Amid heightened global trade tensions and a volatile economic environment, Asian markets have been closely watching the impact of new tariffs announced by the U.S., which have led to significant declines in key indices like Japan's Nikkei 225 and China's CSI 300. In this challenging landscape, identifying high-growth tech stocks that can navigate these uncertainties is crucial, as these companies often possess innovative capabilities and resilient business models that may offer potential opportunities for growth despite broader market pressures.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.15% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.60% | 36.56% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 21.43% | 26.56% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| PharmaResearch | 20.39% | 27.65% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: I'LL Inc. is a Japanese company specializing in system solutions, with a market capitalization of ¥48.60 billion.

Operations: The company focuses on providing system solutions in Japan, generating revenue primarily through its specialized services. With a market capitalization of ¥48.60 billion, it operates within the technology sector, catering to diverse business needs through its offerings.

I'LL's trajectory in the high-growth tech sector is marked by its robust R&D commitment, with recent figures illustrating a significant investment in innovation. This strategic focus has translated into a promising 9.5% annual revenue growth, outpacing the Japanese market average of 4.3%. Despite earnings growth last year lagging behind the broader software industry at 2.8%, future projections are more optimistic, forecasting an annual increase of 15.4%, which doubles the national rate of 7.8%. Furthermore, I'LL's Return on Equity is expected to surge to an impressive 27.9% in three years, underscoring potential for substantial financial health improvement and investor interest stimulation in this dynamic market landscape.

- Dive into the specifics of I'LL here with our thorough health report.

Gain insights into I'LL's past trends and performance with our Past report.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plus Alpha Consulting Co., Ltd. specializes in providing marketing solutions and has a market capitalization of ¥52.51 billion.

Operations: The company generates revenue primarily through its marketing solutions and HR solutions segments, with ¥10.92 billion from HR Solutions and ¥3.82 billion from Marketing Solutions. The focus on these two core areas highlights its strategic emphasis on providing comprehensive marketing services alongside human resources offerings.

Plus Alpha ConsultingLtd. demonstrates a notable trajectory in the tech landscape with its strategic emphasis on R&D, investing significantly to foster innovation. This approach is reflected in its robust revenue growth of 14.7% annually, surpassing Japan's market average of 4.3%. While its earnings growth of 11.7% last year slightly trailed the software industry's 12.2%, future forecasts are more promising with an expected annual increase of 18.1%. The company also actively manages its capital return strategy; from November last year to February this year, it repurchased over 1.74 million shares for ¥2,999.96 million, underscoring confidence in its financial health and commitment to shareholder value.

- Delve into the full analysis health report here for a deeper understanding of Plus Alpha ConsultingLtd.

Evaluate Plus Alpha ConsultingLtd's historical performance by accessing our past performance report.

Smaregi (TSE:4431)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smaregi, Inc. is a company that specializes in planning, designing, developing, and providing Internet services with a market capitalization of ¥50.73 billion.

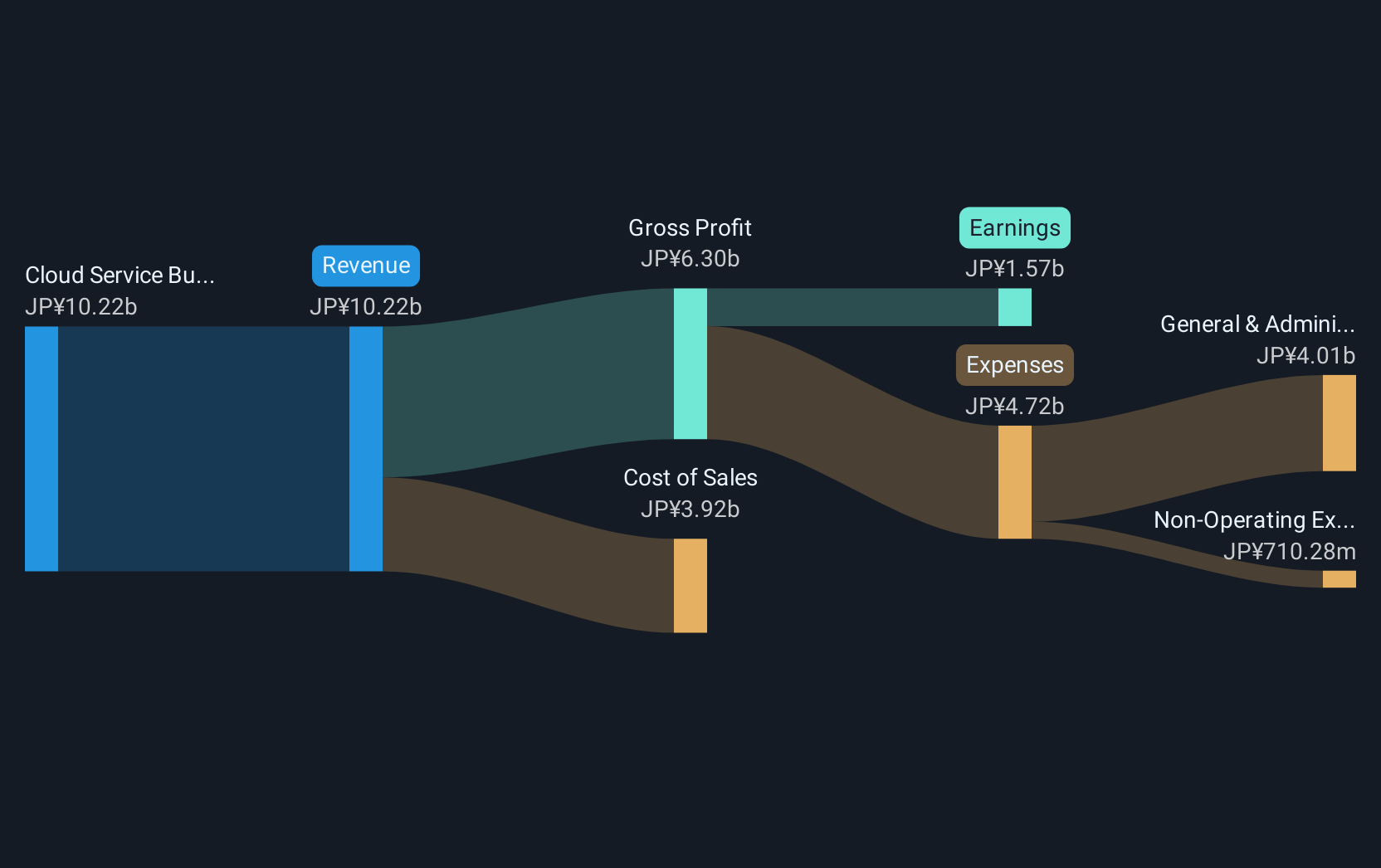

Operations: The primary revenue stream for Smaregi comes from its Cloud Service Business, which generated ¥10.22 billion.

Smaregi's strategic focus on R&D has catalyzed its robust growth trajectory, with a notable 18.3% annual increase in revenue and an impressive 21.3% surge in earnings. This commitment is evidenced by its substantial investment in innovation, as reflected in the recent revision of its fiscal year guidance projecting net sales reaching ¥10.88 billion and operating profit at ¥2.28 billion. Despite a highly volatile share price over the past three months, Smaregi's performance outpaces the Japanese market average significantly, suggesting strong future prospects amid competitive pressures within Asia's high-tech landscape.

- Get an in-depth perspective on Smaregi's performance by reading our health report here.

Examine Smaregi's past performance report to understand how it has performed in the past.

Where To Now?

- Click here to access our complete index of 501 Asian High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4071

Flawless balance sheet and good value.

Market Insights

Community Narratives