Sun* Inc.'s (TSE:4053) Stock Retreats 25% But Earnings Haven't Escaped The Attention Of Investors

The Sun* Inc. (TSE:4053) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

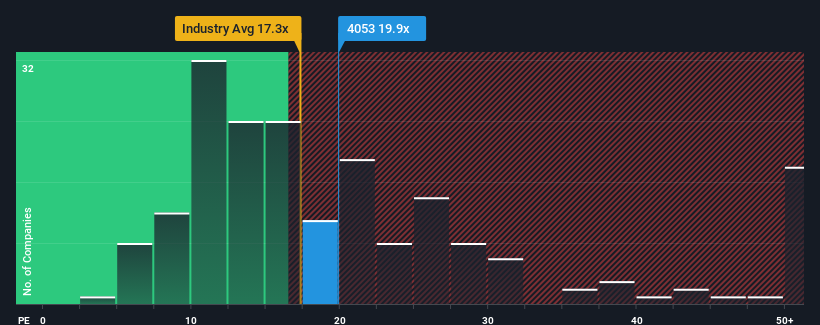

In spite of the heavy fall in price, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may still consider Sun* as a stock to avoid entirely with its 19.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Sun*'s earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Sun*

How Is Sun*'s Growth Trending?

In order to justify its P/E ratio, Sun* would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 22% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 57% over the next year. With the market only predicted to deliver 11%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Sun*'s P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Sun*'s P/E?

Sun*'s shares may have retreated, but its P/E is still flying high. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Sun* maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Sun*.

If you're unsure about the strength of Sun*'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4053

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026