As Japan's stock markets have recently experienced a decline, with the Nikkei 225 Index down 1.58% and the broader TOPIX Index losing 0.64%, investors are closely watching economic indicators such as easing domestic inflation and export performance to gauge potential opportunities. In this environment, identifying promising stocks requires a keen understanding of market dynamics and the ability to recognize companies that can navigate these challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Togami Electric Mfg | 1.39% | 3.97% | 10.23% | ★★★★★★ |

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Nippon Denko | 18.00% | 4.31% | 48.41% | ★★★★★★ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| GakkyushaLtd | 23.64% | 5.03% | 18.56% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

GNI Group (TSE:2160)

Simply Wall St Value Rating: ★★★★★☆

Overview: GNI Group Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical drugs both in Japan and internationally, with a market capitalization of ¥152.69 billion.

Operations: GNI Group generates revenue primarily from its pharmaceutical segment, contributing ¥19.35 billion, and a smaller portion from medical devices at ¥4.30 billion. The company experiences adjustments in its segments that slightly impact overall revenue figures.

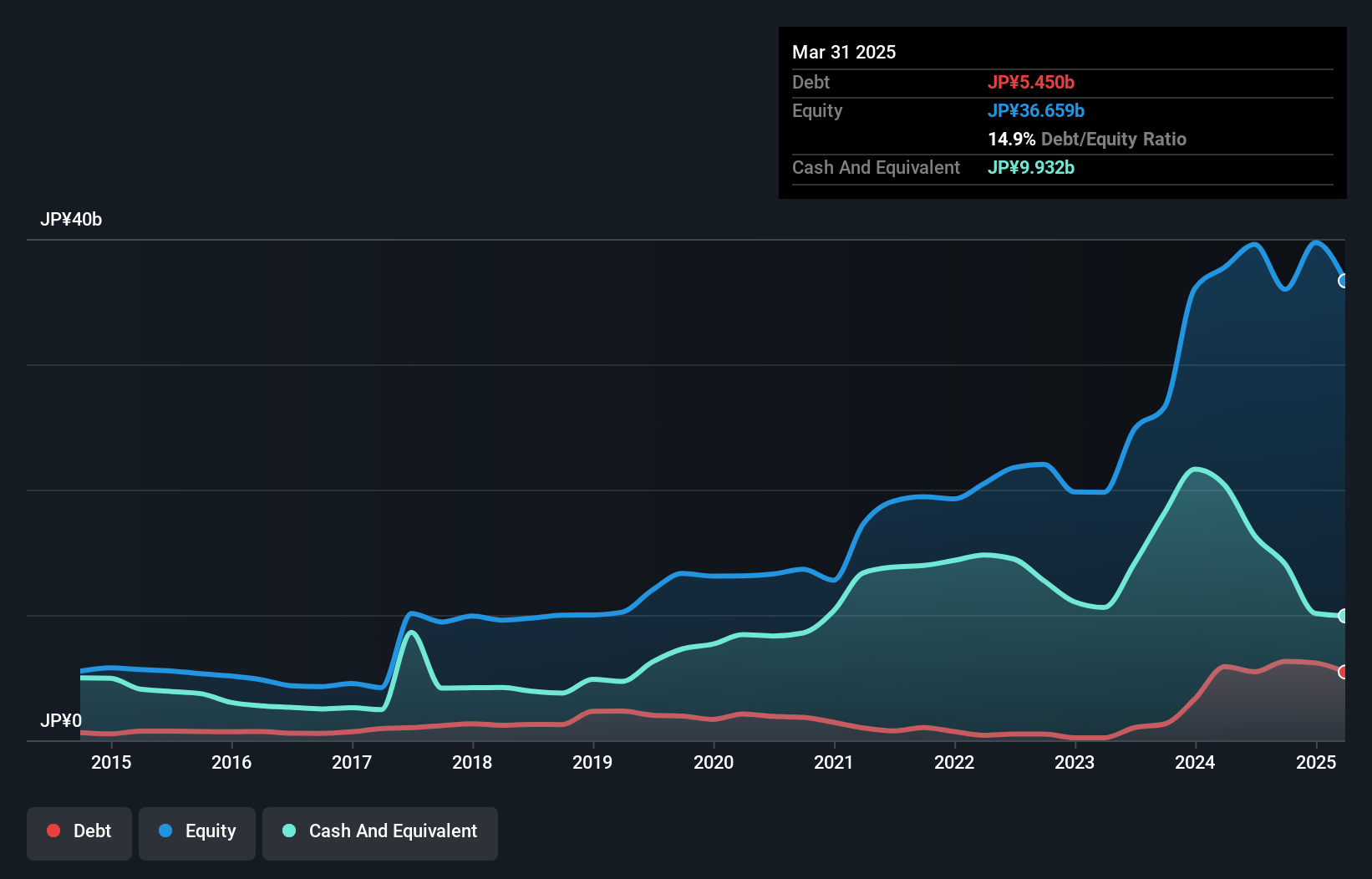

GNI Group, a small player in the biotech sector, has shown impressive earnings growth of 393.9% over the past year, outpacing the industry average of 4%. Despite a volatile share price recently, its debt to equity ratio improved from 16.8% to 13.8% over five years. The company is free cash flow positive and holds more cash than its total debt, suggesting solid financial footing. However, interest payments are not well covered by EBIT at just 0.5x coverage. Looking ahead, earnings are projected to grow annually by about 18.95%, indicating potential for future expansion in this dynamic industry.

- Click here to discover the nuances of GNI Group with our detailed analytical health report.

Examine GNI Group's past performance report to understand how it has performed in the past.

TRANSACTIONLtd (TSE:7818)

Simply Wall St Value Rating: ★★★★★★

Overview: TRANSACTION CO., Ltd. is engaged in planning, designing, manufacturing, and selling consumer products both in Japan and internationally with a market capitalization of ¥75.44 billion.

Operations: TRANSACTIONLtd generates revenue through the planning, designing, manufacturing, and selling of consumer products in Japan and internationally. The company's market capitalization stands at ¥75.44 billion.

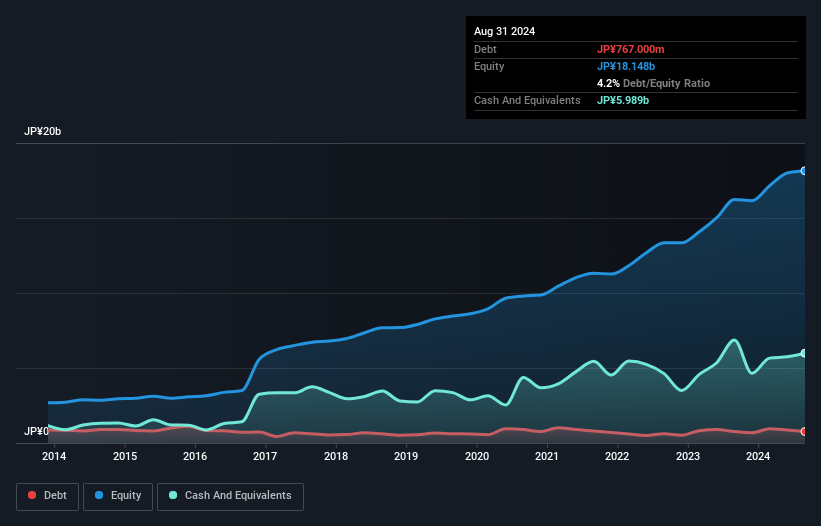

TRANSACTION Ltd. stands out with its robust earnings growth of 21% annually over the past five years, coupled with a favorable price-to-earnings ratio of 20x, which is attractive compared to the industry average. The company has successfully reduced its debt to equity ratio from 7.3 to 4.2 in this period, highlighting effective financial management. Recent activities include a share repurchase worth ¥499.87 million and increased dividends for fiscal year-end August 2024 from JPY 35 to JPY 39 per share, indicating shareholder-friendly policies and confidence in future prospects with projected sales reaching JPY 27.9 billion by August 2025.

- Dive into the specifics of TRANSACTIONLtd here with our thorough health report.

Assess TRANSACTIONLtd's past performance with our detailed historical performance reports.

Monex Group (TSE:8698)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Monex Group, Inc. is an online financial institution offering retail online brokerage services across Japan, the United States, China, and Australia with a market cap of ¥171.14 billion.

Operations: The company's primary revenue streams are from its operations in the United States, generating ¥51.33 billion, and its Crypto-Asset Business, contributing ¥11.28 billion. The Japan segment adds ¥3.86 billion to the overall revenue mix, while the Asia Pacific region contributes ¥1.19 billion.

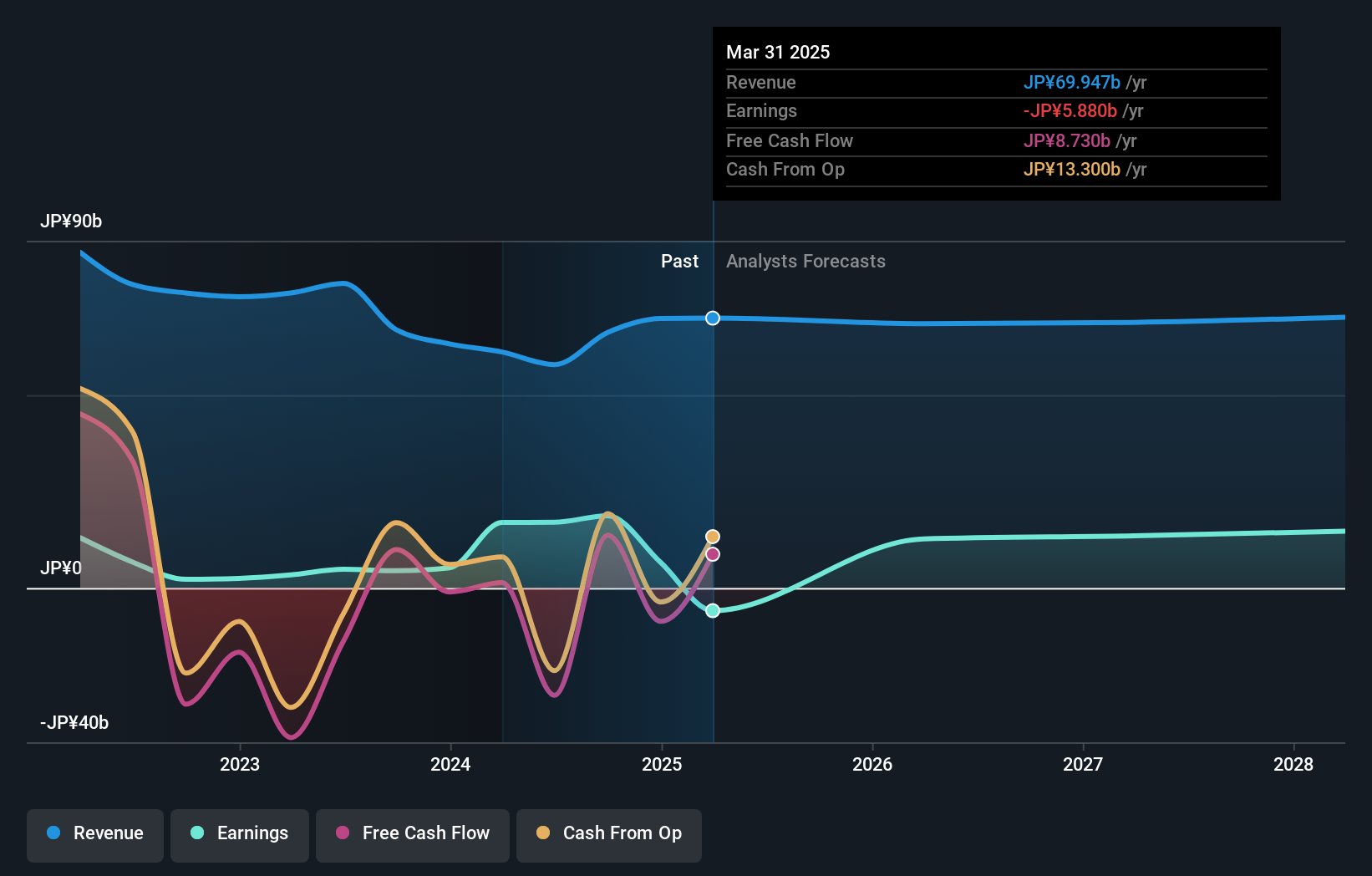

Monex Group, a financial services company in Japan, has shown impressive growth with earnings surging by 251% over the past year, significantly outpacing the Capital Markets industry's 36.1%. Despite a large one-off gain of ¥15.5 billion impacting recent results, Monex is trading at a favorable price-to-earnings ratio of 10x compared to the broader JP market's 13.5x. The company's debt management appears prudent as its debt-to-equity ratio has decreased from 339.3% to 81.1% over five years, and it holds more cash than total debt. Recently, Monex repurchased approximately 0.5% of its shares for ¥834 million as part of a buyback plan aimed at returning unutilized cash to shareholders through June 2025.

- Get an in-depth perspective on Monex Group's performance by reading our health report here.

Gain insights into Monex Group's past trends and performance with our Past report.

Taking Advantage

- Get an in-depth perspective on all 733 Japanese Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2160

GNI Group

Engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally.

Excellent balance sheet with reasonable growth potential.