Japan’s stock markets rebounded strongly over a holiday-shortened week, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%. This positive momentum, coupled with better-than-expected economic data from both Japan and the U.S., has created a favorable environment for high-growth tech stocks in Japan this August 2024. In such a dynamic market, identifying promising tech stocks involves looking at companies that are not only innovating but also demonstrating resilience amid broader economic shifts.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 25.55% | 25.92% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| SHIFT | 21.58% | 32.81% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.51% | 66.90% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: I'LL Inc. operates a system solution business in Japan and has a market cap of ¥72.34 billion.

Operations: The company generates revenue primarily through its system solution business in Japan. It has a market cap of ¥72.34 billion.

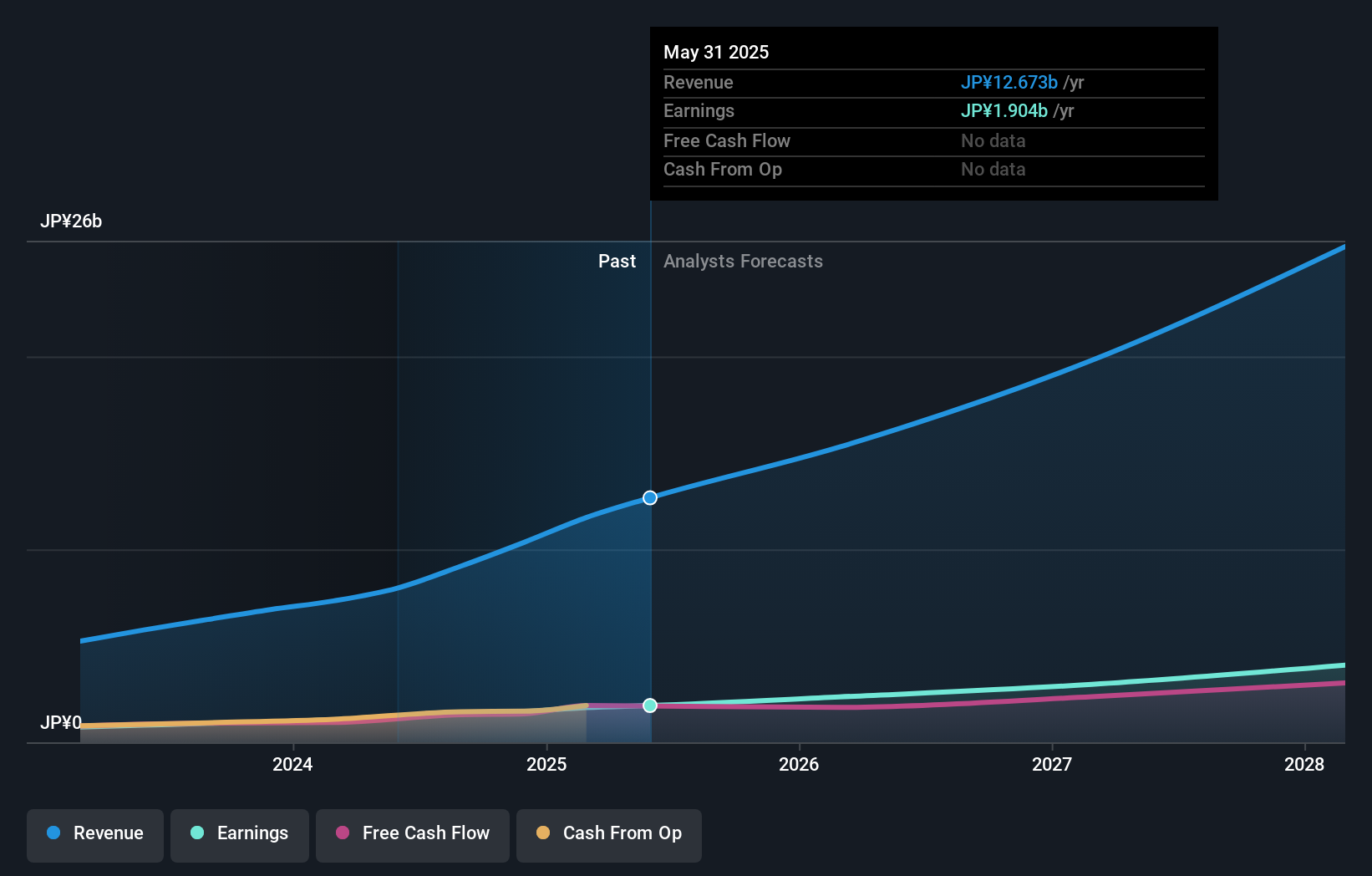

I'LL's earnings grew by 39.2% over the past year, significantly outpacing the software industry’s 15.4% growth. With a forecasted annual profit growth of 12.3%, it surpasses the JP market’s expected 8.6%. Revenue is projected to grow at 9.1% annually, also above the market average of 4.3%. The company’s R&D expenses are a key focus, ensuring continued innovation and competitiveness in its SaaS offerings, which drive recurring revenue streams from subscriptions.

- Delve into the full analysis health report here for a deeper understanding of I'LL.

Assess I'LL's past performance with our detailed historical performance reports.

baudroieinc (TSE:4413)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baudroie, Inc. provides optimal IT solutions in Japan and has a market cap of ¥82.40 billion.

Operations: Baudroie, Inc. specializes in delivering advanced IT solutions across Japan. The company generates revenue primarily through its IT services and products, focusing on innovative technology integration and support for various industries.

BaudroieInc. has demonstrated impressive growth, with earnings increasing by 48% over the past year and revenue expected to grow at 30.6% annually, significantly outpacing the JP market's 4.3%. The company's R&D expenses play a crucial role in sustaining this momentum; they have allocated substantial resources towards innovation, ensuring their competitive edge in advanced IT infrastructure technology. Moreover, their recent share repurchase program and revised earnings forecast for fiscal year-end February 2025 highlight a robust financial strategy aimed at enhancing shareholder value.

- Take a closer look at baudroieinc's potential here in our health report.

Gain insights into baudroieinc's historical performance by reviewing our past performance report.

Takara Bio (TSE:4974)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Takara Bio Inc., along with its subsidiaries, operates in the bioindustry, CDMO, and gene therapy sectors across Japan, China, other parts of Asia, the United States, Europe, and internationally with a market cap of ¥126.44 billion.

Operations: The company generates revenue primarily from its drug discovery segment, which accounted for ¥42.82 billion. Its operations span various regions including Japan, China, the United States, and Europe.

Takara Bio's recent guidance projects net sales of ¥48.90 billion and operating profit of ¥5 billion for the fiscal year ending March 2025. Despite a challenging past year with a significant one-off loss of ¥556 million, the company is forecast to achieve annual earnings growth of 30.2%, surpassing Japan's market average of 8.6%. With R&D expenses constituting a substantial portion, Takara Bio continues to invest heavily in innovation, ensuring sustained advancements in biotech sectors.

- Click here and access our complete health analysis report to understand the dynamics of Takara Bio.

Understand Takara Bio's track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 131 Japanese High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3854

Outstanding track record with flawless balance sheet.