Assessing Trend Micro (TSE:4704) Valuation After a Period of Steady Share Price Performance

Reviewed by Simply Wall St

See our latest analysis for Trend Micro.

Looking beyond the daily moves, Trend Micro’s share price has shown a measured pace this year, with a 1-year total shareholder return of -3.1%. Despite some cautious trading lately, long-term holders have still enjoyed a solid 64% total return over five years. This suggests that, while momentum is not especially strong, the company has rewarded patient investors over time.

If you’re curious to see which other technology leaders might be set for their next big chapter, check out the See the full list for free..

With Trend Micro’s shares lagging both analyst targets and some of its peers, the key question is whether the market is underestimating its growth potential or if current prices already reflect all foreseeable upside.

Most Popular Narrative: 15.7% Undervalued

With Trend Micro’s fair value narrative set at ¥9,250, the stock closed at ¥7,800, putting it firmly in undervalued territory by their standards. This sets up a compelling story where growth optimism collides with a cautious market mood.

The company has reported strong pre-GAAP performance and significant multiyear contracts, signaling a robust sales pipeline and customer confidence in Trend Micro's platform, likely supporting revenue and earnings growth.

Want to know what drives this bullish outlook? The narrative leans on a foundation of aggressive profit expansion and a future earnings multiple rarely seen outside high-growth tech. The hidden ingredient is financial projections that could surprise even seasoned market watchers. Dive deeper to see what makes this valuation stand out.

Result: Fair Value of ¥9,250 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as continued struggles in Trend Micro’s consumer segment and setbacks in online settlements could hinder the positive outlook currently driving the stock.

Find out about the key risks to this Trend Micro narrative.

Another View: Multiples Suggest a Hefty Price Tag

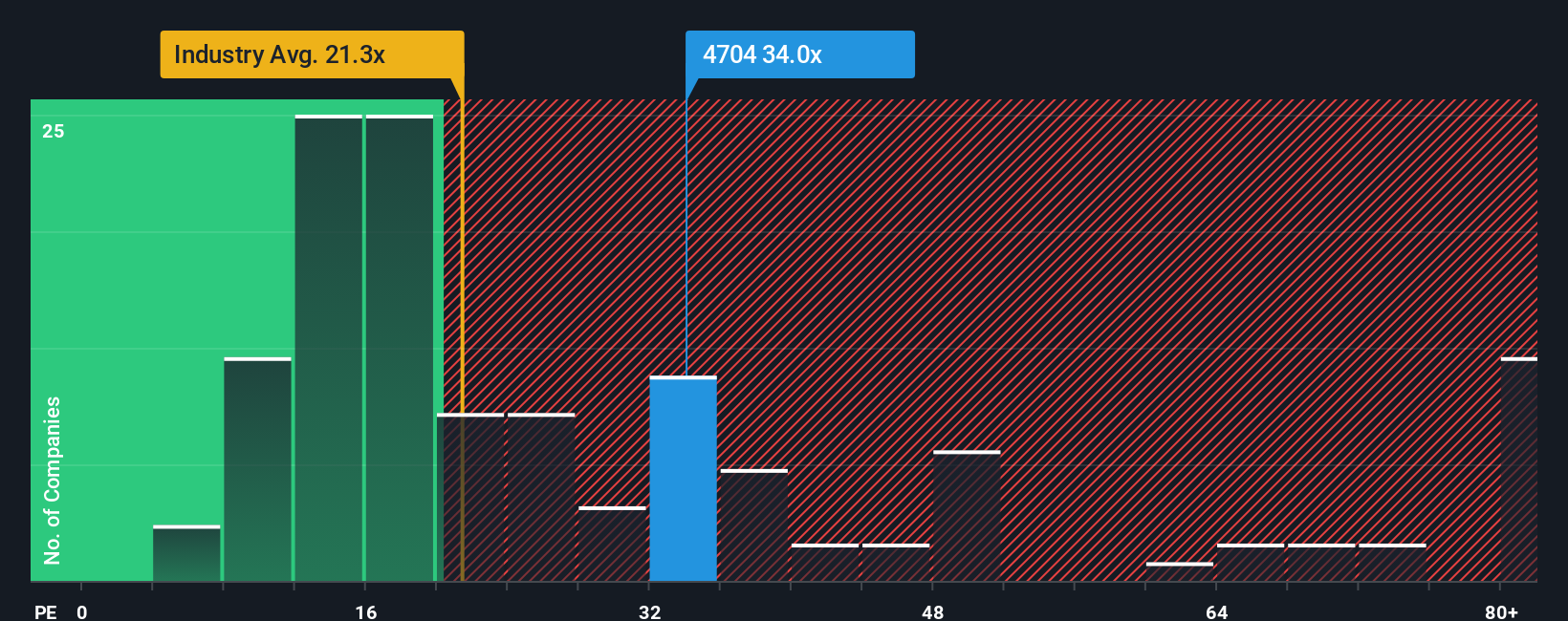

While the fair value case looks compelling, comparing Trend Micro's share price to its earnings tells a more cautious story. The company's current ratio is 33.4x, which is notably higher than both the industry average of 21.6x and its own fair ratio of 30.4x. This premium means investors are already paying up for growth, but does the earnings trajectory justify such confidence?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trend Micro Narrative

If you're keen to challenge the prevailing outlook or dive into your own research, shaping a personal narrative takes just a few minutes: Do it your way.

A great starting point for your Trend Micro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Broaden your horizons and give yourself an edge by checking out other standout possibilities on Simply Wall Street today. There is a world of potential waiting, and you do not want to miss your chance.

- Uncover companies tapping into the fast-growing healthcare and artificial intelligence sectors by starting with these 32 healthcare AI stocks.

- Target reliable returns and attractive yields with these 16 dividend stocks with yields > 3% to boost your income strategy.

- Ride the wave of next-generation finance through these 82 cryptocurrency and blockchain stocks as it shapes tomorrow’s digital marketplace.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives