NTT Data Intramart (TSE:3850) Margin Gains Reinforce Bullish Narrative Despite Premium Valuation

Reviewed by Simply Wall St

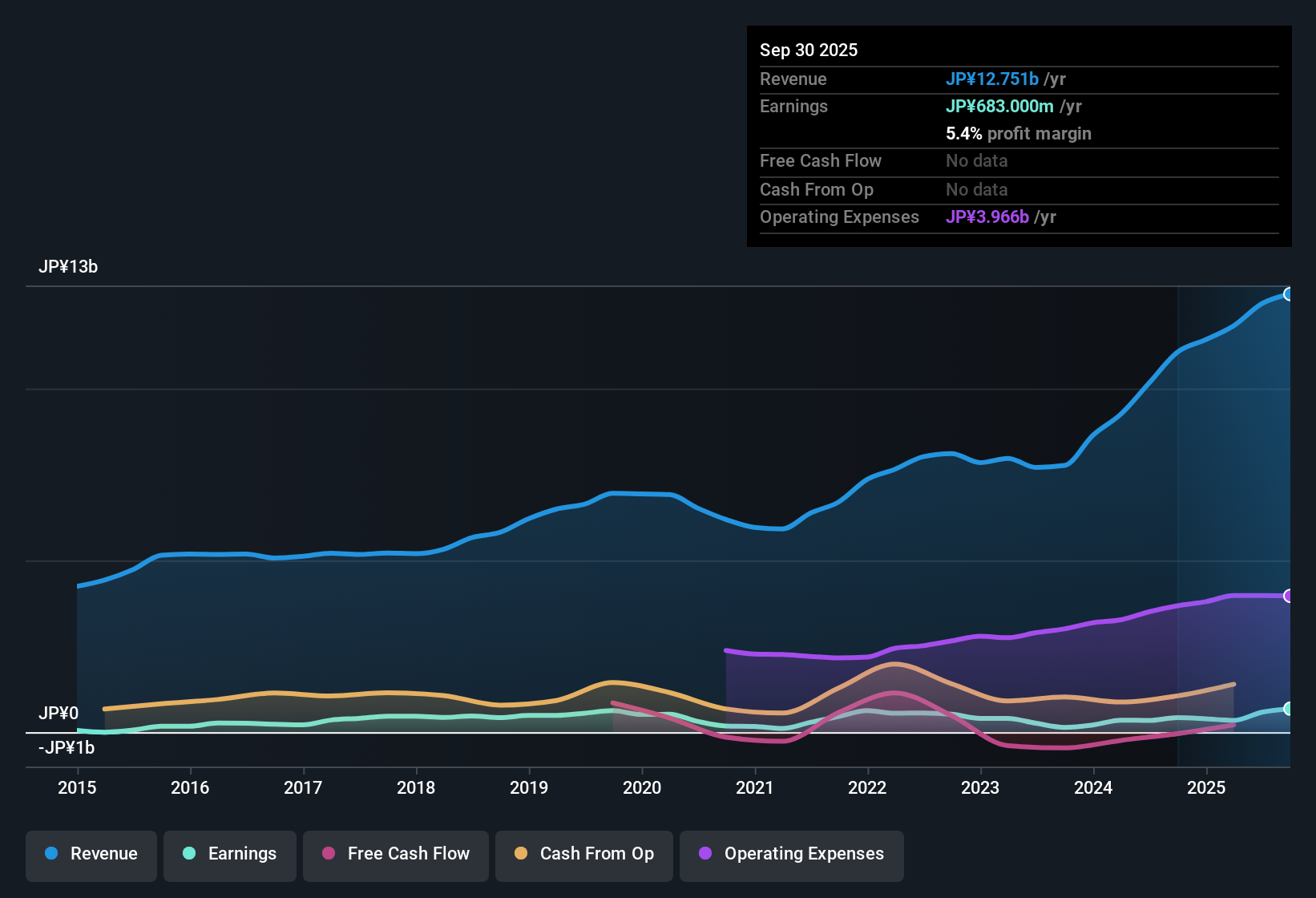

NTT Data Intramart (TSE:3850) reported net profit margins of 5.4%, up from 3.8% a year earlier, and earnings surged by 60.7% in the most recent year. Annual earnings growth over the past five years stands at 9.5%, while revenue is set to grow 6.5% a year, outpacing the JP market’s 4.5% average. With robust forecasts of 27.6% annual earnings growth ahead and margins improving, the balance of signals currently favors rewards for investors.

See our full analysis for NTT Data Intramart.Next up, we will see how these headline numbers align with the dominant market narratives. This will highlight the views that get confirmed and those that might be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Industry Benchmarks

- Net profit margin improved to 5.4% from 3.8% last year, which is notably higher than recent JP software industry averages.

- Profit margin strength heavily supports the optimistic narrative that digital transformation demand is fueling higher-quality earnings.

- Analysts highlight that such margin expansion demonstrates resilience, backed by five-year average annual earnings growth of 9.5%. This year’s profit growth jumped to 60.7%.

- The prevailing view considers this margin momentum as a key differentiator, setting NTT Data Intramart ahead of most sector peers expecting only moderate profitability gains.

Growth Forecast Beats Market Averages

- Revenue is projected to rise 6.5% per year, exceeding the broader JP market’s 4.5% annual forecast. Earnings are forecast to expand at an even faster 27.6% yearly pace for the next three years.

- These above-market growth expectations are seen as central to the idea that NTT Data Intramart can maintain leadership in workflow automation.

- The prevailing narrative points to continued product and client growth as the engine behind accelerating revenue, as supported by company forecasts.

- It is worth watching whether persistent execution and demand for digital transformation are enough to keep the pace ahead of intensifying competition among domestic and global rivals.

Valuation Premium Raises Eyebrows

- The stock’s price-to-earnings ratio stands at 25.6x, topping both peer (23.7x) and industry averages (21.1x). The share price of ¥3,590 is trading far above the DCF fair value estimate of ¥185.67.

- This valuation stretch has become the main point of tension, with many weighing current growth strength against the potential for a correction if fundamentals do not catch up.

- The prevailing analysis notes that high-quality earnings alone may not justify such a large fair value gap, raising the possibility of short-term volatility even while the long-term growth story remains intact.

- Shareholders must decide if the premium is justified by sector-leading performance, or if a reality check is due should earnings momentum slow or investor appetite shift to lower-priced peers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NTT Data Intramart's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NTT Data Intramart’s premium valuation stands out as a vulnerability, with the current share price significantly above fair value estimates and sector averages.

If stretching beyond fair value makes you uneasy, check out these 852 undervalued stocks based on cash flows to focus on companies with stronger upside potential based on cash flows and realistic pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTT Data Intramart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3850

NTT Data Intramart

Provides software products and services in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives