High Growth Tech Stocks Including Guangzhou Hexin InstrumentLtd For Potential Portfolio Expansion

Reviewed by Simply Wall St

As global markets continue to react to political developments and economic indicators, with major indexes like the S&P 500 reaching new highs amid optimism over trade policies and AI investments, investors are increasingly looking at high growth tech stocks for potential portfolio expansion. In this dynamic environment, a good stock often exhibits strong innovation potential, adaptability to market trends such as artificial intelligence, and resilience in the face of economic shifts—qualities that can be particularly appealing when considering small-cap tech companies like Guangzhou Hexin Instrument Ltd.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Guangzhou Hexin InstrumentLtd (SHSE:688622)

Simply Wall St Growth Rating: ★★★★★☆

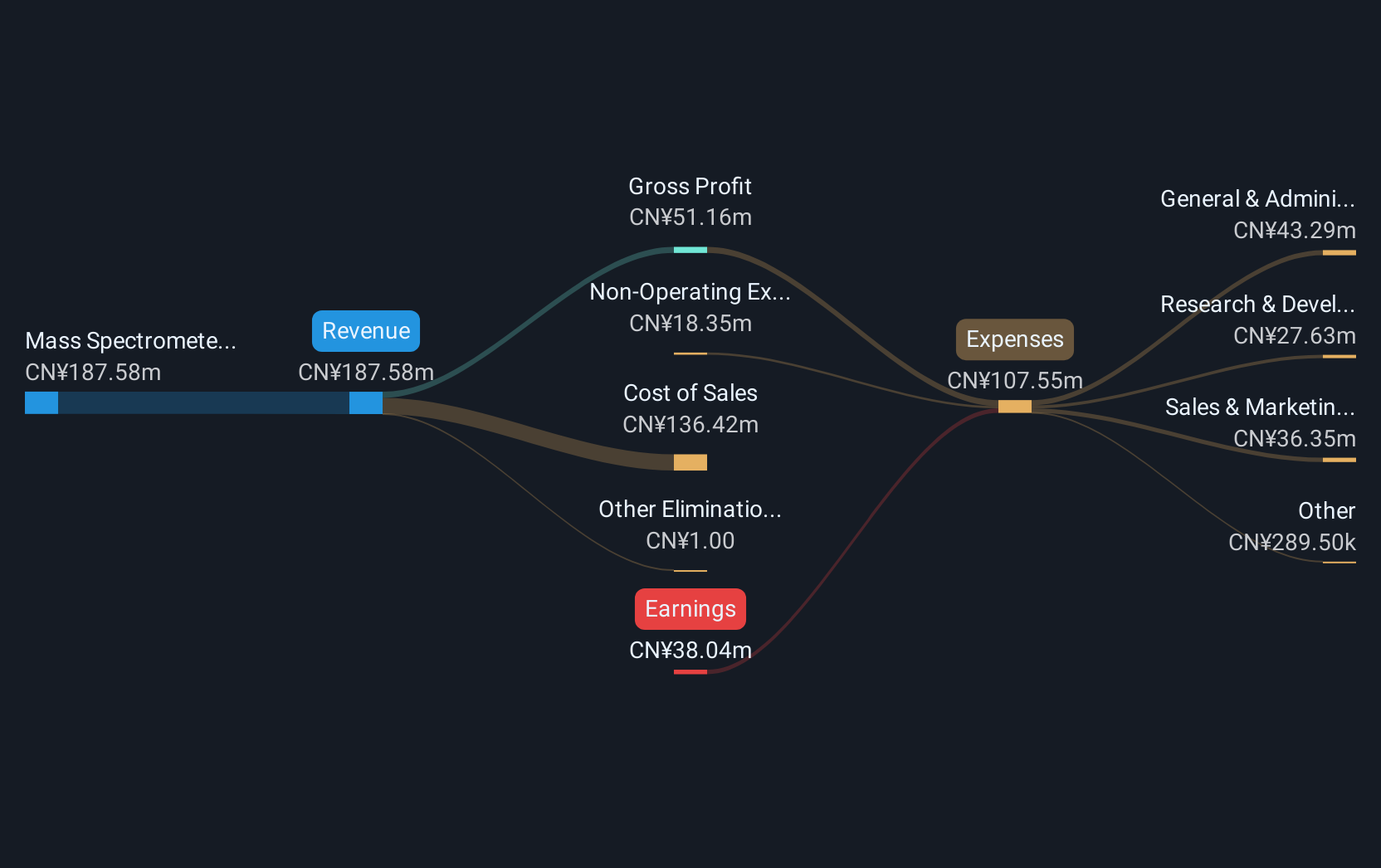

Overview: Guangzhou Hexin Instrument Co., Ltd. is involved in the research, development, production, sale, and technical services of mass spectrometry products in China with a market cap of CN¥5.15 billion.

Operations: Hexin Instrument focuses on the mass spectrometer business, generating revenue of CN¥266.19 million through its comprehensive offerings in research, development, production, sales, and technical services within China.

Guangzhou Hexin Instrument Co., Ltd. has demonstrated remarkable growth dynamics, with a projected annual revenue increase of 67%, significantly outpacing the Chinese market average of 13.3%. Despite current unprofitability, the company's earnings are expected to surge by approximately 201.5% annually. Recent strategic moves include a private placement aimed at bolstering its financial position and supporting ongoing innovations, particularly in its core segments that could reshape industry standards. This approach, combined with an aggressive R&D investment strategy which remains undisclosed but is pivotal for staying ahead in technology advancements, positions Guangzhou Hexin for potential future profitability and industry leadership.

ExaWizards (TSE:4259)

Simply Wall St Growth Rating: ★★★★★★

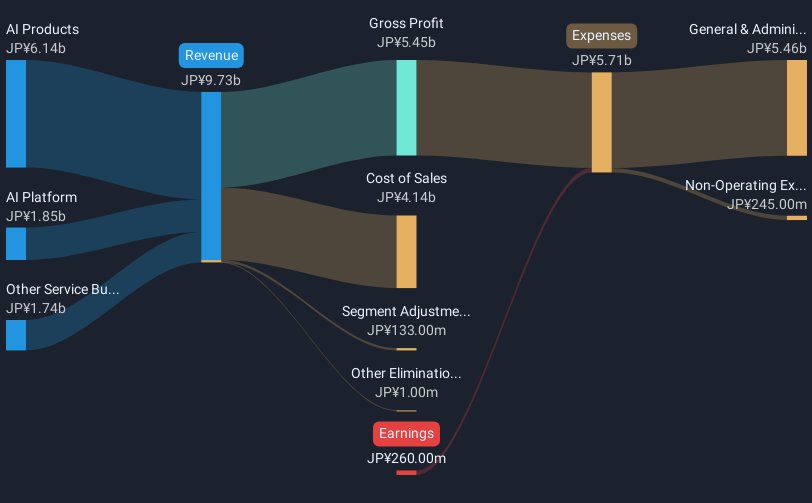

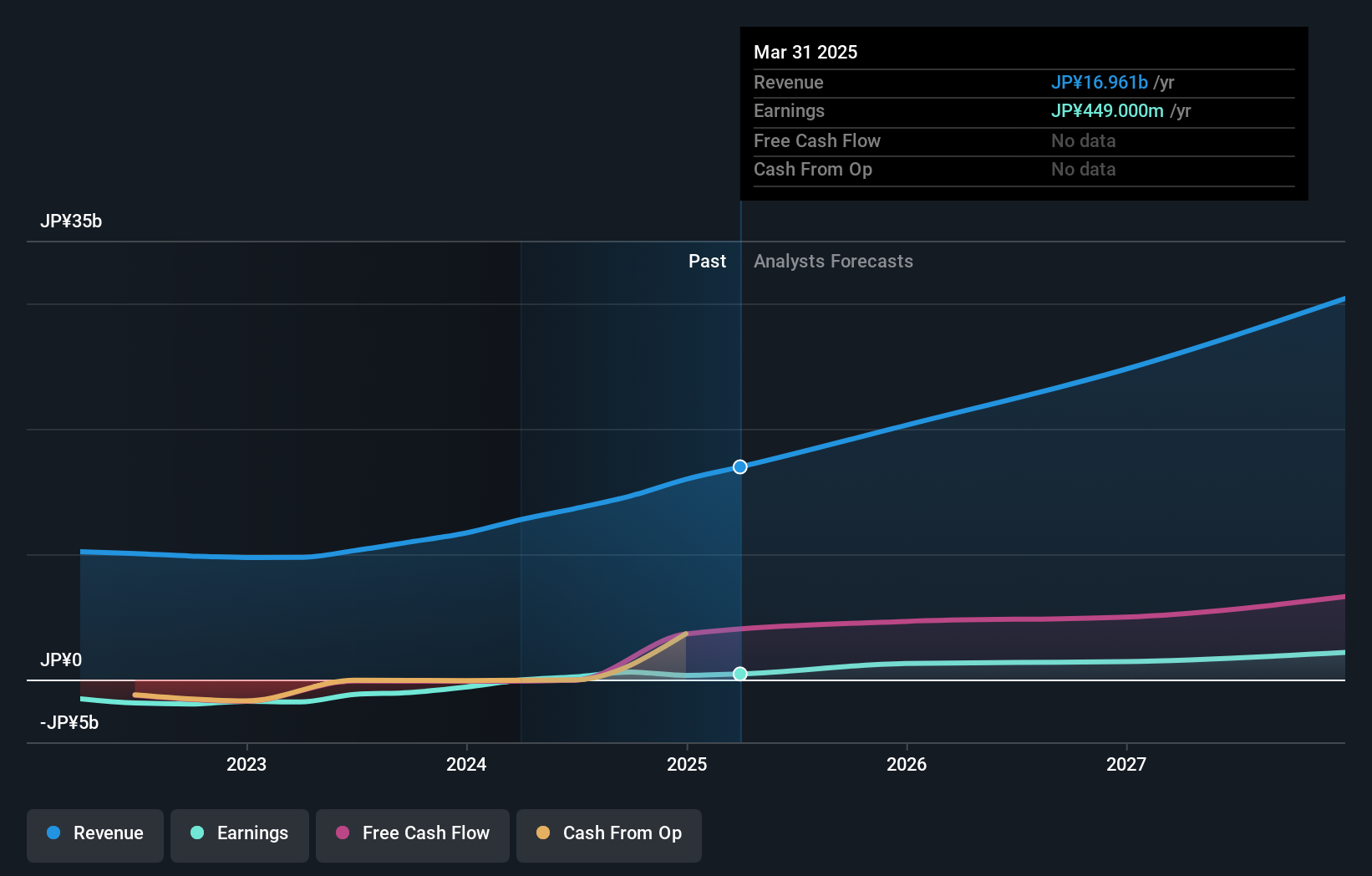

Overview: ExaWizards Inc. focuses on creating AI-enabled services aimed at driving industrial innovation and addressing social issues in Japan, with a market capitalization of approximately ¥41.55 billion.

Operations: The company generates revenue primarily from its AI Products and AI Platform segments, with ¥6.14 billion and ¥1.85 billion respectively. Its business model centers on leveraging artificial intelligence to offer solutions across various industries, contributing to social problem-solving in Japan.

ExaWizards Inc. is harnessing AI to revolutionize HR and investor relations, evidenced by its recent launch of a service that integrates DIA human resource assessments with organizational data. This innovation has attracted 2000 companies, including Hokkaido Gas Co., leveraging generative AI to enhance data-driven decision-making in HR practices. Additionally, the company’s Exa Enterprise AI group introduced the exaBase IR Assistant at Konica Minolta to automate tasks in shareholder communications, reflecting a strategic push towards digital transformation in corporate environments. These developments underscore ExaWizards’ commitment to expanding its technological footprint and addressing niche market needs effectively.

- Unlock comprehensive insights into our analysis of ExaWizards stock in this health report.

Examine ExaWizards' past performance report to understand how it has performed in the past.

BASEInc (TSE:4477)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BASE, Inc. is a Japanese company focused on the planning, development, and operation of web services with a market capitalization of ¥39.79 billion.

Operations: BASE,Inc. generates revenue primarily through its BASE Business, contributing ¥8.65 billion, followed by PAY.JP Business at ¥5.25 billion, and YELL BANK Business at ¥743 million. The company's focus on web services in Japan is reflected in these diverse revenue streams.

BASEInc. is navigating the high-growth tech landscape with strategic acquisitions and robust R&D investment, positioning itself for sustained growth. The company's recent board decision to acquire Estore Corporation underscores its aggressive expansion strategy, expected to enhance its market footprint significantly. With an annual revenue growth of 14.6% and earnings surging by 34.8%, BASEInc.'s commitment to innovation is evident in its R&D spending, which has consistently aligned with industry-leading practices. This focus on development not only fuels technological advancements but also secures a competitive edge in a rapidly evolving sector.

- Click here and access our complete health analysis report to understand the dynamics of BASEInc.

Assess BASEInc's past performance with our detailed historical performance reports.

Key Takeaways

- Navigate through the entire inventory of 1231 High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BASEInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4477

BASEInc

Engages in the planning, development, and operation of web services in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives