Stock Analysis

High Growth Tech Stocks In Japan To Watch October 2024

Reviewed by Simply Wall St

Japan's stock markets have recently experienced a downturn, with the Nikkei 225 Index and the TOPIX Index both posting losses, amid easing domestic inflation and speculation around potential changes in monetary policy by the Bank of Japan. In this environment, investors might look for high growth tech stocks that demonstrate resilience through innovation and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.22% | 71.29% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

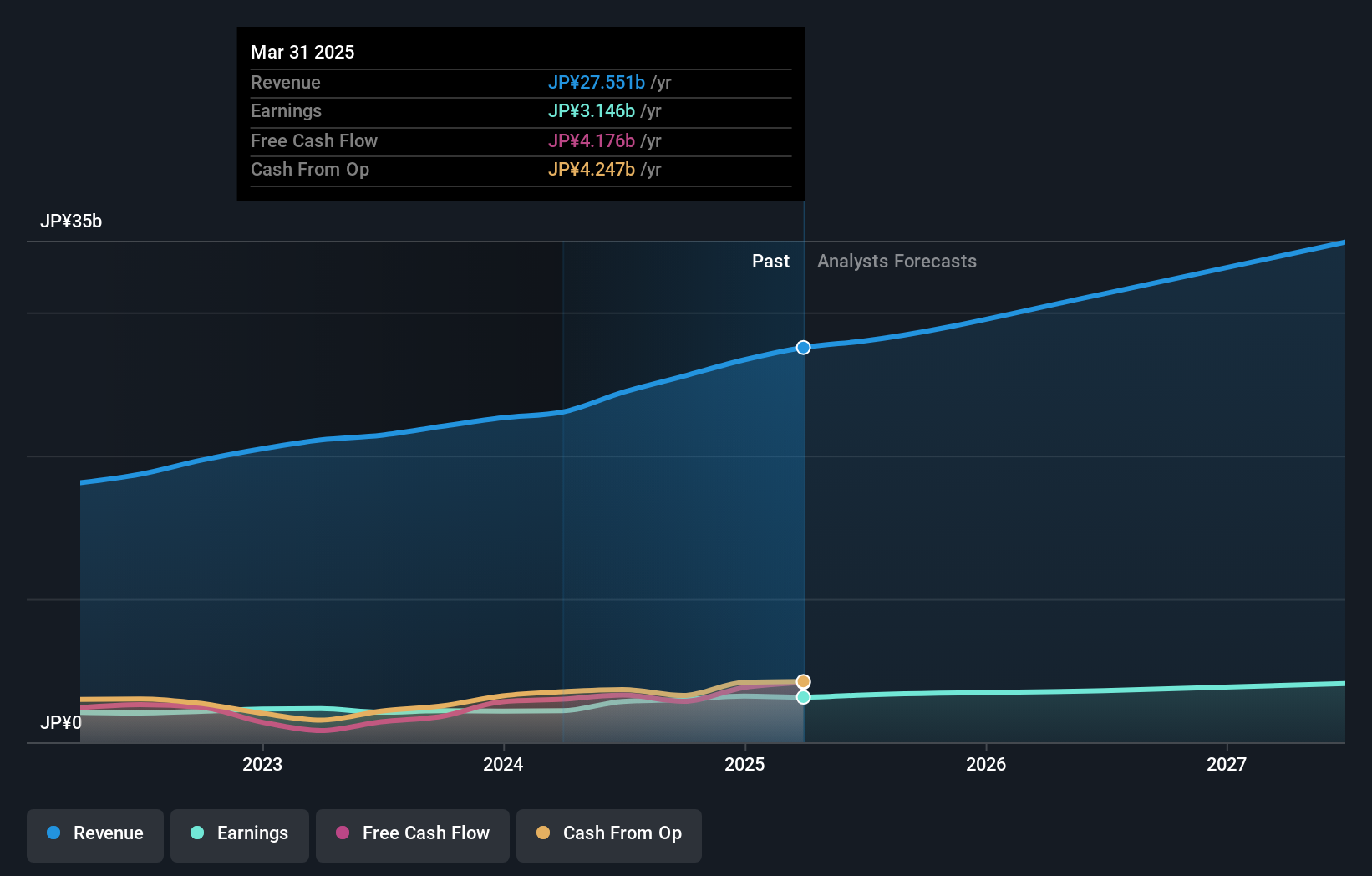

Overview: Avant Group Corporation, with a market cap of ¥80.72 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company generates revenue through three primary segments: Management Solutions Business (¥8.52 billion), Digital Transformation Promotion Business (¥8.85 billion), and Consolidated Financial Statements Disclosure Business (¥7.54 billion).

Amidst a competitive landscape, Avant Group stands out with its robust growth trajectory and strategic financial maneuvers. The company's revenue is forecasted to grow at 15.8% annually, surpassing Japan's market average of 4.2%, while its earnings are expected to expand by 17.9% per year, significantly outpacing the national market forecast of 8.7%. This performance is underpinned by substantial R&D investments that have fueled innovations and sustained earnings quality, evidenced by a notable increase in profit by 36.1% over the past year. Recent strategic activities further underscore Avant Group's proactive approach in shareholder value enhancement; from July to September 2024 alone, it repurchased shares worth ¥351.3 million, reflecting confidence in its financial health and future prospects. Additionally, the company has raised its dividend payout significantly from ¥15 to ¥25 per share anticipated next year, aligning with an optimistic earnings guidance projecting net sales reaching ¥28.8 billion and operating profit at ¥4.9 billion for the upcoming fiscal year.

- Click here to discover the nuances of Avant Group with our detailed analytical health report.

Review our historical performance report to gain insights into Avant Group's's past performance.

Safie (TSE:4375)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Safie Inc. develops and operates a cloud-based video recording platform under the Safie brand in Japan, with a market cap of ¥46.75 billion.

Operations: The company generates revenue primarily from its cloud-based video platform business, which recorded ¥13.24 billion. The focus is on delivering video recording solutions in Japan, leveraging cloud technology to enhance service offerings.

Safie, a player in Japan's high-tech scene, is demonstrating significant growth with its earnings projected to surge by 98.5% annually. This leap is supported by an aggressive R&D strategy where expenses have grown to represent 17.9% of their revenue, fostering innovation and competitive edge in the smart security solutions market. Despite current unprofitability, these investments are pivotal for future gains, aligning with trends where software firms increasingly adopt SaaS models to boost recurring revenues. Safie's commitment is also evident in its recent share repurchases, signaling strong confidence in its strategic direction and financial health moving forward.

- Unlock comprehensive insights into our analysis of Safie stock in this health report.

Assess Safie's past performance with our detailed historical performance reports.

Bengo4.comInc (TSE:6027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bengo4.com, Inc. provides online professional consultancy services in Japan and has a market capitalization of ¥66.83 billion.

Operations: Bengo4.com, Inc. generates revenue primarily through its IT/Solutions segment, which accounts for ¥7.62 billion, and the Media segment, contributing ¥4.61 billion. The company's focus on online professional consultancy services positions it within the digital solutions market in Japan.

Bengo4.com Inc. is carving a niche in Japan's tech landscape with its pioneering AI legal research tool, Legal Brain, which integrates vast legal databases to streamline complex tasks for lawyers. This innovation reflects the company's robust R&D commitment, where expenses surged to 17.9% of revenue, aligning with an industry trend towards specialized software solutions. Impressively, Bengo4.com's revenue is projected to grow by 20.8% annually, outpacing the Japanese market average of 4.2%, and its earnings could see an even more dramatic increase at a rate of 46.8% per year—evidence of its potential in transforming legal services through technology.

- Dive into the specifics of Bengo4.comInc here with our thorough health report.

Examine Bengo4.comInc's past performance report to understand how it has performed in the past.

Taking Advantage

- Click through to start exploring the rest of the 116 Japanese High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3836

Avant Group

Through its subsidiaries, provides accounting, business intelligence, and outsourcing services.