- China

- /

- Basic Materials

- /

- SHSE:600449

3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 46.1%

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, including interest rate decisions and trade agreements, Asian stock markets are experiencing varied reactions. Amid these fluctuations, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| T'Way Air (KOSE:A091810) | ₩1711.00 | ₩3398.49 | 49.7% |

| Takara Bio (TSE:4974) | ¥914.00 | ¥1815.23 | 49.6% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.196 | NZ$0.39 | 49.2% |

| Meitu (SEHK:1357) | HK$8.68 | HK$17.27 | 49.8% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.06 | CN¥20.02 | 49.7% |

| EverProX Technologies (SZSE:300548) | CN¥93.50 | CN¥185.29 | 49.5% |

| Daiichi Sankyo Company (TSE:4568) | ¥3369.00 | ¥6631.69 | 49.2% |

| COVER (TSE:5253) | ¥1838.00 | ¥3673.18 | 50% |

| Chongqing Baiya Sanitary Products (SZSE:003006) | CN¥22.18 | CN¥43.54 | 49.1% |

| Alibaba Health Information Technology (SEHK:241) | HK$5.68 | HK$11.29 | 49.7% |

Let's uncover some gems from our specialized screener.

Ningxia Building Materials GroupLtd (SHSE:600449)

Overview: Ningxia Building Materials Group Co., Ltd operates in China, manufacturing and selling cement, cement clinkers, concrete, and aggregates with a market capitalization of approximately CN¥6.65 billion.

Operations: The company generates revenue through the production and sale of cement, cement clinkers, concrete, and aggregates in China.

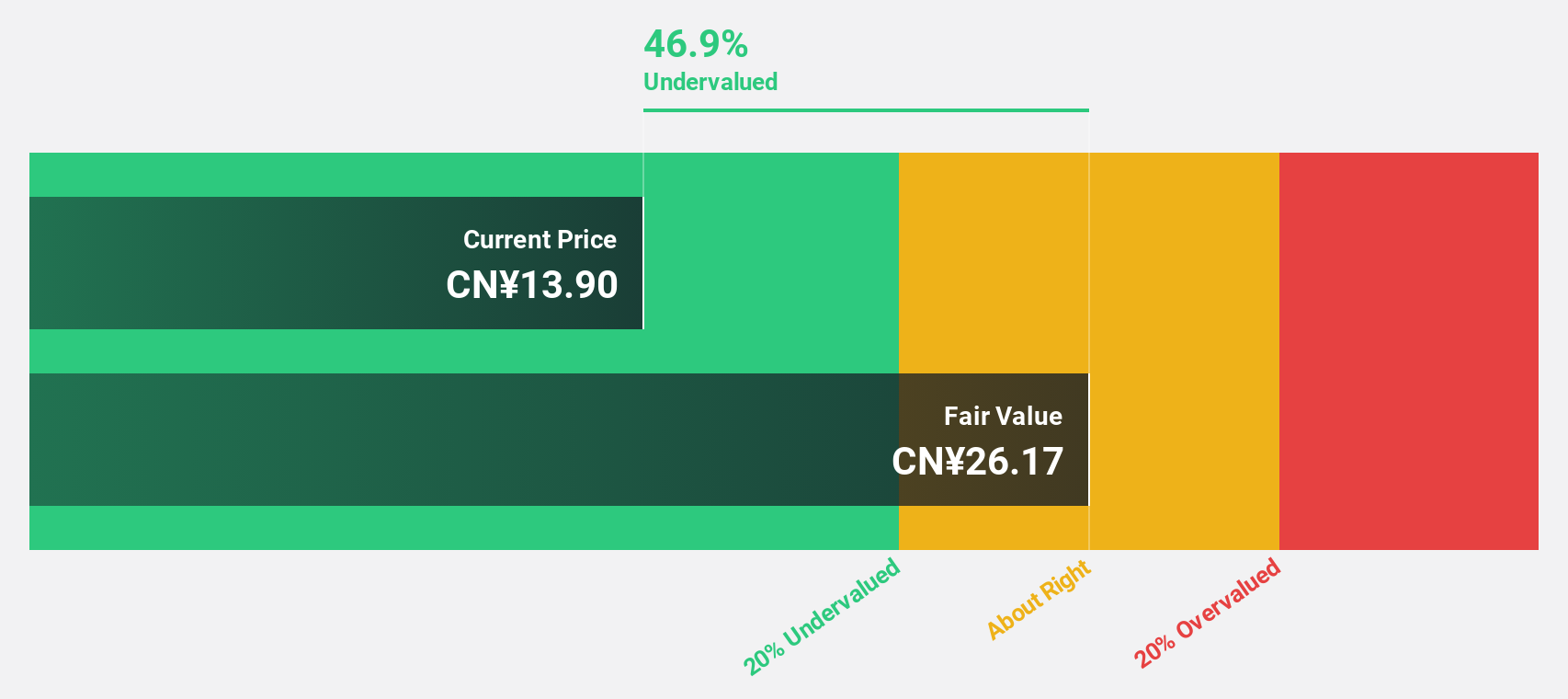

Estimated Discount To Fair Value: 46.1%

Ningxia Building Materials Group Ltd. appears undervalued, trading 46.1% below its estimated fair value of CNY 25.83 per share, with a current price of CNY 13.91. Despite a decline in sales to CNY 4 billion for the first nine months of 2025, net income rose to CNY 221 million from the previous year’s CNY 171 million. Earnings are expected to grow significantly over the next three years, although return on equity is forecasted to remain low at around 6%.

- In light of our recent growth report, it seems possible that Ningxia Building Materials GroupLtd's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Ningxia Building Materials GroupLtd stock in this financial health report.

Venustech Group (SZSE:002439)

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥18.75 billion.

Operations: The company's revenue segments include Information Network Security, contributing CN¥2.51 billion.

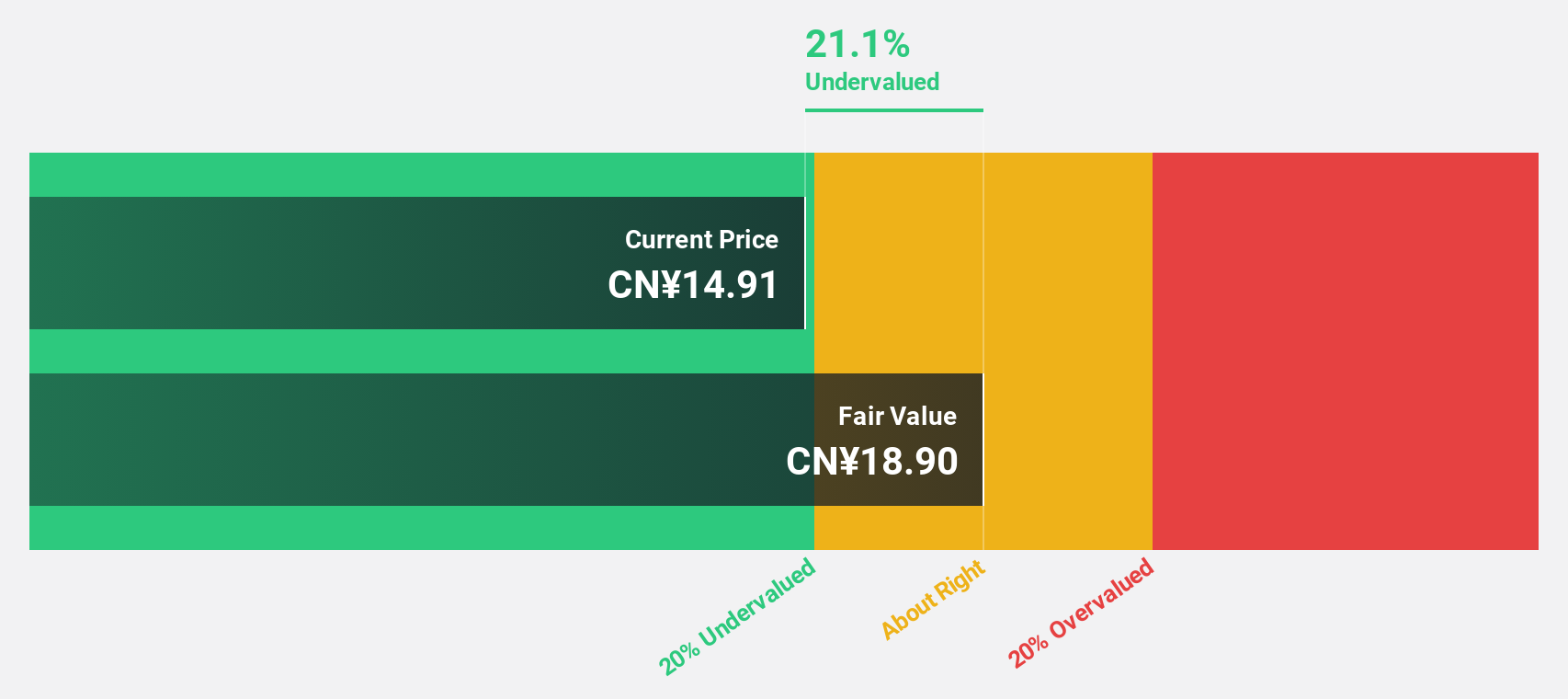

Estimated Discount To Fair Value: 12.3%

Venustech Group is trading at CN¥15.48, slightly below its fair value of CN¥17.64, indicating potential undervaluation based on cash flows. Despite a net loss of CN¥215.76 million for the first nine months of 2025 and declining sales from CN¥2.33 billion to CN¥1.55 billion year-over-year, earnings are forecast to grow significantly over the next three years, outpacing average market growth while maintaining good relative value compared to peers and industry standards.

- Our expertly prepared growth report on Venustech Group implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Venustech Group's balance sheet by reading our health report here.

SHIFT (TSE:3697)

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥281.06 billion.

Operations: The company generates revenue primarily from Software Testing Related Services at ¥84.30 billion and Software Development Related Services at ¥40.13 billion.

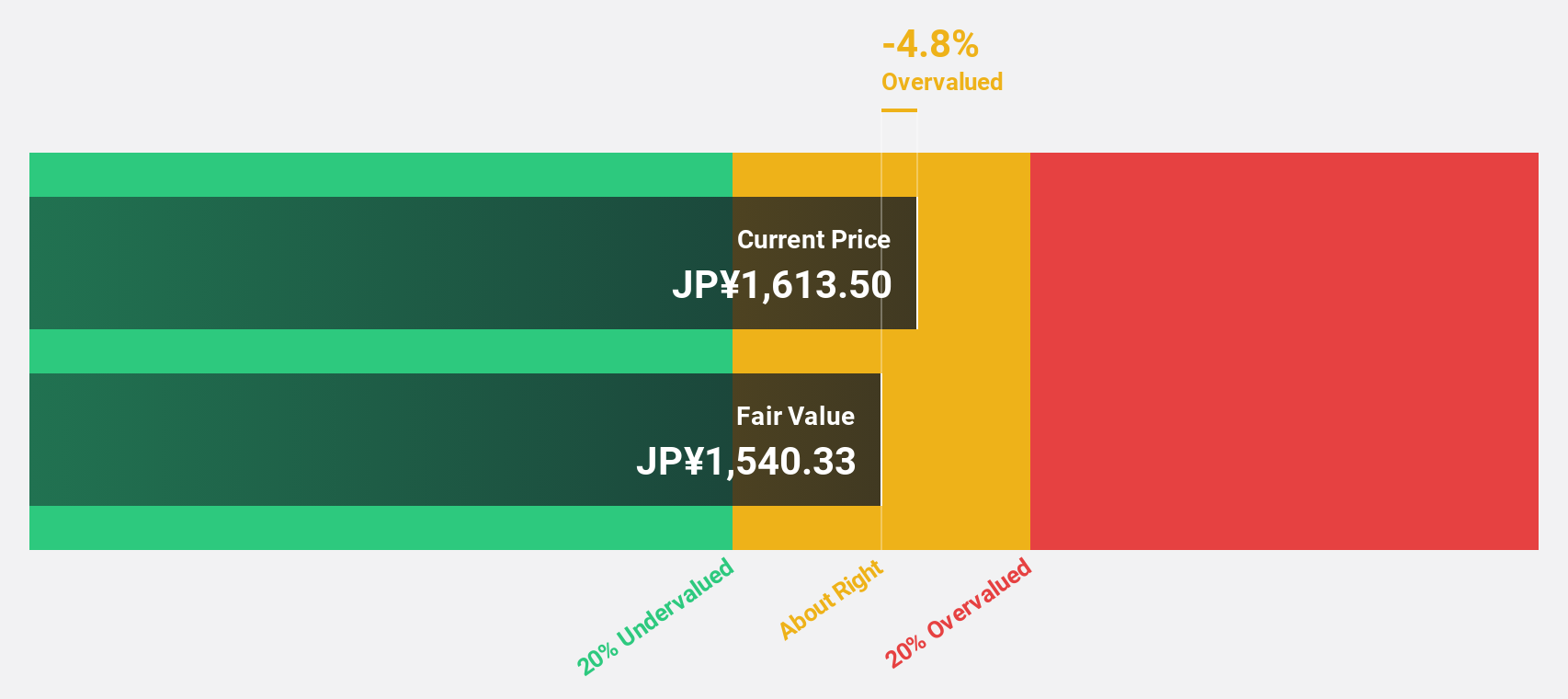

Estimated Discount To Fair Value: 20%

SHIFT Inc. is trading at ¥1067.5, below its fair value of ¥1333.74, reflecting potential undervaluation based on cash flows. Earnings grew by 74.3% last year and are forecasted to grow significantly at 22.2% annually, outpacing the Japanese market average growth rate of 7.8%. Despite recent volatility in share price and restructuring efforts to enhance synergies within its subsidiaries, SHIFT's robust revenue projections and strategic expansions position it for continued financial improvement.

- Upon reviewing our latest growth report, SHIFT's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of SHIFT.

Seize The Opportunity

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 272 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Building Materials GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600449

Ningxia Building Materials GroupLtd

Manufactures and sells cement, cement clinkers, concrete, and aggregates in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives