Did Nomura Research Institute’s (TSE:4307) Dividend Hike and Outlook Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Nomura Research Institute recently announced a second-quarter dividend of ¥35.00 per share, up from ¥29.00 a year ago, and provided full-year dividend guidance of ¥39.00 per share alongside detailed earnings forecasts for the year ending March 31, 2026.

- This dividend growth and clear earnings outlook highlight management’s confidence in future performance and enhance visibility for shareholders.

- We’ll explore how the company’s higher dividend and earnings guidance update could strengthen its overall investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Nomura Research Institute Investment Narrative Recap

To be a shareholder of Nomura Research Institute, you need to believe in its ability to consistently grow both revenue and profits while maintaining leadership in IT solutions and consulting. The recent boost in dividends and the issuance of full-year earnings guidance do enhance visibility, but they do not materially alter the most important short-term catalyst: continued growth in the company’s IT solutions business. The biggest risk remains potential headwinds in overseas expansion, especially in markets requiring high capital investment and with uncertain returns.

Among the recent announcements, the updated consolidated earnings guidance released on October 30, 2025 stands out. By confirming revenue and profit expectations for the full year in line with previous updates, the company maintains its stance on performance consistency, a factor that can support the positive momentum from the dividend increase, but may not fully mitigate risks associated with overseas investments or shifting IT demand cycles.

In contrast, investors should be aware of the risk that future high capital demands in international markets could...

Read the full narrative on Nomura Research Institute (it's free!)

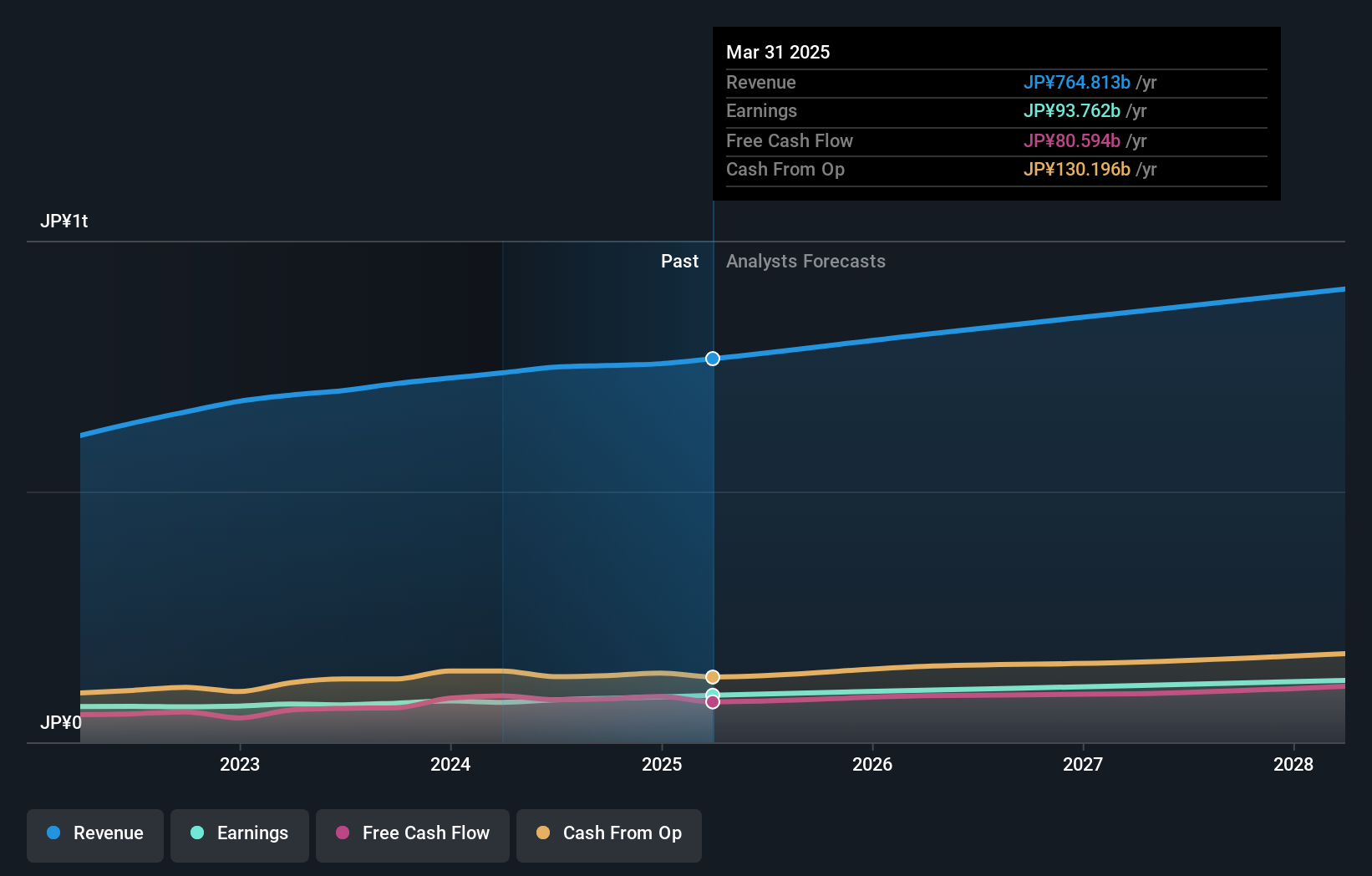

Nomura Research Institute's narrative projects ¥911.2 billion revenue and ¥127.2 billion earnings by 2028. This requires 5.7% yearly revenue growth and a ¥29.6 billion earnings increase from ¥97.6 billion today.

Uncover how Nomura Research Institute's forecasts yield a ¥6142 fair value, in line with its current price.

Exploring Other Perspectives

Only one fair value estimate for Nomura Research Institute has been submitted by the Simply Wall St Community, coming in at ¥3,566 per share, well below recent market pricing. As you consider this viewpoint alongside the company’s consistent guidance and capital-intensive international ambitions, it becomes clear that investor opinions can widely differ, explore several alternative viewpoints for a well-rounded view.

Explore another fair value estimate on Nomura Research Institute - why the stock might be worth 41% less than the current price!

Build Your Own Nomura Research Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nomura Research Institute research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Nomura Research Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nomura Research Institute's overall financial health at a glance.

No Opportunity In Nomura Research Institute?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Research Institute might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4307

Nomura Research Institute

Provides consulting, financial information technology (IT) solutions, industrial IT solutions, and IT platform services in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives