Stock Analysis

Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index fell by 1.0%, amid a backdrop of currency headwinds and evolving monetary policy expectations from the Bank of Japan. Despite these fluctuations, high-growth tech stocks in Japan remain an area of interest for investors looking to capitalize on innovation and strong market potential. When evaluating high-growth tech stocks, it's essential to consider factors such as robust revenue growth, a solid business model, and a competitive edge in their respective industries—especially given current market conditions where technology stocks are outperforming other sectors globally.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

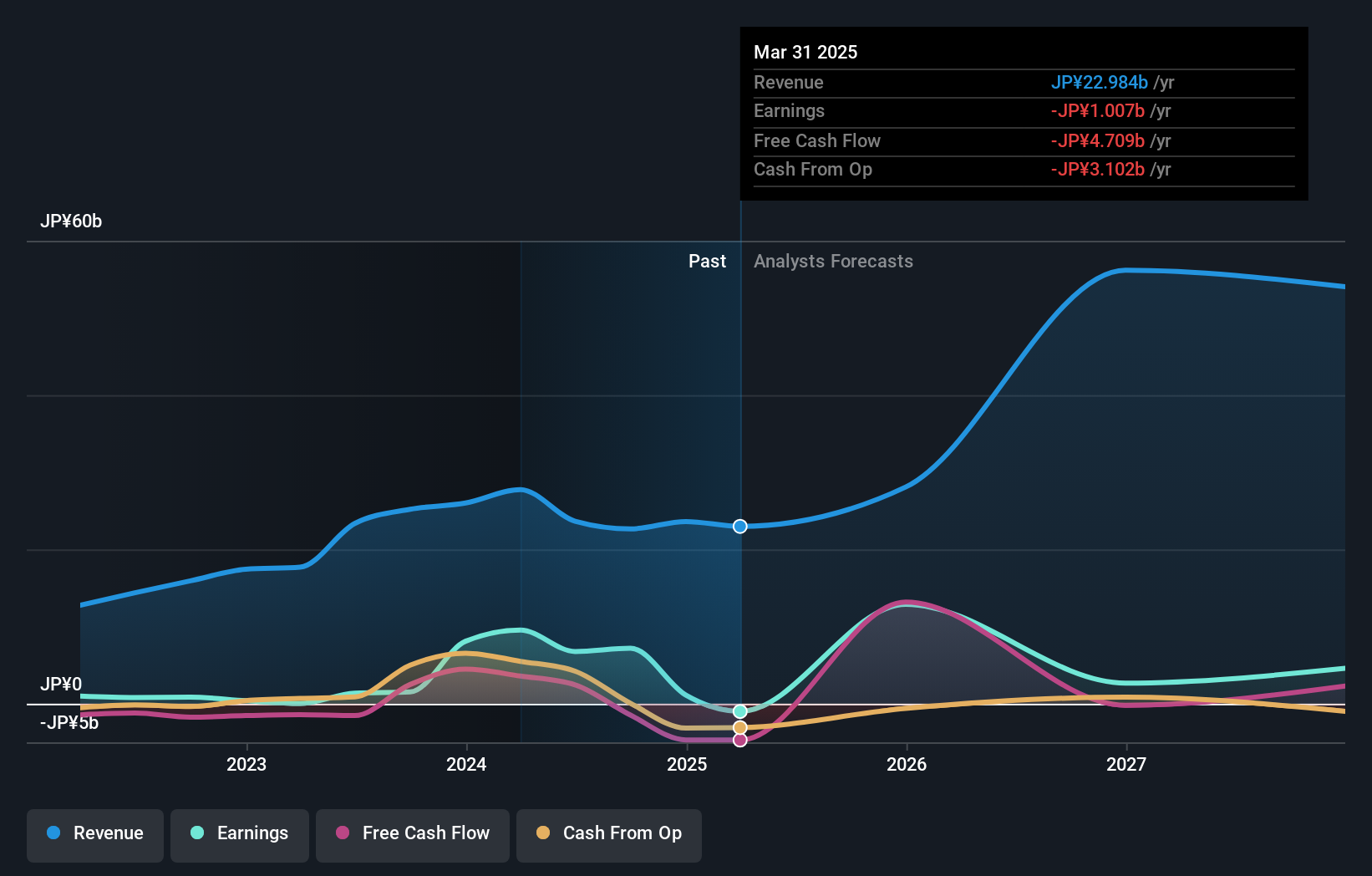

GNI Group (TSE:2160)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GNI Group Ltd. engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally with a market cap of ¥124.90 billion.

Operations: GNI Group Ltd. generates revenue primarily from its pharmaceutical segment, which accounts for ¥19.35 billion, and its medical device segment, contributing ¥4.30 billion.

GNI Group's recent approval for Avatrombopag Maleate Tablets, a treatment for thrombocytopenia associated with chronic liver disease, marks a significant milestone in its product lineup. The company's earnings growth of 393.9% over the past year far outpaced the biotech industry's 172.6%, highlighting robust performance. With forecasted revenue growth at 24.6% annually and earnings expected to rise by 18.9% per year, GNI is positioned well within Japan's tech sector despite high share price volatility recently observed. Research & Development expenses have been pivotal; GNI has strategically invested ¥2 billion into R&D last quarter alone, ensuring sustained innovation and expansion of their pipeline in rare diseases treatments. This commitment is crucial as software firms increasingly shift to SaaS models, driving recurring revenue streams from subscriptions and enhancing long-term profitability prospects in the competitive landscape.

- Click to explore a detailed breakdown of our findings in GNI Group's health report.

Examine GNI Group's past performance report to understand how it has performed in the past.

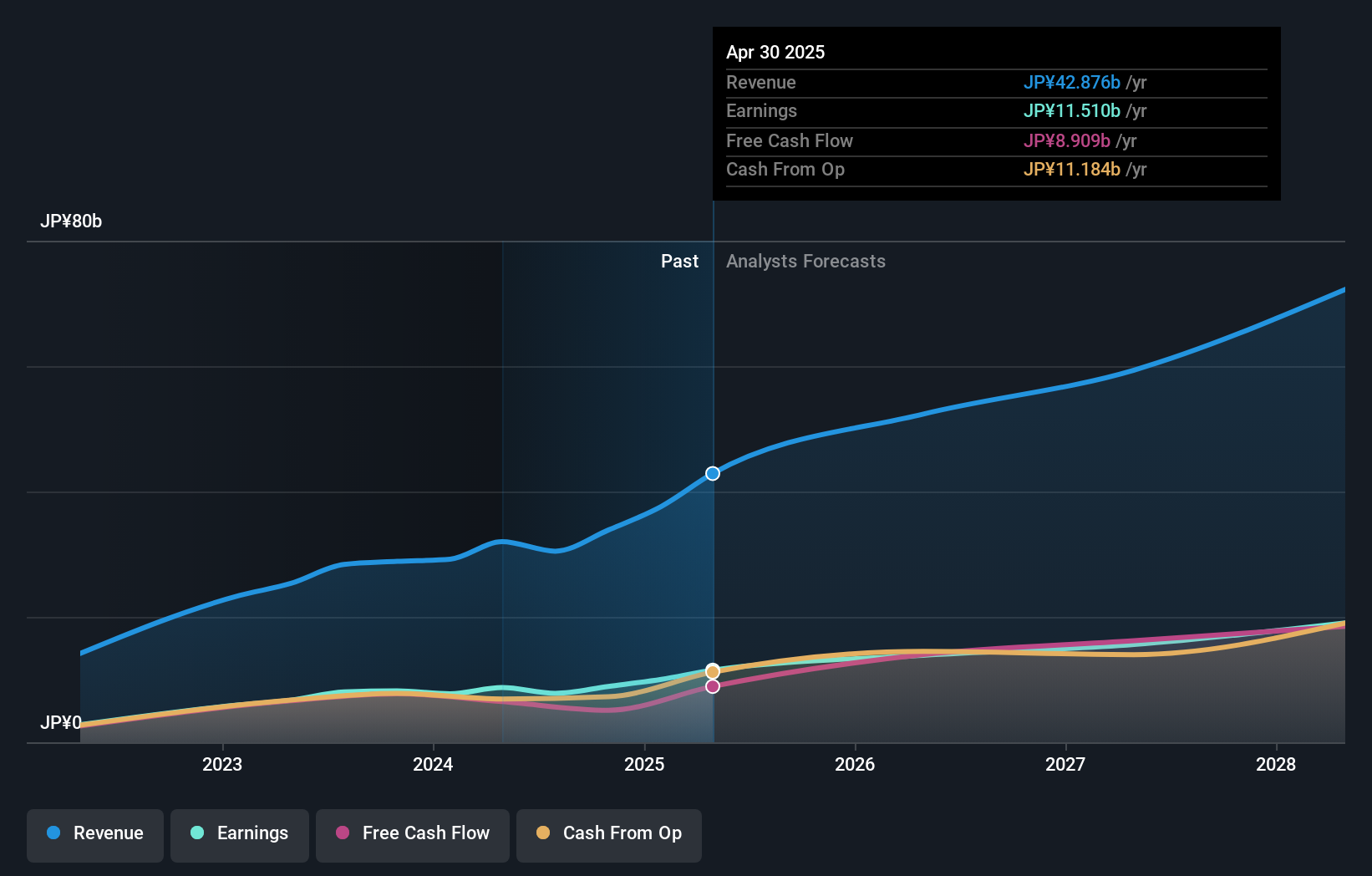

Rakus (TSE:3923)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rakus Co., Ltd., along with its subsidiaries, offers cloud services in Japan and has a market cap of ¥406.64 billion.

Operations: Rakus generates revenue primarily through its Cloud Business segment, which brought in ¥35.18 billion, and its IT Outsourcing Business segment, contributing ¥6.18 billion.

Rakus has shown impressive growth with earnings increasing by 208.9% over the past year, outpacing the software industry's 13.7%. The company's revenue is forecast to grow at 16.8% annually, surpassing Japan's market average of 4.3%. Recent sales results for August reached ¥3,918 million, highlighting consistent performance. Strategic investments in R&D are evident with notable expenses ensuring continued innovation and expansion in their SaaS offerings, which drive recurring revenue streams and long-term profitability.

- Take a closer look at Rakus' potential here in our health report.

Understand Rakus' track record by examining our Past report.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, boasting a market cap of ¥153.52 billion.

Operations: ANYCOLOR Inc. generates revenue through its entertainment operations in Japan and internationally. The company has a market cap of ¥153.52 billion.

ANYCOLOR stands out in Japan's tech landscape with a forecasted annual revenue growth of 13.9%, surpassing the market average of 4.3%. The company's earnings are projected to grow at 14.5% annually, reflecting robust future prospects compared to the broader market's 8.6%. Notably, ANYCOLOR has invested significantly in R&D, ensuring continued innovation and expansion within its entertainment segment—key for sustaining long-term growth. Recent share repurchases totaling ¥7.50 billion underscore confidence in their strategic direction and financial health.

- Navigate through the intricacies of ANYCOLOR with our comprehensive health report here.

Assess ANYCOLOR's past performance with our detailed historical performance reports.

Seize The Opportunity

- Unlock our comprehensive list of 125 Japanese High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3923

Rakus

Provides cloud services in Japan.