- Poland

- /

- Hospitality

- /

- WSE:RBW

Discovering November 2024's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with small-cap stocks like those in the Russell 2000 Index experiencing a notable surge, investors are closely watching how policy shifts might influence growth and inflation dynamics. Amidst this backdrop of economic optimism and shifting fiscal landscapes, identifying stocks with strong fundamentals and growth potential becomes crucial for navigating these evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

WingArc1st (TSE:4432)

Simply Wall St Value Rating: ★★★★★★

Overview: WingArc1st Inc. is a Japanese company that develops and sells software and services, with a market cap of ¥116.72 billion.

Operations: The company generates revenue primarily through the development and sale of software and services in Japan. It has a market capitalization of ¥116.72 billion.

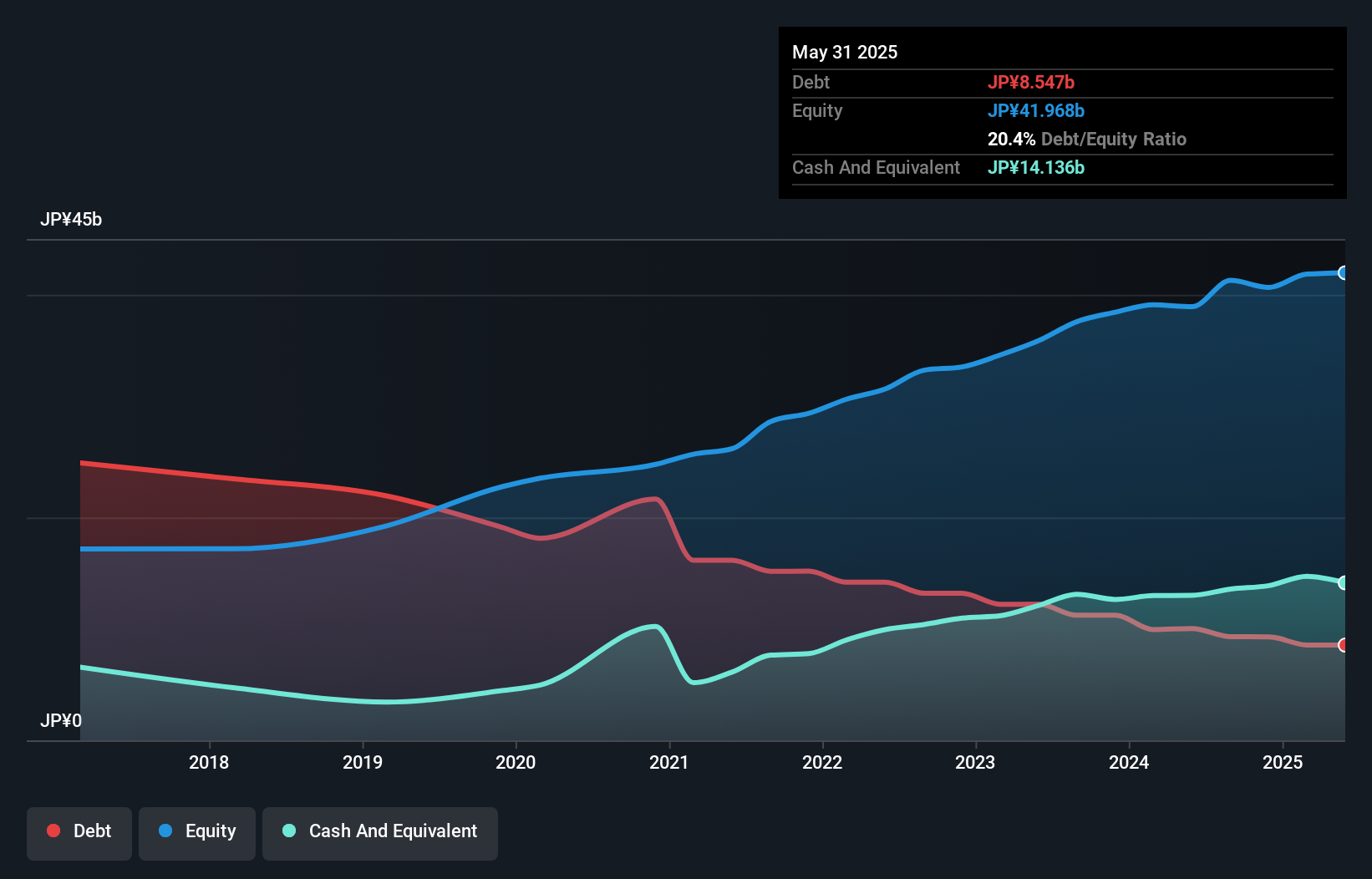

WingArc1st, a promising player in the tech sector, exhibits solid financial health with its debt to equity ratio dropping from 92.8% to 22.5% over five years, indicating prudent debt management. The company has consistently achieved high-quality earnings and maintains more cash than its total debt, highlighting robust fiscal stability. With earnings growing at 13% annually over the past five years and forecasted growth of 12.68% per year, WingArc1st shows potential for continued expansion despite slightly lagging behind industry growth rates recently at 12.3%. Trading at a significant discount of 30.8% below estimated fair value suggests an attractive investment opportunity within its industry context.

- Navigate through the intricacies of WingArc1st with our comprehensive health report here.

Gain insights into WingArc1st's historical performance by reviewing our past performance report.

Shinnihonseiyaku (TSE:4931)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shinnihonseiyaku Co., Ltd. is involved in the production and distribution of cosmetics, pharmaceuticals, and health food products both within Japan and internationally, with a market capitalization of ¥41.86 billion.

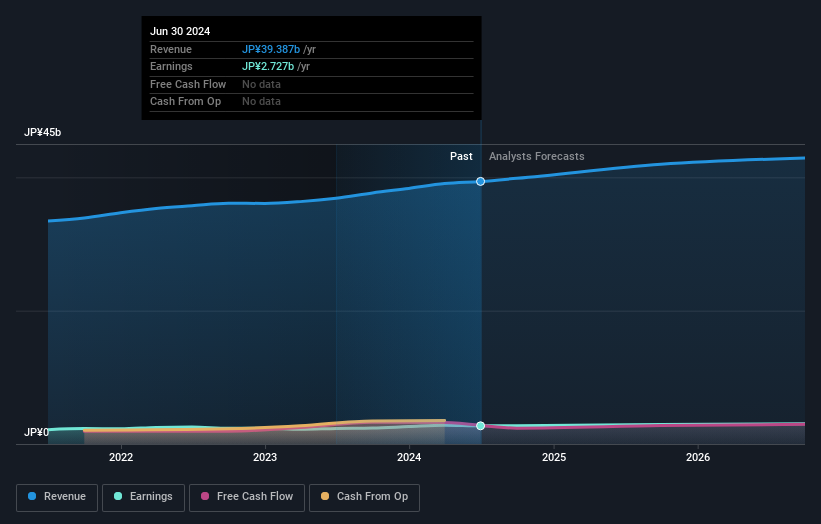

Operations: Shinnihonseiyaku generates revenue primarily through its retail segment, specifically catalog and mail order sales, amounting to ¥39.39 billion. The company's financial performance is influenced by its net profit margin trends over recent periods.

Shinnihonseiyaku, a nimble player in the personal products sector, is gaining traction with its robust financial footing. The company boasts high-quality earnings and operates with more cash than debt, highlighting its financial prudence. Over the past year, earnings surged by 17%, outpacing the industry average of 4.6%. Trading at 37% below estimated fair value suggests potential upside for investors. A share buyback program worth ¥1.1 billion aims to enhance capital efficiency by repurchasing up to 540,000 shares or about 2.5% of issued capital before December's end—an initiative likely reflecting confidence in future growth prospects.

Rainbow Tours (WSE:RBW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rainbow Tours S.A. is a tour operator active in Poland, the Czech Republic, Slovakia, and Lithuania with a market capitalization of PLN 1.75 billion.

Operations: Rainbow Tours derives its primary revenue from Tour Operator Activities in Poland, contributing PLN 3.58 billion, and has additional income from foreign operations amounting to PLN 128.89 million. The Hotel Segment abroad adds PLN 50.82 million to the revenue stream, while activities within Poland contribute an extra PLN 5.54 million.

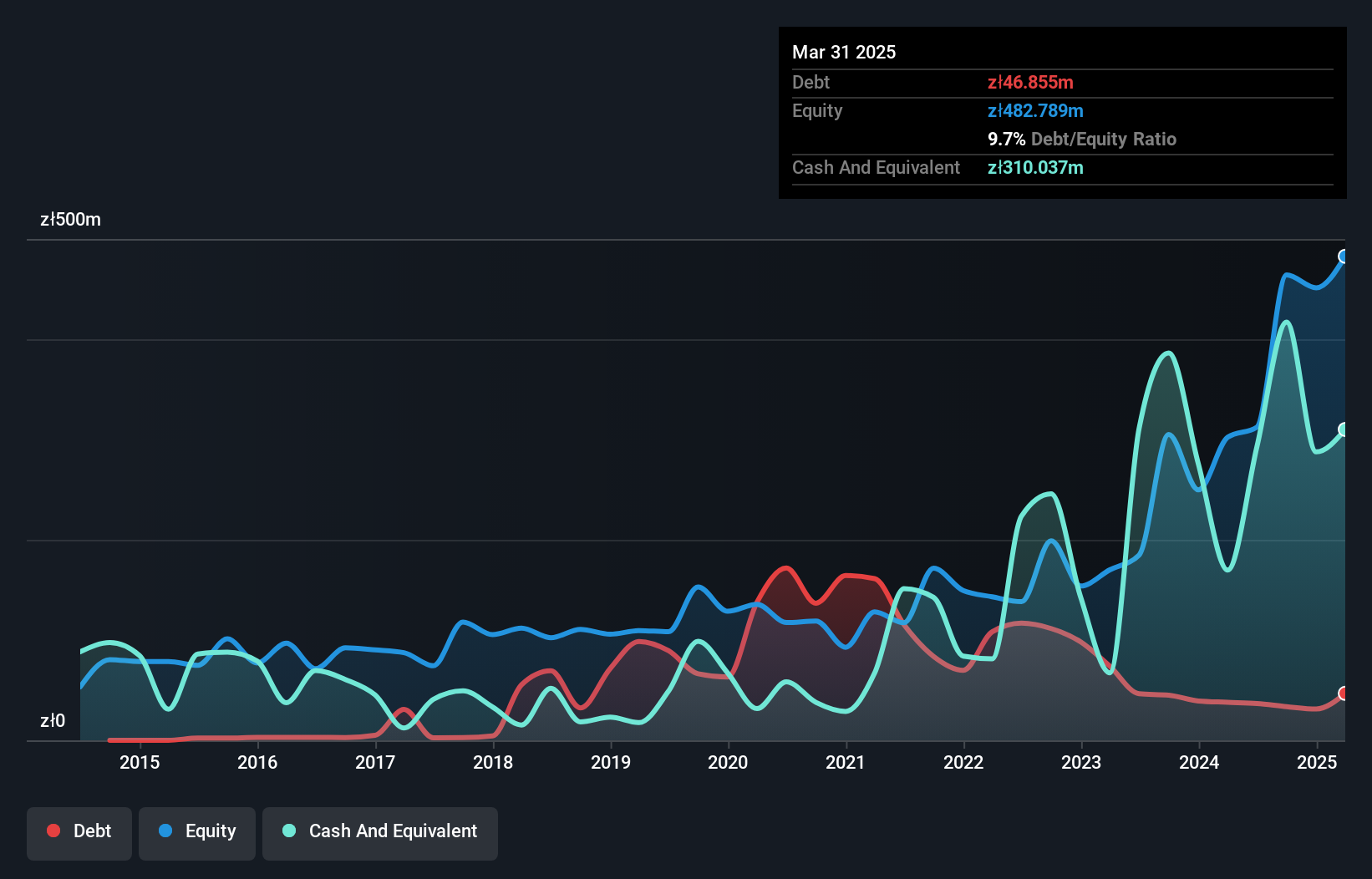

Rainbow Tours, a nimble player in its field, has shown impressive financial strides. Over the past year, earnings surged by 146%, outpacing the broader Hospitality sector's modest growth of 3%. The company has also significantly improved its debt situation, with a debt to equity ratio dropping from 83% to just 12% over five years. Recent half-year results revealed sales of PLN 1.61 billion and net income climbing to PLN 97 million from PLN 55 million previously. With shares trading at a discount of over 26% below estimated fair value, Rainbow Tours presents an intriguing opportunity for investors seeking potential value plays.

- Unlock comprehensive insights into our analysis of Rainbow Tours stock in this health report.

Examine Rainbow Tours' past performance report to understand how it has performed in the past.

Where To Now?

- Dive into all 4648 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:RBW

Rainbow Tours

Operates as a tour operator in Poland, the Czech Republic, Slovakia, and Lithuania.

Outstanding track record with excellent balance sheet.