Stock Analysis

Japan's stock markets have experienced a notable rise recently, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, supported by yen weakness that has improved profit outlooks for exporters. In this environment of rising indices and favorable currency conditions, high-growth tech stocks like Rakus are drawing attention as investors seek companies with robust innovation potential and strong market positioning to navigate these dynamic market conditions effectively.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| freee K.K | 18.18% | 74.08% | ★★★★★☆ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.04% | 68.45% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Rakus (TSE:3923)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rakus Co., Ltd. is a Japanese company that, along with its subsidiaries, specializes in providing cloud services and has a market capitalization of ¥406 billion.

Operations: The company's primary revenue stream is derived from its Cloud Business, generating ¥35.18 billion, complemented by an IT Outsourcing Business contributing ¥6.18 billion. The focus on cloud services indicates a strategic emphasis in this sector for growth and expansion within Japan.

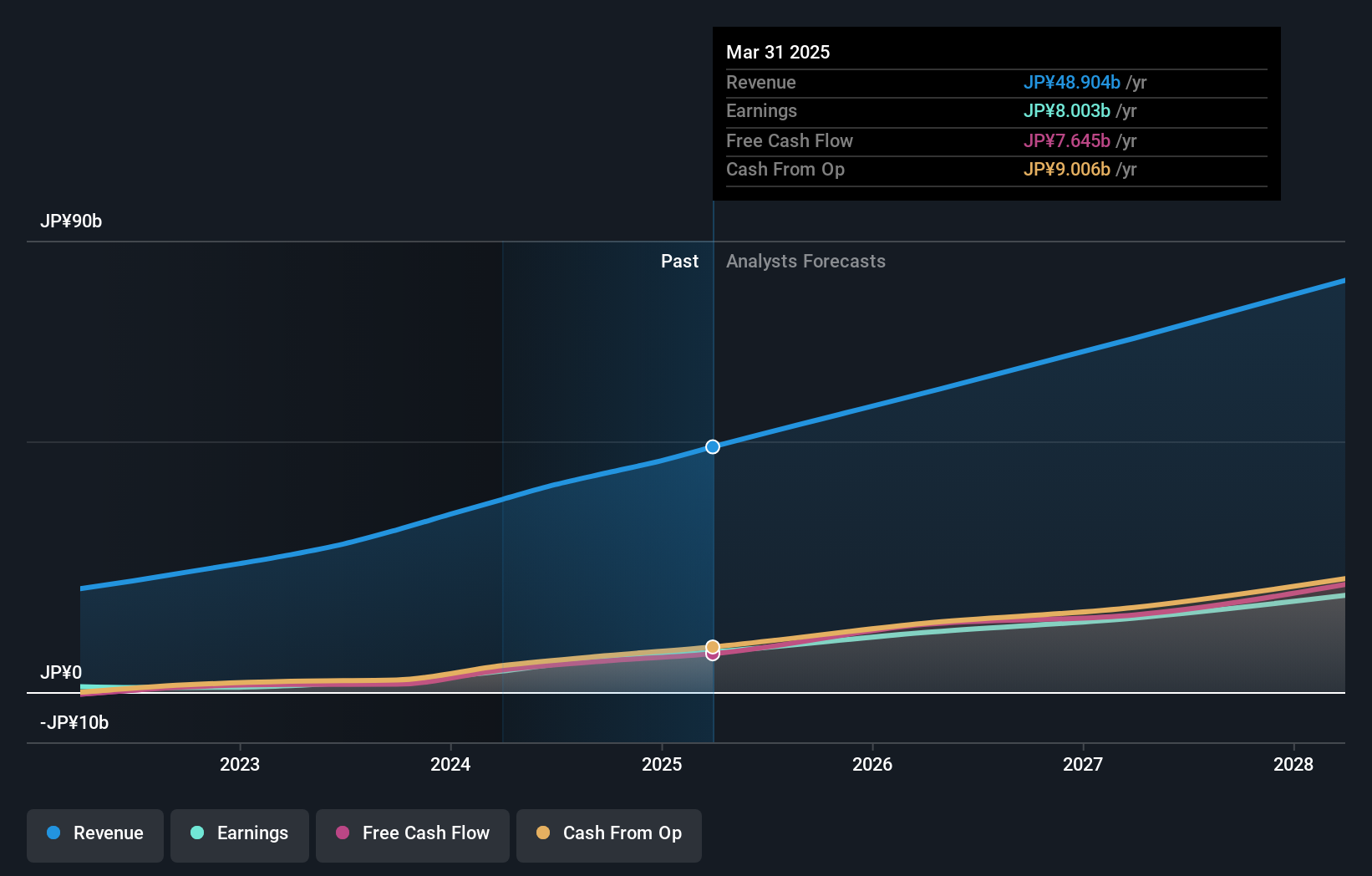

Rakus Co., Ltd. has demonstrated a robust performance with earnings growth of 208.9% over the past year, significantly outpacing the software industry's average of 13.5%. This surge is coupled with an impressive forecast of 26.3% annual profit growth, which starkly exceeds Japan's market average growth rate of 8.8%. Additionally, Rakus maintains a strong commitment to innovation as evidenced by its R&D expenses; however, specific figures on R&D spending were not provided in the data available to me. Recent financial statements reveal consistent revenue increases with September sales hitting ¥3,964 million, reflecting steady month-over-month growth from July's ¥3,900 million. These figures underscore Rakus’s capacity to generate revenue amidst competitive market conditions and hint at potential for sustained upward trajectories in both revenue and earnings based on current trends and strategic investments in technology development.

- Navigate through the intricacies of Rakus with our comprehensive health report here.

Explore historical data to track Rakus' performance over time in our Past section.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. offers medical statistics data services in Japan and has a market capitalization of ¥308.77 billion.

Operations: The company generates revenue primarily from Healthcare-Big Data and Tele-Medicine services, with ¥27.17 billion and ¥5.77 billion respectively, while also providing Dispensing Pharmacy Support at ¥1.22 billion. The focus on healthcare-related data services positions it within a niche market in Japan's medical industry.

JMDC Inc., in the throes of Japan's competitive tech landscape, has recently projected a robust revenue outlook of JPY 18.7 billion with an operating profit of JPY 2.8 billion for the half-year ending September 2024, signaling strong operational efficiency and market adaptation. This financial health is complemented by a strategic emphasis on R&D, dedicating 18% of its revenue to foster innovation—a critical driver in sustaining its growth trajectory which is poised to outpace the broader Japanese market's average with an anticipated annual earnings increase of 25.7%. Moreover, JMDC’s recent board meeting focused on enhancing shareholder value through share subscription rights, reflecting proactive governance that could further solidify its position in high-growth tech sectors amidst evolving industry dynamics.

- Get an in-depth perspective on JMDC's performance by reading our health report here.

Review our historical performance report to gain insights into JMDC's's past performance.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, and it has a market capitalization of approximately ¥140.28 billion.

Operations: The company generates revenue primarily through its entertainment operations in Japan and internationally. With a market capitalization of approximately ¥140.28 billion, it focuses on delivering diverse entertainment content to a global audience.

ANYCOLOR Inc., amidst Japan's vibrant tech scene, showcases a promising trajectory with expected revenue growth of 13.8% per year, surpassing the Japanese market average of 4.3%. This growth is supported by an anticipated earnings increase of 14.5% annually, which notably outpaces the broader market's forecast of 8.8%. The firm's commitment to innovation is evident in its strategic allocation towards R&D expenses, fostering advancements that are essential for maintaining its competitive edge in a rapidly evolving digital entertainment landscape. Despite a recent dip in earnings by -2.8%, ANYCOLOR’s robust projected returns and high forecast Return on Equity at 35.5% underscore its resilience and potential for sustained growth within the high-stakes domain of tech-driven entertainment.

Seize The Opportunity

- Unlock more gems! Our Japanese High Growth Tech and AI Stocks screener has unearthed 115 more companies for you to explore.Click here to unveil our expertly curated list of 118 Japanese High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3923

Rakus

Provides cloud services in Japan.