Undiscovered Gems And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, small-cap stocks have faced mixed performances, with indices like the S&P 600 reflecting broader economic sentiments and policy shifts. Despite these challenges, certain small-cap companies continue to attract attention for their potential to capitalize on market dynamics and sector-specific trends. In this environment, identifying a promising stock often involves looking at companies with strong fundamentals that can adapt to regulatory changes and economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Primadaya Plastisindo | 12.52% | 18.29% | 26.12% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

China Beststudy Education Group (SEHK:3978)

Simply Wall St Value Rating: ★★★★★★

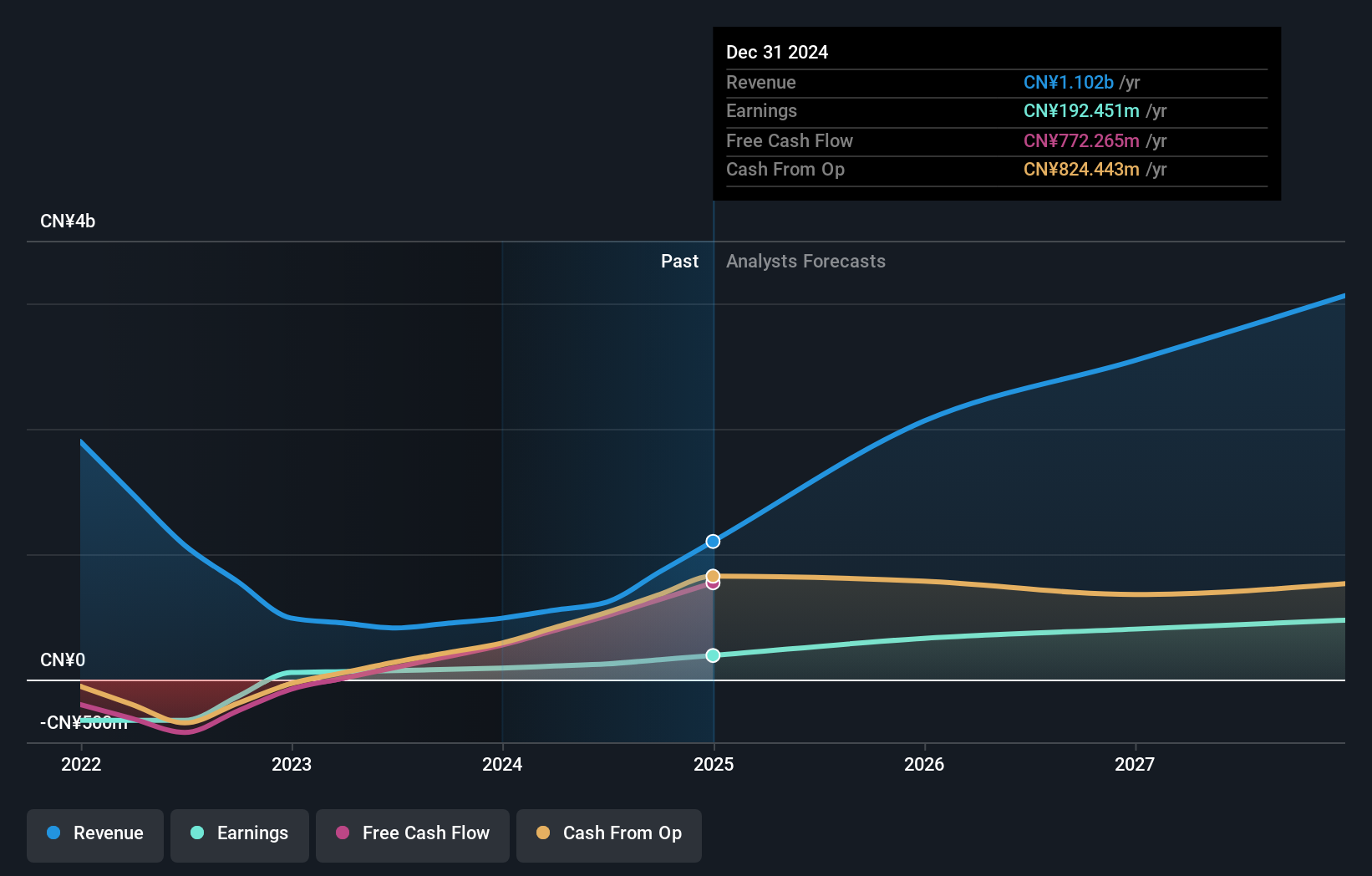

Overview: China Beststudy Education Group focuses on delivering after-school education services to K-12 students in China, with a market capitalization of HK$2.40 billion.

Operations: The primary revenue stream for China Beststudy Education Group is its provision of K-12 after-school education services, generating CN¥617.90 million. The company's financial performance can be assessed by examining its gross profit margin or net profit margin trends over recent periods to understand profitability dynamics.

China Beststudy Education Group, a nimble player in the education sector, has seen its earnings surge by 73.5% over the past year, outpacing the broader Consumer Services industry growth of 4.6%. Trading at a significant discount of 97.1% below estimated fair value, it presents an intriguing opportunity despite recent insider selling activity. The company remains debt-free and boasts high-quality earnings with projected growth of 42.32% annually. Recent board changes include Mr. Wai Ng joining the audit committee and Mr. Haipeng Shen's appointment as an independent director, both potentially bolstering governance and strategic oversight.

Macromill (TSE:3978)

Simply Wall St Value Rating: ★★★★☆☆

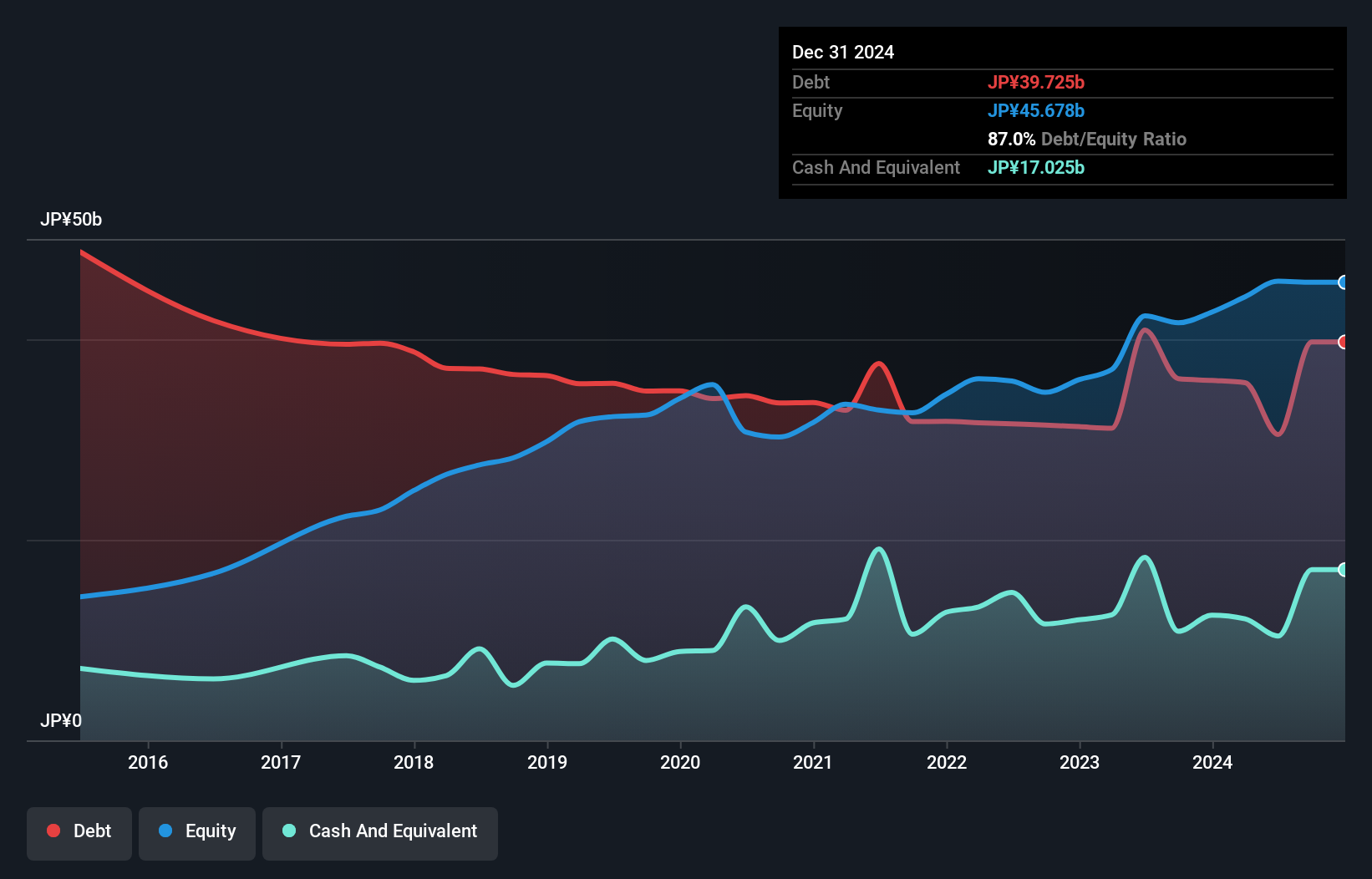

Overview: Macromill, Inc. is a company that offers marketing research and digital marketing solutions both in Japan and internationally, with a market capitalization of ¥42.38 billion.

Operations: Macromill generates revenue primarily from its Japan Business segment, contributing ¥37.73 billion, and its Korean Business segment, which adds ¥6.15 billion.

Macromill is making waves with its recent innovations and strategic moves. The company, trading at 82.2% below its estimated fair value, has seen a notable earnings growth of 28.5% over the past year, outpacing the media industry's average of 3.3%. Despite having a high net debt to equity ratio of 43.9%, Macromill's debt to equity ratio has improved from 110.3% to 66.6% over five years, indicating better financial management. Recently announced M&A activity suggests an acquisition by TJ1 Co., Ltd., offering ¥1150 per share for a majority stake, potentially reshaping its future trajectory in the marketing services sector.

- Dive into the specifics of Macromill here with our thorough health report.

Understand Macromill's track record by examining our Past report.

baudroieinc (TSE:4413)

Simply Wall St Value Rating: ★★★★★☆

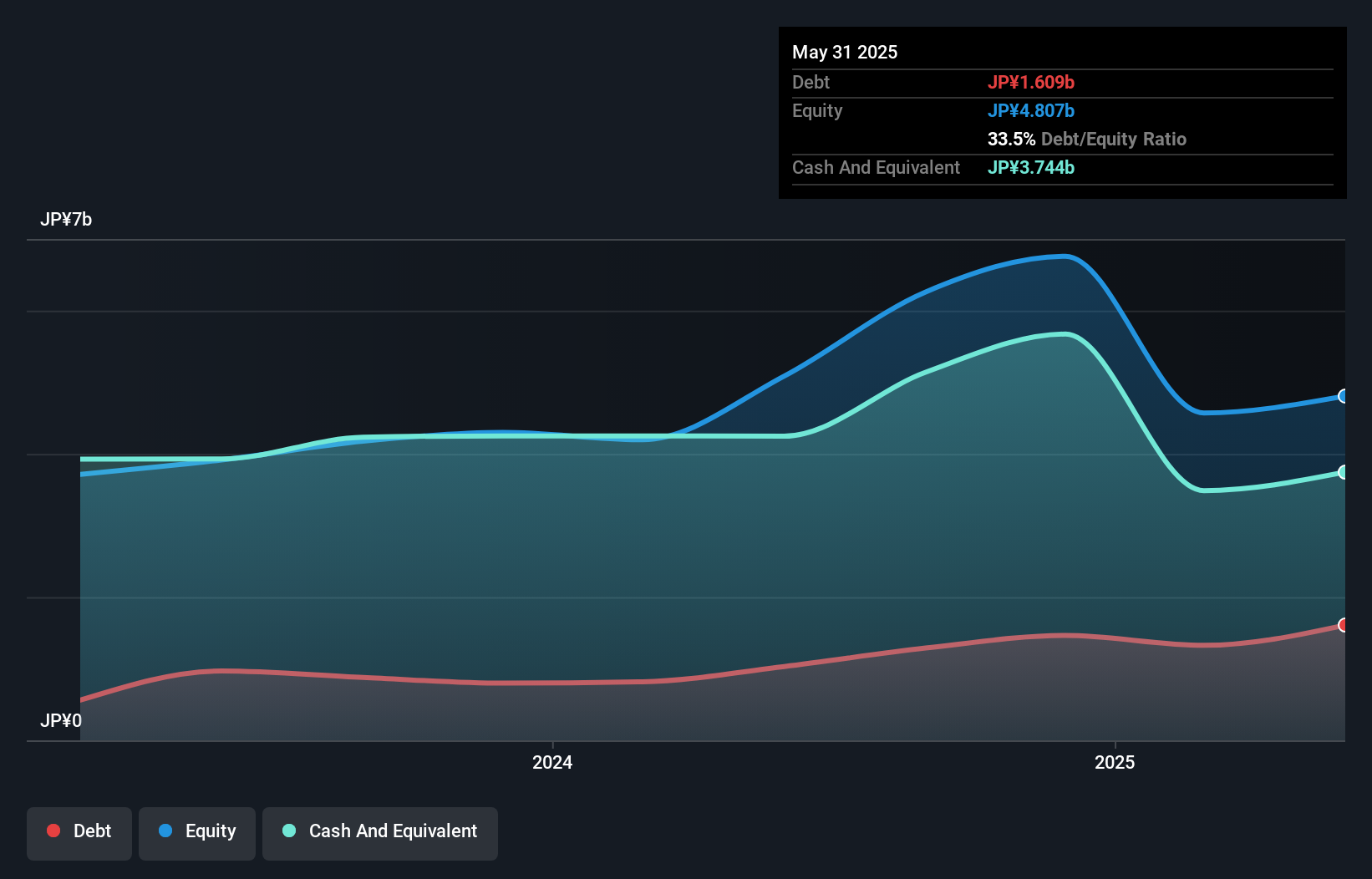

Overview: Baudroie, Inc. offers optimal IT solutions in Japan and has a market cap of ¥78.40 billion.

Operations: The company generates its revenue primarily from providing IT solutions in Japan. It has a market capitalization of ¥78.40 billion, indicating its significant presence in the industry.

Baudroie Inc., a nimble player in the tech sector, recently joined the S&P Global BMI Index, signaling increased visibility. The company boasts high-quality earnings with a 49.9% growth over the past year, significantly outpacing the IT industry's 10.1%. Trading at roughly 6.3% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Despite its volatile share price in recent months, Baudroie's financial health appears robust with more cash than total debt and positive free cash flow of US$1.43 million as of August 2024, underscoring its capacity to cover interest payments comfortably and sustain operations efficiently.

- Unlock comprehensive insights into our analysis of baudroieinc stock in this health report.

Explore historical data to track baudroieinc's performance over time in our Past section.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4644 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3978

Macromill

Provides marketing research and digital marketing solutions in Japan and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives