- China

- /

- Trade Distributors

- /

- SHSE:600058

Minmetals Development And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

As global markets adjust to potential rate cuts and shifting investor sentiment, the Asian market has shown resilience, with China's stock indices recording notable gains amid improved U.S.-China trade ties. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking growth beyond the well-trodden paths of large-cap equities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| System ResearchLtd | 12.02% | 10.93% | 15.51% | ★★★★★★ |

| Lelon Electronics | 17.92% | 5.19% | 9.27% | ★★★★★★ |

| Advancetek EnterpriseLtd | 48.93% | 34.46% | 54.65% | ★★★★★★ |

| Tech Semiconductors | NA | 1.35% | 49.61% | ★★★★★★ |

| Shenzhen Bsc TechnologyLtd | NA | 16.05% | 1.02% | ★★★★★★ |

| Wholetech System Hitech | 6.48% | 14.41% | 19.21% | ★★★★★☆ |

| Suzhou Longjie Special Fiber | 1.49% | 12.26% | -16.14% | ★★★★★☆ |

| Jiangsu Rainbow Heavy Industries | 21.06% | 21.85% | -4.03% | ★★★★★☆ |

| Jiangsu Longda Superalloy | 20.62% | 19.35% | -6.10% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Minmetals Development (SHSE:600058)

Simply Wall St Value Rating: ★★★★★★

Overview: Minmetals Development Co., Ltd. operates in resource trading, metal trading, and supply chain services both in China and internationally, with a market cap of CN¥9.88 billion.

Operations: The company generates revenue primarily from resource and metal trading, alongside supply chain services. It reported a market cap of CN¥9.88 billion.

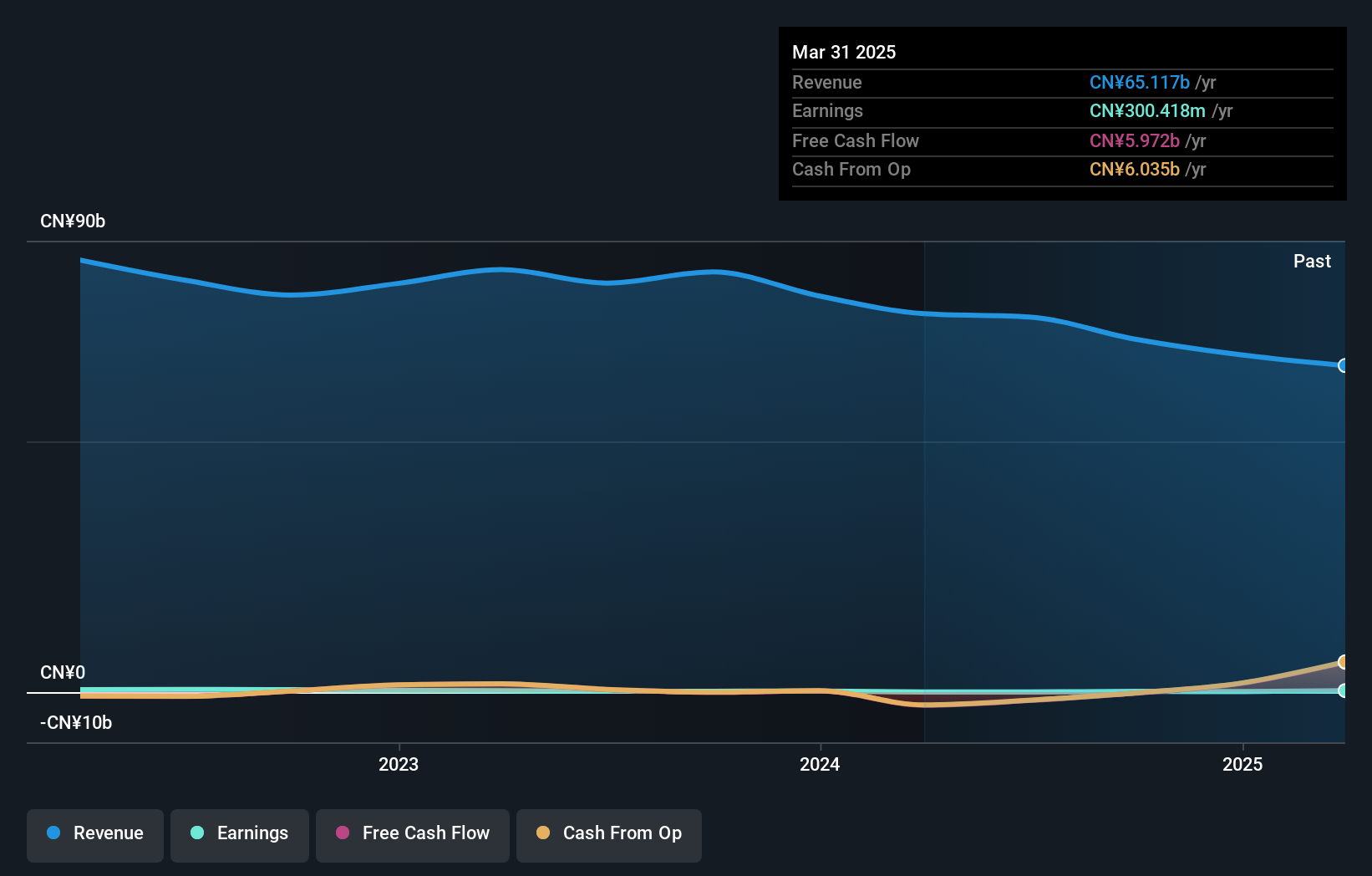

Minmetals Development, a notable player in the Trade Distributors sector, has seen a remarkable earnings growth of 428.7% over the past year, significantly outpacing its industry peers who faced a -23.2% change. The company's net debt to equity ratio stands at an impressive 8.7%, reflecting strong financial health and reduced from 74.6% five years ago to 36%. Despite large one-off gains of CN¥251.5M impacting recent results, Minmetals trades at nearly 97% below its estimated fair value, suggesting potential undervaluation in the market and offering promising prospects for investors looking beyond conventional picks in Asia.

- Click to explore a detailed breakdown of our findings in Minmetals Development's health report.

Understand Minmetals Development's track record by examining our Past report.

Jadard Technology (SHSE:688252)

Simply Wall St Value Rating: ★★★★★★

Overview: Jadard Technology Inc. focuses on the research, design, development, and sale of mobile smart terminals both in China and internationally, with a market cap of CN¥11.73 billion.

Operations: Jadard Technology generates revenue primarily from its electronic components and parts segment, amounting to CN¥2.31 billion. The company has a market cap of CN¥11.73 billion.

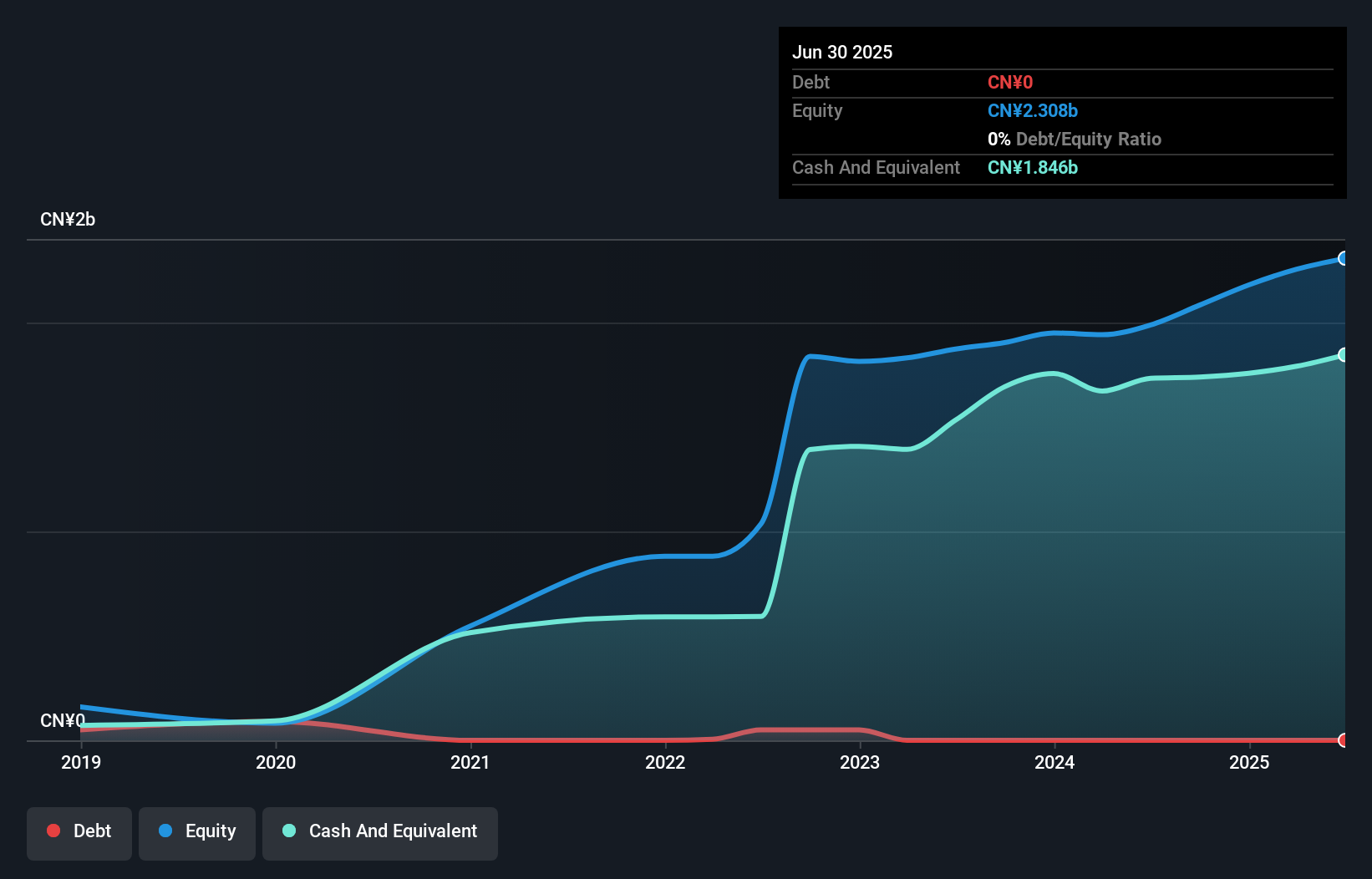

Jadard Technology, a small player in the semiconductor industry, has demonstrated impressive earnings growth of 132% over the past year, significantly outpacing the industry's 10.6%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 34.3%, indicating improved financial health. With a Price-To-Earnings ratio of 37.5x, Jadard trades below the CN market average of 45.3x, suggesting potential value for investors. Despite high non-cash earnings and positive free cash flow, future prospects look promising with an anticipated annual earnings growth rate of 22%.

- Dive into the specifics of Jadard Technology here with our thorough health report.

Examine Jadard Technology's past performance report to understand how it has performed in the past.

Densan System Holdings (TSE:4072)

Simply Wall St Value Rating: ★★★★★☆

Overview: Densan System Holdings Co., Ltd. operates in Japan, providing information service and collection agency services, with a market cap of ¥50.77 billion.

Operations: Densan System Holdings generates revenue primarily from its information service and collection agency service businesses. The company's financial performance includes a notable net profit margin of 8.5%.

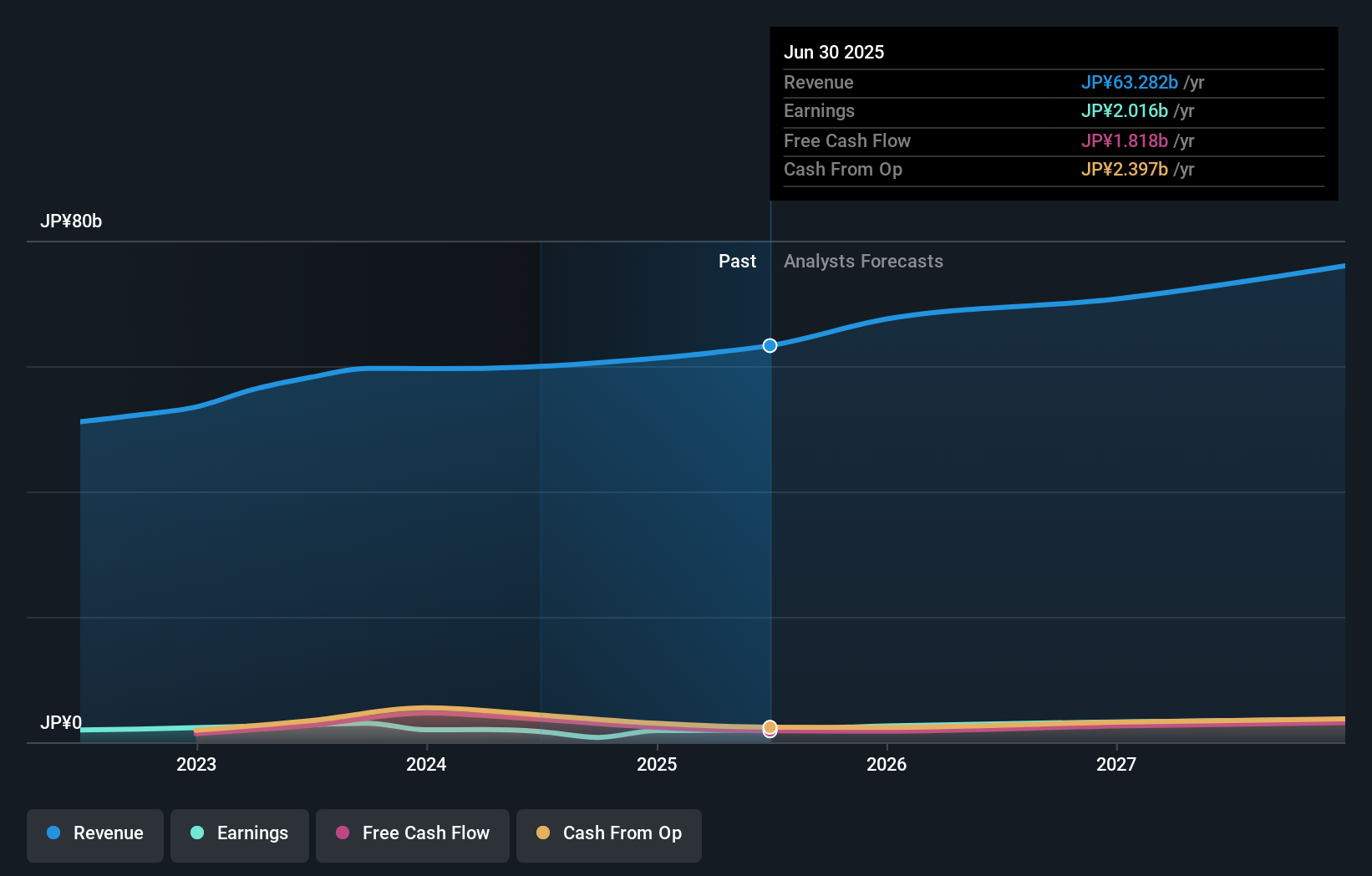

Densan System Holdings, a small player in the IT sector, has shown promising growth with earnings rising 18.9% over the past year, outpacing the industry average of 17%. The company's debt to equity ratio has increased from 12.3% to 24.1% over five years, yet it holds more cash than total debt, reflecting sound financial health. Trading at a discount of 16.2% below its fair value estimate suggests potential upside for investors. Recently doubling its quarterly dividend to JPY 40 per share indicates confidence in future profitability and commitment to shareholder returns amidst a volatile share price environment.

Summing It All Up

- Access the full spectrum of 2414 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600058

Minmetals Development

Engages in resource trading, metal trading, and supply chain services in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives