Stock Analysis

Exploring Hidden Gems On The Japanese Exchange Three Stocks That May Be Trading Below Their Estimated Fair Value

Reviewed by Simply Wall St

As Japan's stock markets experienced notable gains this week, with the Nikkei 225 Index climbing by 2.6% and the TOPIX Index increasing by 3.1%, investors are closely watching for opportunities in a market buoyed by a historically weak yen and anticipations of policy tightening by the Bank of Japan. In such an environment, identifying stocks that may be trading below their estimated fair value could present valuable opportunities for those looking to invest in potential hidden gems on the Japanese exchange.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥467.00 | ¥894.69 | 47.8% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥1897.00 | ¥3557.07 | 46.7% |

| Hibino (TSE:2469) | ¥2641.00 | ¥4930.71 | 46.4% |

| OSAKA Titanium technologiesLtd (TSE:5726) | ¥2768.00 | ¥5516.45 | 49.8% |

| Gift Holdings (TSE:9279) | ¥2711.00 | ¥5330.42 | 49.1% |

| Macromill (TSE:3978) | ¥850.00 | ¥1664.85 | 48.9% |

| NIHON CHOUZAILtd (TSE:3341) | ¥1495.00 | ¥2816.00 | 46.9% |

| IbidenLtd (TSE:4062) | ¥6548.00 | ¥12141.87 | 46.1% |

| freee K.K (TSE:4478) | ¥2422.00 | ¥4775.43 | 49.3% |

| LibertaLtd (TSE:4935) | ¥541.00 | ¥999.73 | 45.9% |

Let's uncover some gems from our specialized screener

Infomart (TSE:2492)

Overview: Infomart Corporation operates an online B2B e-commerce trading platform tailored for the food industry in Japan, with a market capitalization of approximately ¥69.91 billion.

Operations: The company's primary revenue is derived from its online B2B e-commerce platform focused on the food sector in Japan.

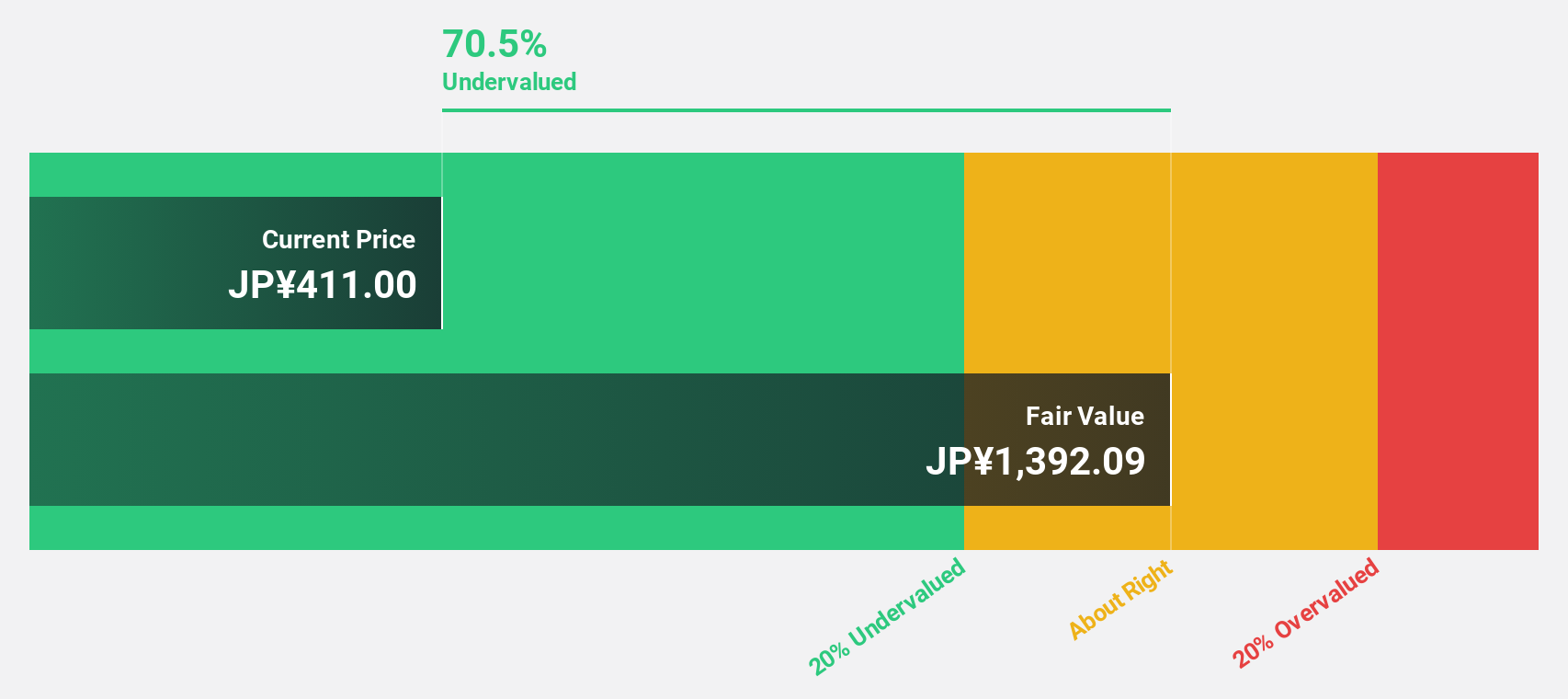

Estimated Discount To Fair Value: 15.8%

Infomart, currently priced at ¥309, is perceived as undervalued with an estimated fair value of ¥366.99, reflecting a 15.8% potential undervaluation based on discounted cash flows. The company's earnings are projected to grow by 38.1% annually over the next three years, outpacing the Japanese market's average growth rate significantly. However, its revenue growth forecast at 12.5% per year is robust but not exceptional when compared to high-growth benchmarks. Analysts expect the stock price to increase by 44.6%, despite recent price volatility and one-off financial items impacting earnings quality.

- Our earnings growth report unveils the potential for significant increases in Infomart's future results.

- Click here to discover the nuances of Infomart with our detailed financial health report.

SHIFT (TSE:3697)

Overview: SHIFT Inc. specializes in providing software quality assurance and testing solutions in Japan, with a market capitalization of approximately ¥256.66 billion.

Operations: The company focuses on delivering software quality assurance and testing solutions, with a market capitalization of approximately ¥256.66 billion.

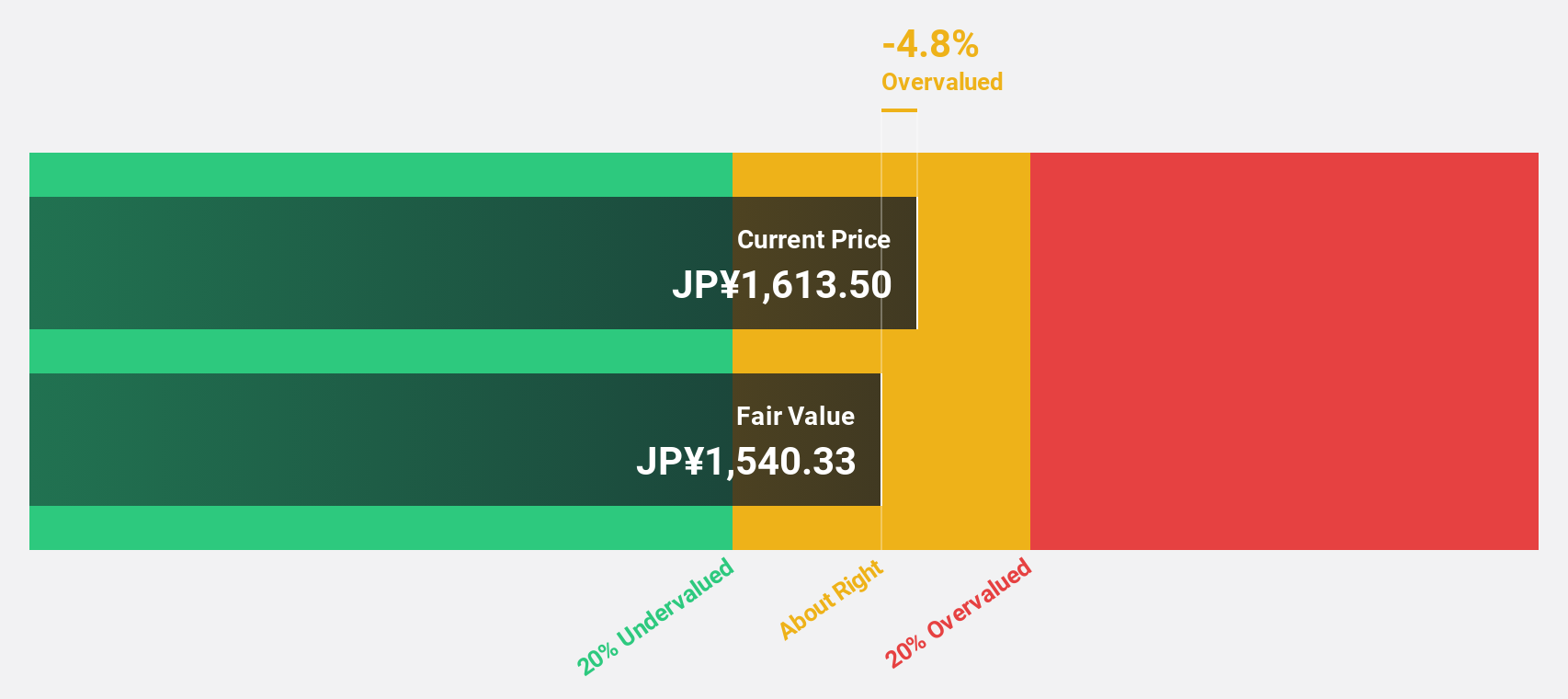

Estimated Discount To Fair Value: 28.0%

SHIFT, priced at ¥14580, is significantly undervalued with a fair value estimate of ¥20259.48, trading 28% below this level. Expected to outperform with earnings growth forecasted at 26.8% annually and revenue growth at 21.9%, both well above the Japanese market averages of 8.8% and 4.1%, respectively. Analyst consensus suggests a potential price increase of over 100%. However, it has experienced high share price volatility recently.

- Our comprehensive growth report raises the possibility that SHIFT is poised for substantial financial growth.

- Navigate through the intricacies of SHIFT with our comprehensive financial health report here.

FP Partner (TSE:7388)

Overview: FP Partner Inc. operates in Japan, offering insurance services to both individuals and corporations, with a market capitalization of approximately ¥67.47 billion.

Operations: The company generates revenue by providing insurance solutions tailored for both personal and corporate clients in Japan.

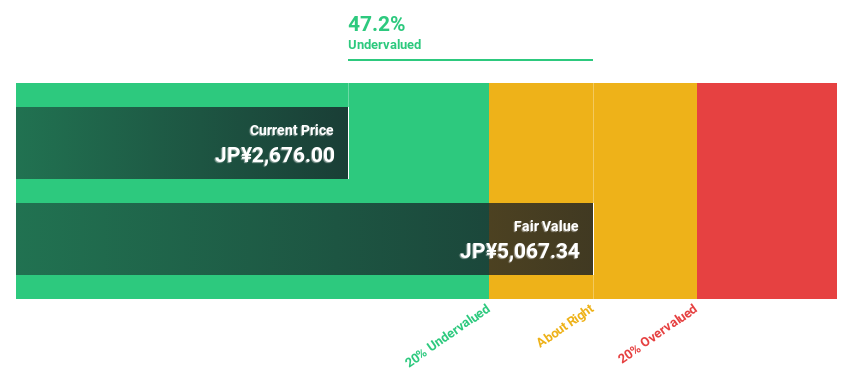

Estimated Discount To Fair Value: 42.3%

FP Partner, currently priced at ¥2925, is significantly undervalued based on cash flows, with a fair value estimate of ¥5067.34. This represents a substantial undervaluation. Despite its unstable dividend track record and highly volatile share price in recent months, the company's earnings are expected to grow by 17.4% annually, outpacing the Japanese market average of 8.8%. Recent guidance anticipates strong half-year performance with net sales reaching JPY 16.79 billion and full-year forecasts suggesting continued revenue growth to JPY 35.63 billion.

- In light of our recent growth report, it seems possible that FP Partner's financial performance will exceed current levels.

- Take a closer look at FP Partner's balance sheet health here in our report.

Next Steps

- Take a closer look at our Undervalued Japanese Stocks Based On Cash Flows list of 98 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether FP Partner is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7388

FP Partner

Provides insurance services for individuals and corporations in Japan.

Outstanding track record with excellent balance sheet.