating: ★★★★★★

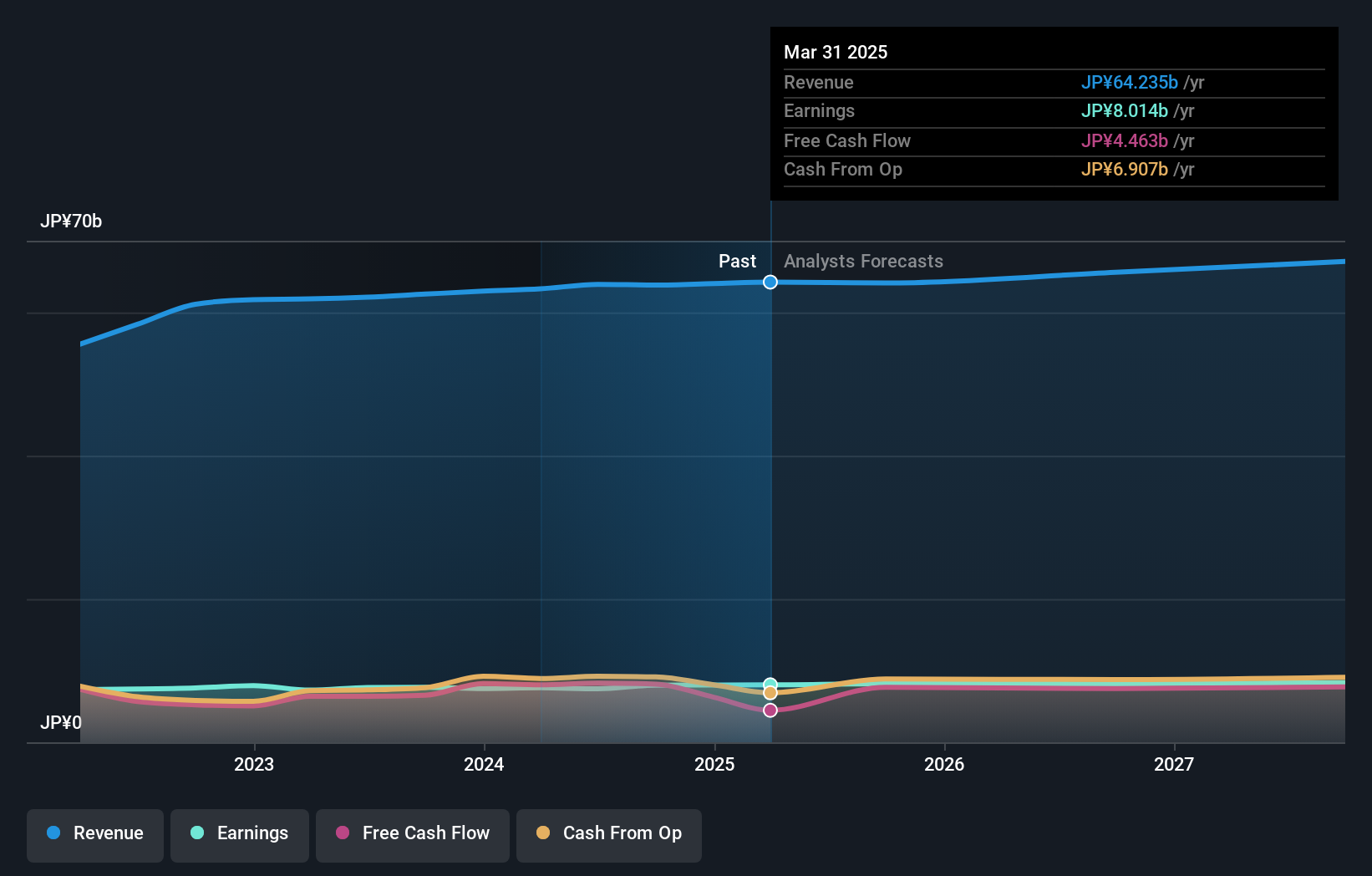

Overview: Noevir Holdings Co., Ltd. is engaged in the development, production, and sale of cosmetics, pharmaceuticals, and health food products across several countries including Japan and North America, with a market capitalization of ¥158.48 billion.

Operations: Noevir Holdings generates revenue primarily from its cosmetics segment, which accounts for ¥49.76 billion, followed by the pharmaceuticals and food business contributing ¥11.44 billion. The company focuses on these key areas to drive its financial performance across its operational regions.

Noevir Holdings, a nimble player in the personal products sector, has been showcasing impressive financial health with no debt over the past five years and a price-to-earnings ratio of 20x, which is attractive compared to the industry average. The company’s high-quality earnings have outpaced the industry with a 3.9% growth last year against an industry dip of 8.4%. Recent announcements highlight consistent dividend growth, now at JPY 225 per share, reflecting solid profitability. Looking ahead, Noevir anticipates net sales of JPY 64 billion and operating profits reaching JPY 11.5 billion for fiscal year-end September 2025.

- Take a closer look at Noevir Holdings' potential here in our health report.

Gain insights into Noevir Holdings' historical performance by reviewing our past performance report.

Monex Group (TSE:8698)

Simply Wall St Value Rating: ★★★★★☆

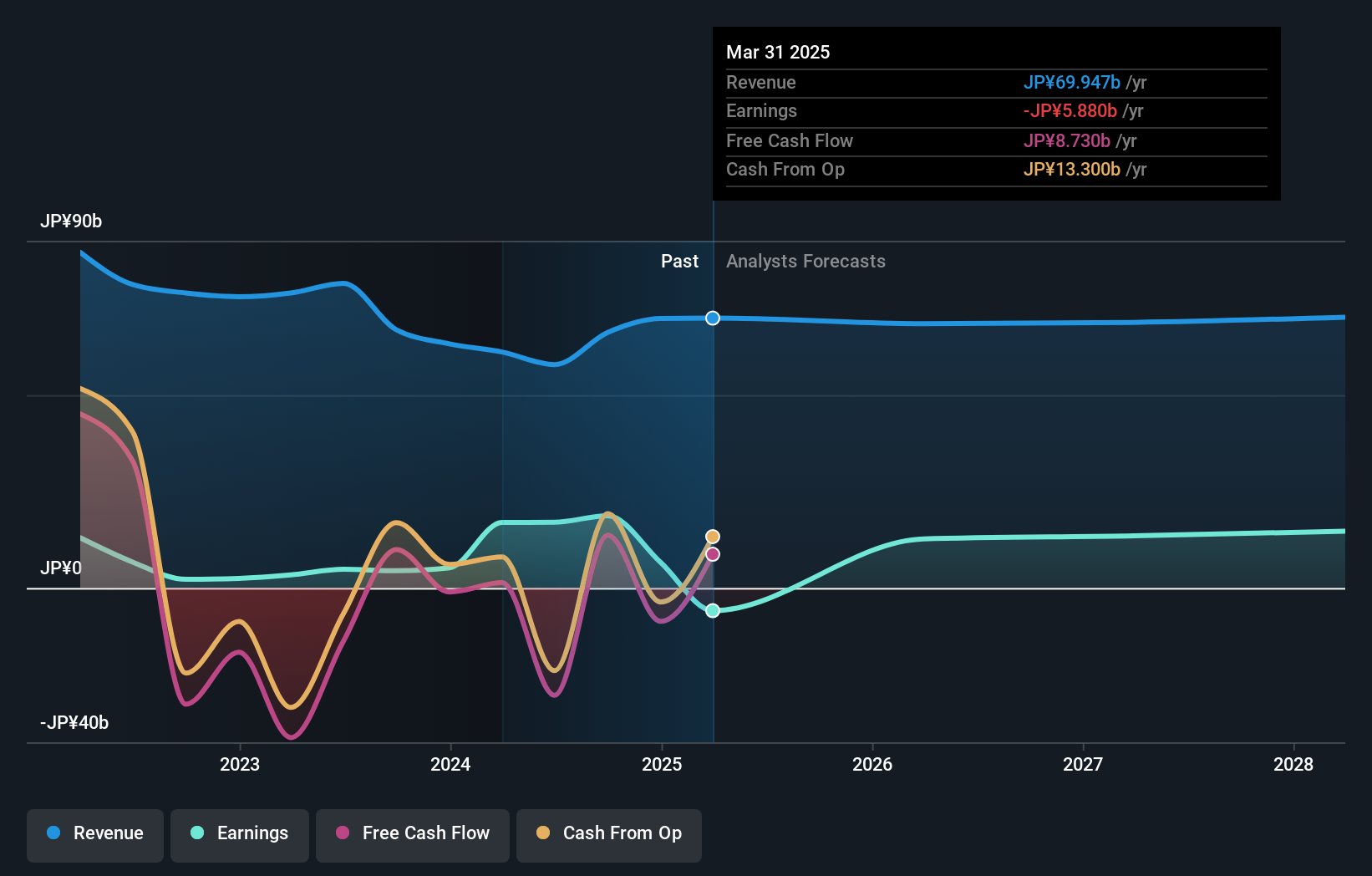

Overview: Monex Group, Inc. is an online financial institution offering retail brokerage services across Japan, the United States, China, and Australia with a market capitalization of ¥230.83 billion.

Operations: Monex Group's revenue is primarily driven by its operations in the United States, contributing ¥50.17 billion, followed by Japan at ¥10.81 billion and the Crypto-Asset Business at ¥11.83 billion. The Investment Segment recorded a negative contribution of -¥34 million, while segment adjustments added ¥1.37 billion to the total revenue.

Monex Group, a nimble player in the financial sector, has shown impressive earnings growth of 320% over the past year, outpacing its industry peers. With a price-to-earnings ratio of 12.4x, it trades below the JP market average of 13.7x, suggesting good relative value. The company recently reduced its debt-to-equity ratio from 362% to 59% over five years and completed a share buyback program involving ¥2.27 billion for about 1.21% of shares outstanding. Additionally, Monex is venturing into blockchain with its Monex Web3 ID initiative to enhance digital identity solutions in this evolving space.

- Get an in-depth perspective on Monex Group's performance by reading our health report here.

Review our historical performance report to gain insights into Monex Group's's past performance.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4677 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8698

Monex Group

An online financial institution, provides retail online brokerage services.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion