System Research Ltd (TSE:3771) Net Profit Margin Improves, Reinforcing Bullish Investor Narratives

Reviewed by Simply Wall St

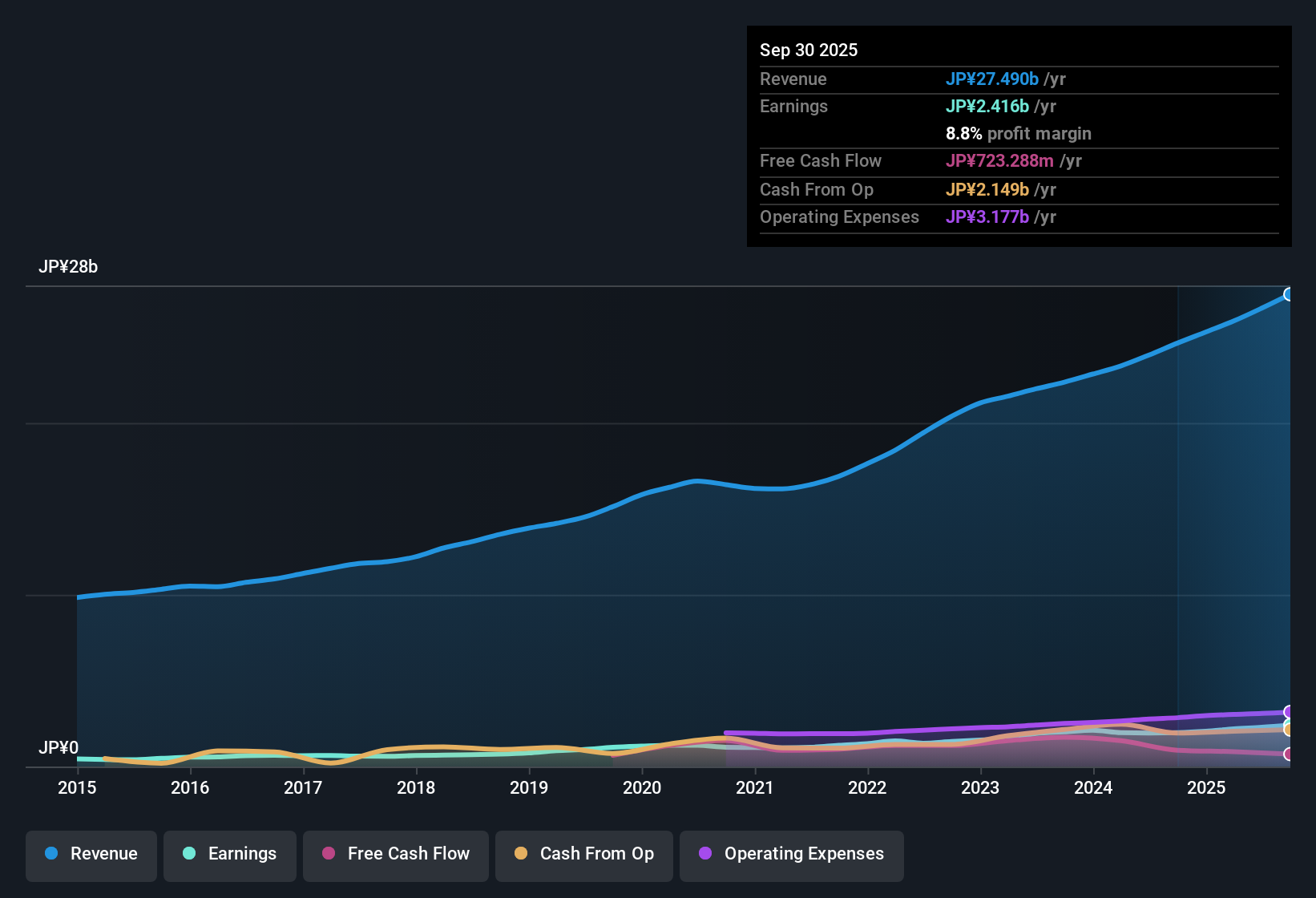

System Research Ltd (TSE:3771) reported net profit margins of 8.6%, improving from 8.2% a year ago. Over the past five years, earnings have grown at an annual rate of 16.2%, and the latest earnings growth reached 16.9%, marking another strong period of expansion. Investors are likely to take notice of this ongoing trajectory of consistent earnings growth and expanding profitability as earnings season heats up.

See our full analysis for System ResearchLtd.Next, we will see how these headline results line up with the investor narrative. Some expectations will be validated, while others may get a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-To-Earnings Multiple Undercuts Industry

- System Research Ltd shares trade at a Price-To-Earnings ratio of 14.9x, below both the peer average of 15.5x and the JP Software industry at 21.1x. This points to a relative value edge in the sector.

- Recent expansion in net profit margins and disciplined earnings growth strongly support portfolio managers’ preference for stocks trading below sector average multiples.

- The 16.2% annual earnings growth over five years, combined with an 8.6% net profit margin, marks a performance that justifies a move away from more richly valued software peers.

- Consensus narrative highlights how such a valuation gap increases attention on whether the market is undervaluing sustained profit expansion compared to the sector.

Discounted Cash Flow Flags Intrinsic Value Gap

- The current share price of ¥2,058 is noticeably above the discounted cash flow (DCF) fair value estimate of ¥1,464.70, creating a material gap for investors monitoring long-term upside.

- The market’s willingness to pay a premium over DCF value challenges the assumptions that valuation will revert to fundamentals in the near term.

- It is notable that despite the DCF signal, the Price-To-Earnings discount to sector peers continues, adding nuance to the stock’s value profile.

- This tension keeps System Research Ltd attractive to value-seeking investors but also raises questions about future price catalysts beyond intrinsic worth.

Dividend Sustainability Draws Caution

- Risks identified in recent filings specifically highlight concerns regarding the sustainability of System Research Ltd’s dividend, putting shareholder returns under the spotlight.

- The latest earnings momentum reinforces the company’s ability to generate cash flow, but the flagged dividend risk prompts careful scrutiny of payout durability.

- Bears often highlight the risk that enduring high growth may require reinvestment, placing added pressure on the company’s ability to reliably support its dividend.

- With net profit margins improving, some may expect dividend security. However, persistent warning signals keep this as a front-of-mind issue for cautious investors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on System ResearchLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite solid earnings growth, System Research Ltd’s premium to fair value and flagged dividend risks may undermine its investment appeal for cautious investors.

If you want more reliable dividends and less uncertainty, turn your attention to these 1997 dividend stocks with yields > 3% that offer stronger yields and sustainable payouts even during turbulent times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3771

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives