SHANON Inc. (TSE:3976) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

SHANON Inc. (TSE:3976) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

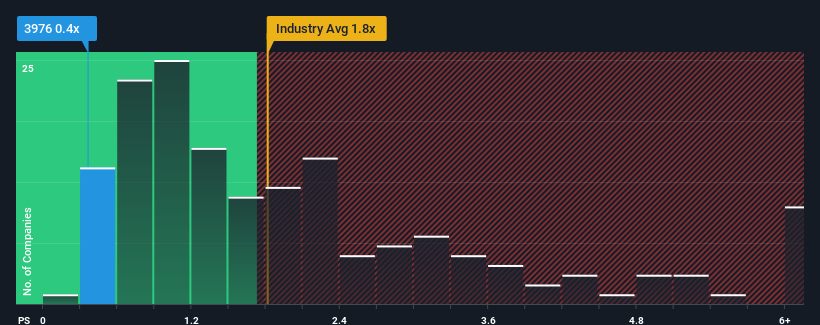

Following the heavy fall in price, SHANON may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Software industry in Japan have P/S ratios greater than 1.8x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for SHANON

What Does SHANON's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for SHANON, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for SHANON, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is SHANON's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SHANON's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.8%. The latest three year period has also seen an excellent 51% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

In light of this, it's peculiar that SHANON's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On SHANON's P/S

The southerly movements of SHANON's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of SHANON revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for SHANON (3 don't sit too well with us) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3976

SHANON

Provides cloud solutions. It develops and sells SHANONMARKETING PLATFORM, an integrated marketing support cloud product; SHANONAdCloud, a demand-side platform for advertising distribution services; SHANONvbitCMCloud, a content management system; and ZIKU, a metaverse event platform, as well as creates related homepages and databases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives