Amidst heightened global trade tensions and economic uncertainty fueled by recent tariff announcements, Asian markets are navigating a complex landscape with significant implications for high-growth sectors. In such volatile times, identifying promising tech stocks often involves assessing their resilience to external shocks, adaptability to changing market dynamics, and potential for innovation-driven growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.15% | ★★★★★★ |

| Zhongji Innolight | 28.16% | 28.04% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.60% | 36.56% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 20.52% | 25.50% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.31% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Infomart (TSE:2492)

Simply Wall St Growth Rating: ★★★★★☆

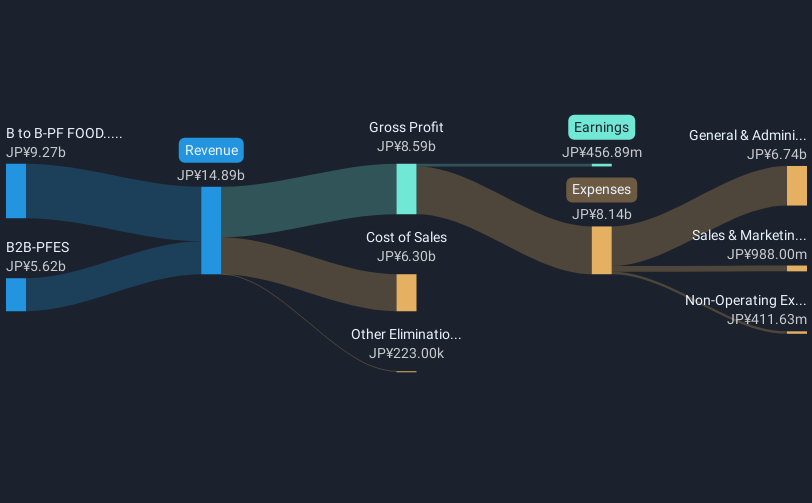

Overview: Infomart Corporation operates an online business-to-business electronic commerce platform in Japan, with a market capitalization of ¥78.53 billion.

Operations: Infomart Corporation generates revenue through its online BtoB electronic commerce platform in Japan. The company's market capitalization is approximately ¥78.53 billion.

Infomart, a key player in Asia's tech sector, is set to outpace the Japanese market with its earnings forecasted to grow by 30.2% annually, significantly higher than the market's 7.8%. This growth trajectory is supported by a robust increase in earnings over the past year at 119.8%, surpassing industry averages. Despite a slower revenue growth rate of 9% per year compared to some global peers, Infomart benefits from strong fundamentals including a positive free cash flow and an expected high Return on Equity of 22.9% in three years' time. The company also navigated challenges like a one-off loss of ¥255 million last fiscal year which impacted financial results but demonstrated resilience and potential for sustained profitability moving forward.

- Navigate through the intricacies of Infomart with our comprehensive health report here.

Assess Infomart's past performance with our detailed historical performance reports.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

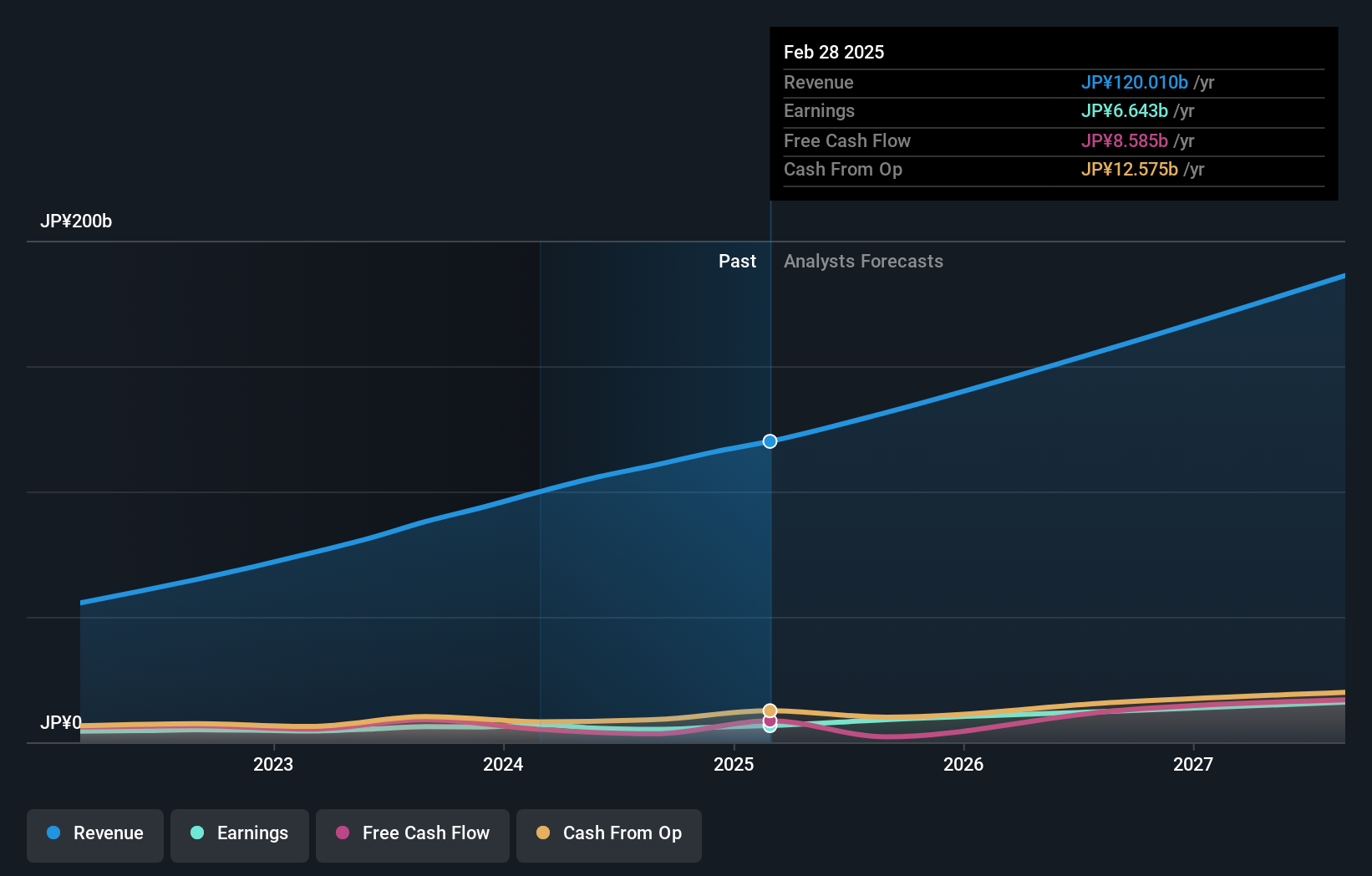

Overview: SHIFT Inc. specializes in software quality assurance and testing solutions in Japan, with a market capitalization of ¥317.67 billion.

Operations: SHIFT Inc. generates revenue primarily through software testing-related services, amounting to ¥74.26 billion, and software development-related services, contributing ¥36.57 billion.

SHIFT's strategic maneuvers, including the recent establishment of Japan Aerospace & Defense Consulting and the merger with SHIFT Enterprise Consulting, underscore its aggressive expansion in niche markets. These moves complement an impressive financial outlook for 2025, with expected net sales reaching ¥130 billion and a profit of ¥7.9 billion. Notably, SHIFT is outpacing industry growth norms with projected annual revenue and earnings increases of 17.2% and 30.9%, respectively, significantly above Japan's average tech sector growth rates. This robust performance highlights SHIFT's effective adaptation to evolving market demands while maintaining a strong innovation pipeline through focused R&D investments.

- Click here and access our complete health analysis report to understand the dynamics of SHIFT.

Evaluate SHIFT's historical performance by accessing our past performance report.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

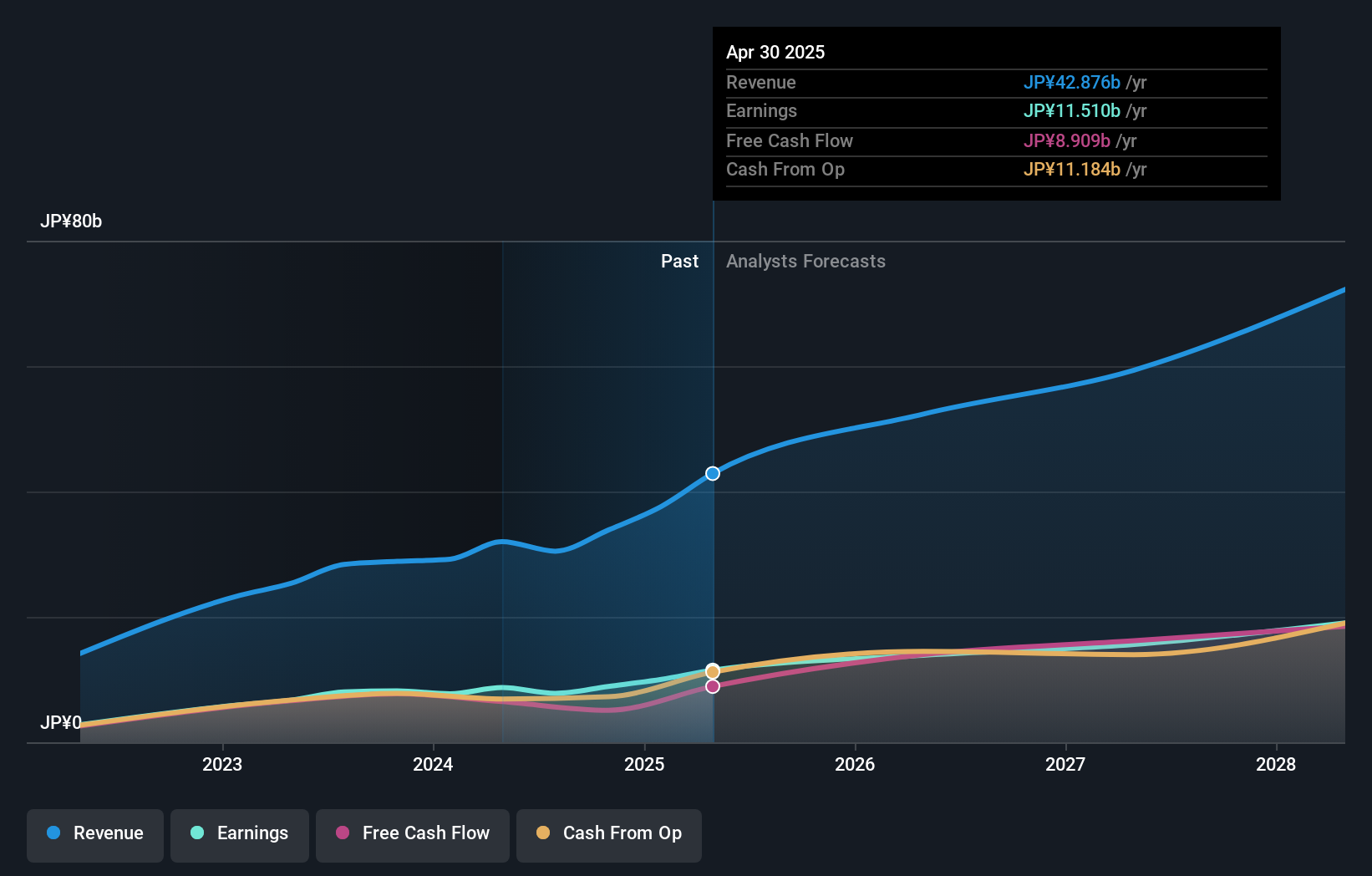

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, and it has a market cap of ¥207.50 billion.

Operations: ANYCOLOR Inc. generates revenue primarily through its entertainment operations in Japan and abroad. The company focuses on creating and distributing digital content, leveraging its brand to engage a global audience.

ANYCOLOR is navigating the competitive tech landscape in Asia with notable agility. With a projected annual revenue growth of 14.5% and earnings expected to increase by 14.1% per year, the company is outpacing the Japanese market averages of 4.3% and 7.8%, respectively. This robust growth trajectory is supported by strategic R&D investments, which have fueled innovations crucial for staying relevant in evolving markets. Despite a highly volatile share price recently, ANYCOLOR's strong financial performance and aggressive market positioning underscore its potential to continue thriving amidst industry challenges.

- Click here to discover the nuances of ANYCOLOR with our detailed analytical health report.

Gain insights into ANYCOLOR's historical performance by reviewing our past performance report.

Where To Now?

- Click here to access our complete index of 493 Asian High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3697

SHIFT

Provides software quality assurance and testing solutions in Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion