WITZ Corporation (TSE:4440) Looks Just Right With A 25% Price Jump

The WITZ Corporation (TSE:4440) share price has done very well over the last month, posting an excellent gain of 25%. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

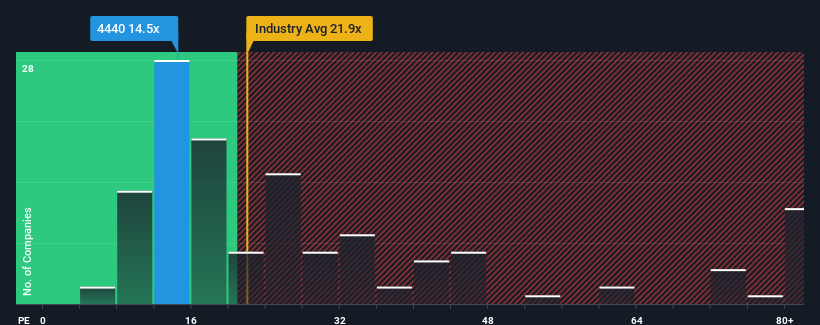

Although its price has surged higher, there still wouldn't be many who think WITZ's price-to-earnings (or "P/E") ratio of 14.5x is worth a mention when the median P/E in Japan is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

WITZ certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for WITZ

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like WITZ's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 109% last year. The strong recent performance means it was also able to grow EPS by 38% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

In light of this, it's understandable that WITZ's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From WITZ's P/E?

WITZ's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that WITZ maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - WITZ has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

You might be able to find a better investment than WITZ. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if WITZ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4440

WITZ

Engages in the service design and software development businesses in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives