In recent weeks, global markets have experienced volatility as investors navigate the uncertainty surrounding the incoming Trump administration's policies and their potential impact on various sectors, including technology. The S&P 500 and Nasdaq Composite indices have seen declines amid this backdrop, highlighting the importance of carefully evaluating high-growth tech stocks that may offer opportunities for expansion despite broader market fluctuations. When assessing such stocks, it's crucial to consider factors like innovation potential, market demand for their products or services, and how they might adapt to changing regulatory environments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.90% | 42.65% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1309 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

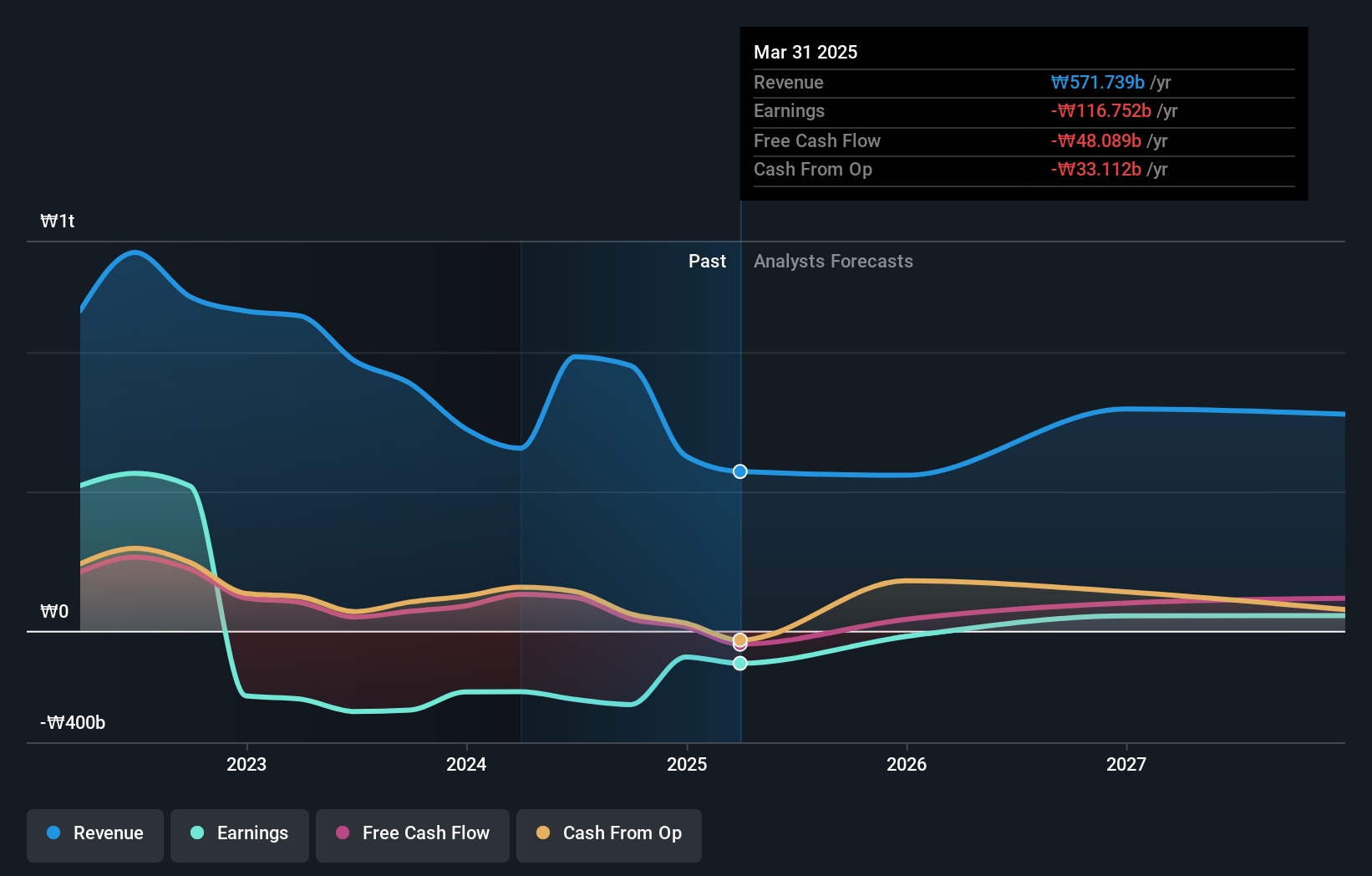

Kakao Games (KOSDAQ:A293490)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide, with a market cap of ₩1.31 trillion.

Operations: The company generates revenue primarily from its computer graphics segment, amounting to ₩915.92 million.

Kakao Games, with its 11.8% annual revenue growth outpacing the South Korean market's 9.6%, is navigating the competitive tech landscape effectively. Despite current unprofitability, projections are optimistic as earnings could surge by 130.2% annually. The firm's commitment to innovation is evident in its R&D spending trends which align with strategic expansions and enhancements in gaming technology. Recent participation in Citi's Korea Corporate Day highlights their active pursuit of investor engagement and market presence, signaling potential for future profitability within three years amidst a challenging yet growing entertainment sector.

- Dive into the specifics of Kakao Games here with our thorough health report.

Review our historical performance report to gain insights into Kakao Games''s past performance.

Affle (India) (NSEI:AFFLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Affle (India) Limited, along with its subsidiaries, specializes in mobile advertisement services via information technology and software development for mobile devices both in India and globally, with a market cap of ₹220.68 billion.

Operations: Affle (India) Limited, through its subsidiaries, generates revenue primarily from its Consumer Platform segment, which recorded ₹20.67 billion. The company focuses on mobile advertisement services leveraging technology and software development for mobile devices across India and international markets.

Affle (India) is demonstrating robust growth in the tech sector, with a notable 17.6% annual revenue increase and an expected earnings surge of 20.9% per year, outpacing the broader Indian market's growth rates. This performance is underpinned by strategic investments in R&D, which are crucial for maintaining competitive edge and fostering innovation in mobile advertising technologies. Recent financial reports show a strong upward trajectory in earnings, with net income rising to INR 919.91 million from INR 667.84 million year-over-year for Q2 2025, reflecting effective operational execution and market expansion strategies. Moreover, Affle's proactive approach to exploring acquisitions underscores its commitment to scaling operations and enhancing shareholder value through careful strategic alignments and potential integration synergies.

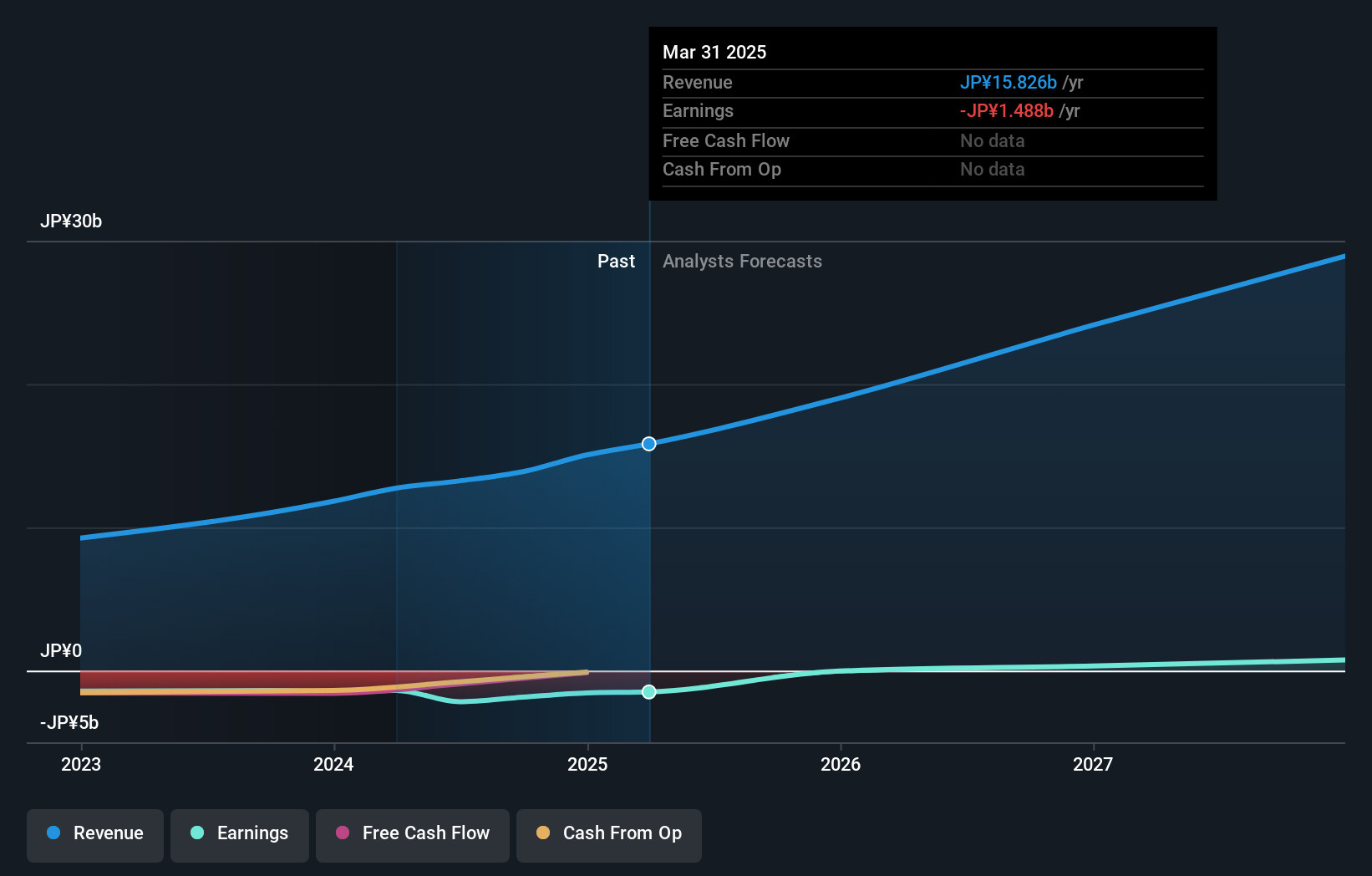

Safie (TSE:4375)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Safie Inc. develops and operates a cloud-based video recording platform under the Safie brand in Japan, with a market cap of ¥48.20 billion.

Operations: The company generates revenue primarily through its Video Platform Business, which brought in ¥13.24 billion. With a focus on cloud-based video recording services, the business model leverages digital solutions to cater to various customer needs in Japan.

Safie Inc. is poised for significant growth, with earnings expected to surge by 103.4% annually, reflecting its strategic focus on expanding its tech capabilities. This optimism is underpinned by a robust R&D investment strategy, where recent figures show a commitment that aligns with an 18.5% forecasted annual revenue growth—outpacing the broader Japanese market's 4.2% expansion rate. Despite current unprofitability, these aggressive reinvestments in innovation signal Safie's potential to reshape its market segment and deliver future profitability, as evidenced during their recent earnings call which highlighted upcoming enhancements and product expansions planned for the next fiscal year.

- Click here and access our complete health analysis report to understand the dynamics of Safie.

Understand Safie's track record by examining our Past report.

Key Takeaways

- Click through to start exploring the rest of the 1306 High Growth Tech and AI Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4375

Safie

Develops and operates a cloud-based video recording platform under the Safie brand in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives