T&S Group Inc. (TSE:4055) Stocks Pounded By 34% But Not Lagging Market On Growth Or Pricing

To the annoyance of some shareholders, T&S Group Inc. (TSE:4055) shares are down a considerable 34% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

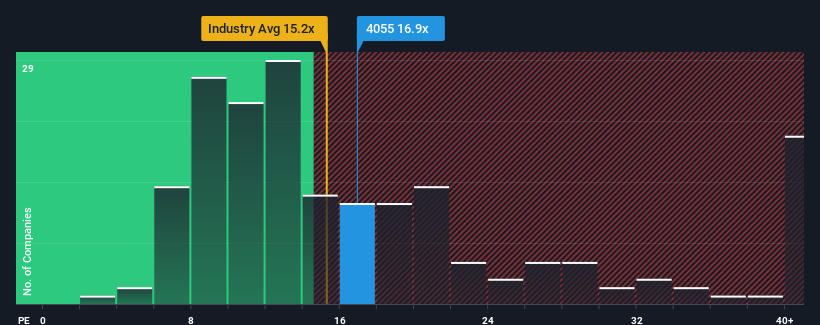

Although its price has dipped substantially, T&S Group's price-to-earnings (or "P/E") ratio of 16.9x might still make it look like a sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 12x and even P/E's below 8x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, T&S Group's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for T&S Group

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as T&S Group's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. The last three years don't look nice either as the company has shrunk EPS by 28% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the one analyst following the company. That's shaping up to be materially higher than the 9.7% per annum growth forecast for the broader market.

In light of this, it's understandable that T&S Group's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

T&S Group's P/E hasn't come down all the way after its stock plunged. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that T&S Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for T&S Group that you need to be mindful of.

You might be able to find a better investment than T&S Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if T&S Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4055

T&S Group

Provides system development and operation/maintenance services in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026