Global Security Experts (TSE:4417): Share Price Lags DCF Value Despite Forecasted 34% Earnings Growth

Reviewed by Simply Wall St

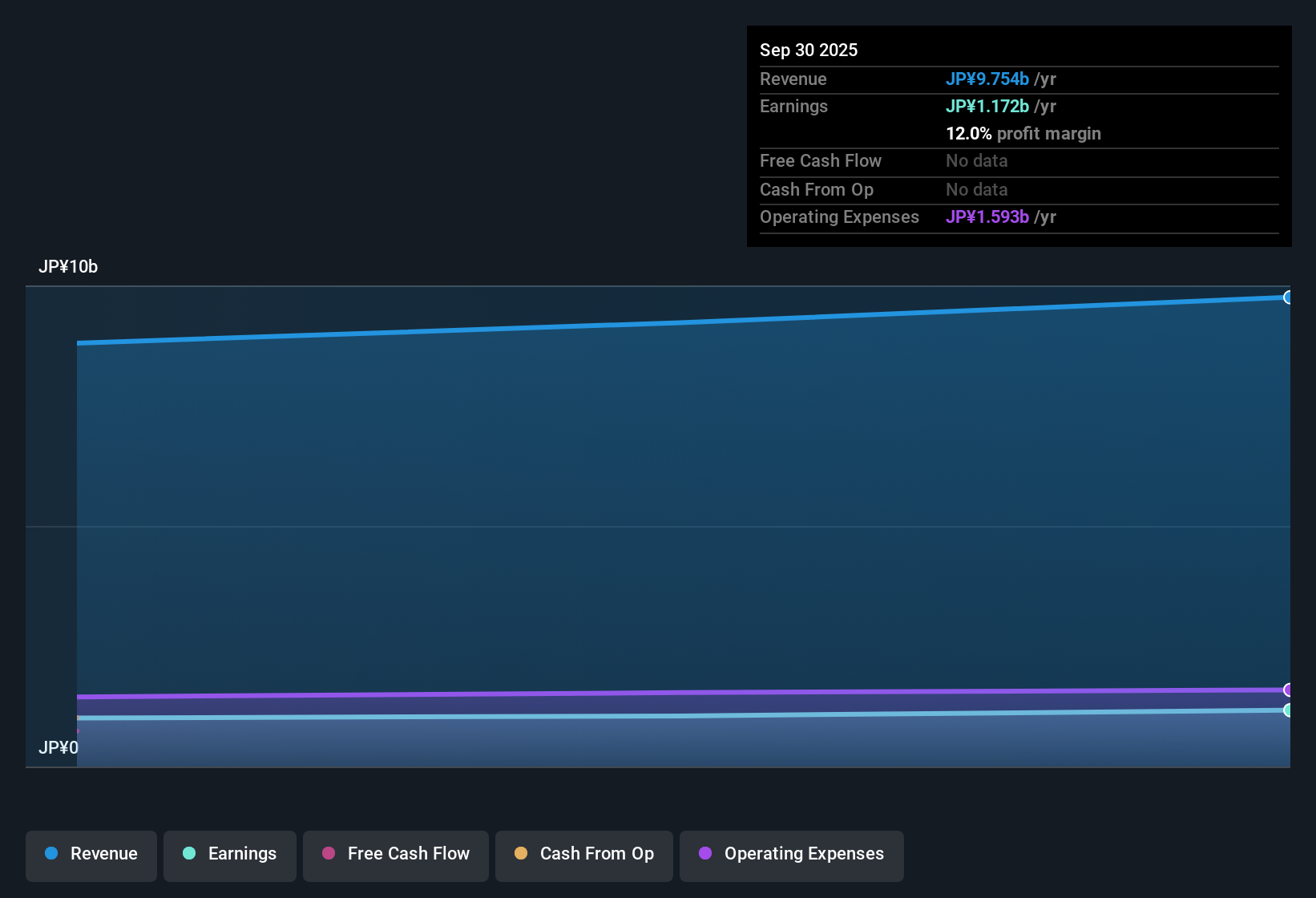

Global Security Experts (TSE:4417) posted a robust set of headline numbers, trading at ¥3,705 per share while the estimated fair value sits higher at ¥5,736.41. The company’s earnings are forecast to accelerate at 34.2% annually, with revenue expected to climb 24.7% each year. Both figures easily outpace the Japanese market averages of 7.9% for earnings and 4.5% for revenue. Despite high-quality earnings and attractive growth expectations, investors are watching a notably elevated Price-To-Earnings Ratio of 47.5x, alongside minor concerns about share price stability and major risks tied to financial data sufficiency.

See our full analysis for Global Security Experts.Next, we will see how these earnings predictions and valuation measures compare with widely followed market narratives, highlighting both confirmations and potential surprises.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Outpaces Share Price

- Shares trading at ¥3,705 remain well below the DCF fair value of ¥5,736.41. This suggests a substantial gap that could imply undervaluation if current growth trends persist.

- Market analysis highlights that, despite the premium multiples, investors who focus on discounted cash flow methods find strong justification for upside potential

- The DCF valuation gap reflects confidence from those prioritizing robust profit and revenue growth over headline ratios.

- Even with the 47.5x P/E far above industry norms, the case for value leans on forward projections staying on track.

P/E Multiple Climbs Far Above Peers

- A 47.5x Price-To-Earnings Ratio puts Global Security Experts not only above the Japanese IT industry average of 17.4x but also higher than the peer group average of 28.4x. This flags a steep valuation premium versus the sector.

- What is surprising is that this premium has not deterred optimism from value-driven investors

- Strong annual profit growth expectations of 34.2% give some justification for the elevated multiple, even as skeptics question the durability of this pace.

- DCF fair value still lands well above the current share price, so narrative tension remains between traditional multiple-based caution and growth-based optimism.

Spotlight on Share Price Stability Risk

- While high-quality earnings are noted by analysts, a minor risk was flagged in relation to share price stability over the last three months. This is a sign that volatility may be lurking beneath the surface of solid headline figures.

- Critics highlight that, alongside major risks tied to financial data sufficiency, the premium valuation only leaves a narrow margin for error on future disclosures

- In this context, the market’s willingness to tolerate a 47.5x P/E hinges on complete and timely reporting.

- Any gaps or delays in financial data could quickly sour sentiment among those already cautious about price swings.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Global Security Experts's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong growth forecasts, Global Security Experts faces skepticism over its high valuation multiples and risks tied to inconsistent financial disclosures and reporting.

If you’re concerned about overpaying or want alternatives with more compelling value, check out these 836 undervalued stocks based on cash flows to discover stocks currently priced more attractively based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4417

Global Security Experts

Operates as a cybersecurity education company in Japan.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives