- Japan

- /

- Semiconductors

- /

- TSE:6920

Japanese Exchange Growth Companies With Insider Ownership October 2024

Reviewed by Simply Wall St

Japan's stock markets have experienced a positive trend, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index rising by 0.45%, as yen weakness boosts the profit outlook for exporters. In this favorable market environment, growth companies with high insider ownership can be particularly appealing due to their potential for alignment between management interests and shareholder value creation.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 26.1% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 40.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Inforich (TSE:9338) | 19.1% | 29.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.4% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| freee K.K (TSE:4478) | 23.9% | 74.1% |

Let's uncover some gems from our specialized screener.

UT GroupLtd (TSE:2146)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: UT Group Co., Ltd. specializes in the dispatch and outsourcing of permanent employees across various sectors such as manufacturing, design and development, and construction in Japan, with a market cap of ¥108.43 billion.

Operations: The company's revenue segments include Area Business at ¥66.39 billion, Vietnam Business at ¥11.86 billion, Solution Business at ¥18.89 billion, and Manufacturing Business (Excluding Solution Business) at ¥64.78 billion.

Insider Ownership: 22.7%

Earnings Growth Forecast: 13% p.a.

UT Group Ltd. shows potential as a growth company with high insider ownership, evidenced by its earnings growing 153.5% over the past year and forecasted to grow at 13% annually, outpacing the Japanese market's average. Despite a volatile share price recently, it trades at a favorable P/E ratio of 11.6x compared to the market's 13.5x, suggesting good relative value. However, its dividend yield of 6.06% is not well covered by free cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of UT GroupLtd.

- Insights from our recent valuation report point to the potential undervaluation of UT GroupLtd shares in the market.

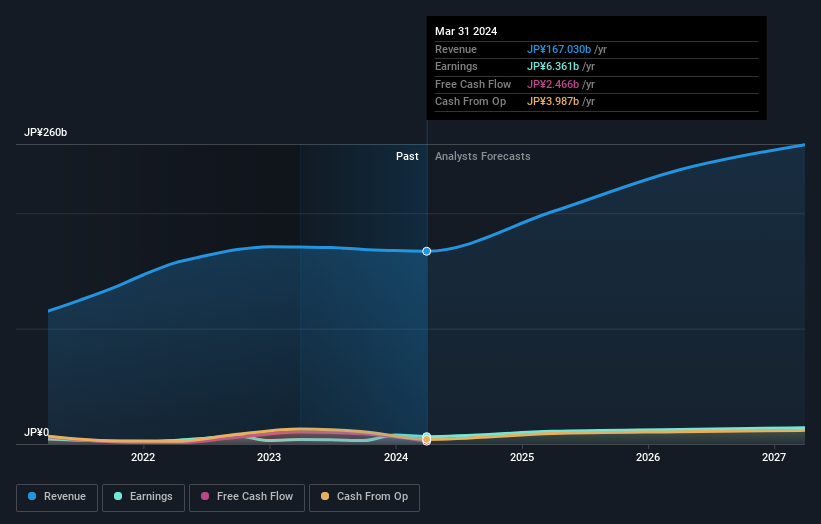

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment globally, with a market cap of ¥2.31 trillion.

Operations: Lasertec's revenue segments include the design, manufacture, and sale of inspection and measurement equipment both domestically and internationally.

Insider Ownership: 11.1%

Earnings Growth Forecast: 15.8% p.a.

Lasertec's earnings grew by 28% last year and are forecasted to grow at 15.84% annually, surpassing the Japanese market average of 8.8%. Despite recent share price volatility, Lasertec's revenue is expected to increase by 13.2% per year, outpacing the market's growth rate. The company recently launched SICA108, enhancing SiC wafer inspection capabilities and supporting its growth trajectory in high-demand sectors like electric vehicles and renewable energy applications.

- Click here to discover the nuances of Lasertec with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Lasertec shares in the market.

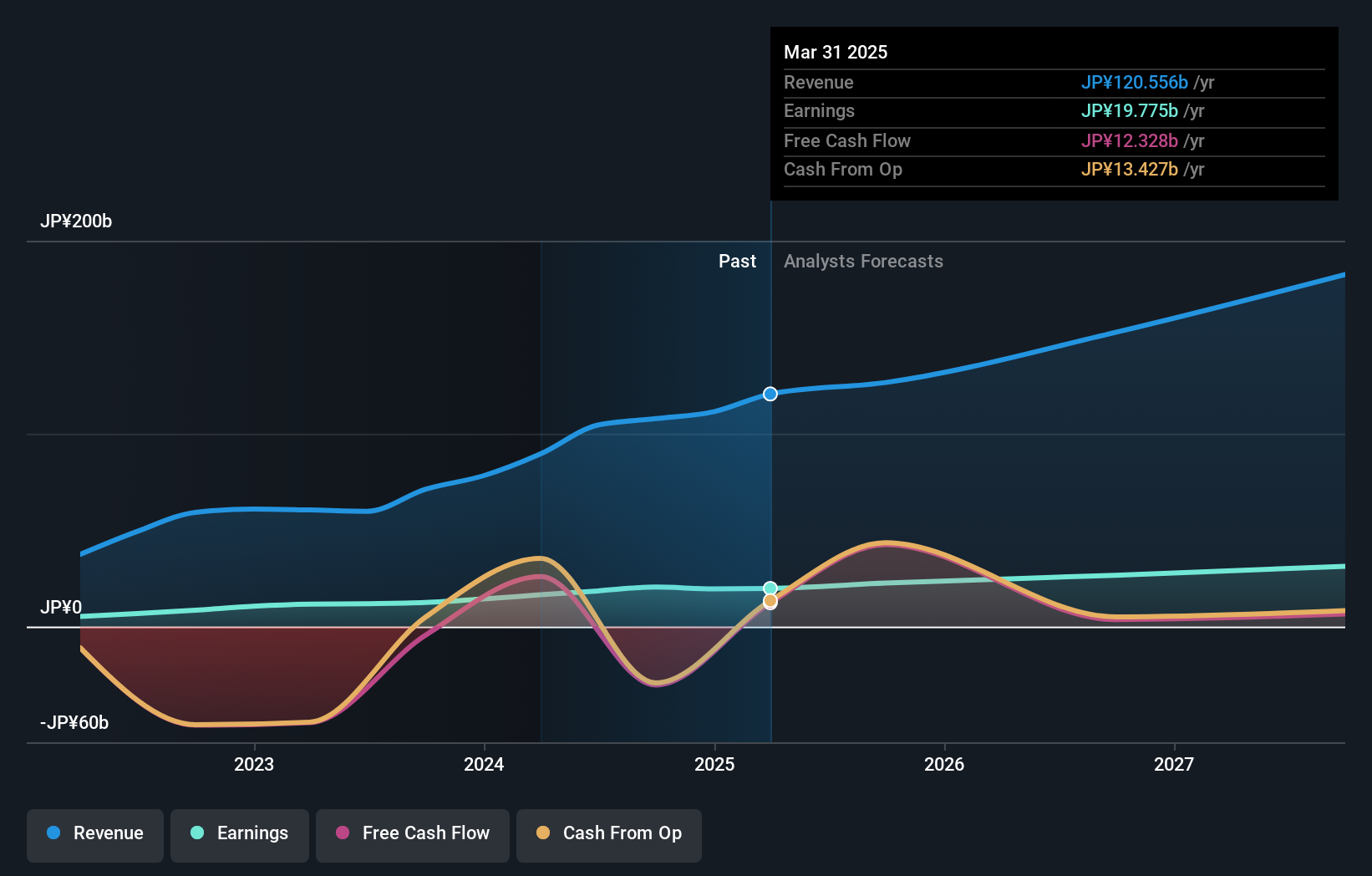

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan and has a market capitalization of approximately ¥206.79 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse portfolio of financial products and services offered within Japan.

Insider Ownership: 31.3%

Earnings Growth Forecast: 17% p.a.

Financial Partners Group Ltd. is experiencing robust growth, with earnings projected to increase by 16.95% annually, outpacing the Japanese market's average of 8.8%. Despite share price volatility and a high debt level, it trades at a relatively low P/E ratio of 11.2x compared to the JP market's 13.5x, indicating good value potential. Recent business expansions include a new sales office in Imabari City and strategic real estate acquisitions in Fukuoka City to enhance its investment offerings.

- Navigate through the intricacies of Financial Partners GroupLtd with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Financial Partners GroupLtd's share price might be too pessimistic.

Next Steps

- Unlock more gems! Our Fast Growing Japanese Companies With High Insider Ownership screener has unearthed 98 more companies for you to explore.Click here to unveil our expertly curated list of 101 Fast Growing Japanese Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.