As global markets react to potential rate cuts signaled by the Federal Reserve, Asian tech stocks are capturing attention amid a backdrop of cautious optimism and strategic investment shifts. In this dynamic environment, identifying promising high-growth tech stocks involves assessing their adaptability to evolving market conditions and their capacity for innovation within the burgeoning technological landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Fositek | 33.77% | 43.92% | ★★★★★★ |

| Eoptolink Technology | 29.67% | 32.15% | ★★★★★★ |

| Foxconn Industrial Internet | 27.61% | 27.23% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 53.33% | 71.63% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

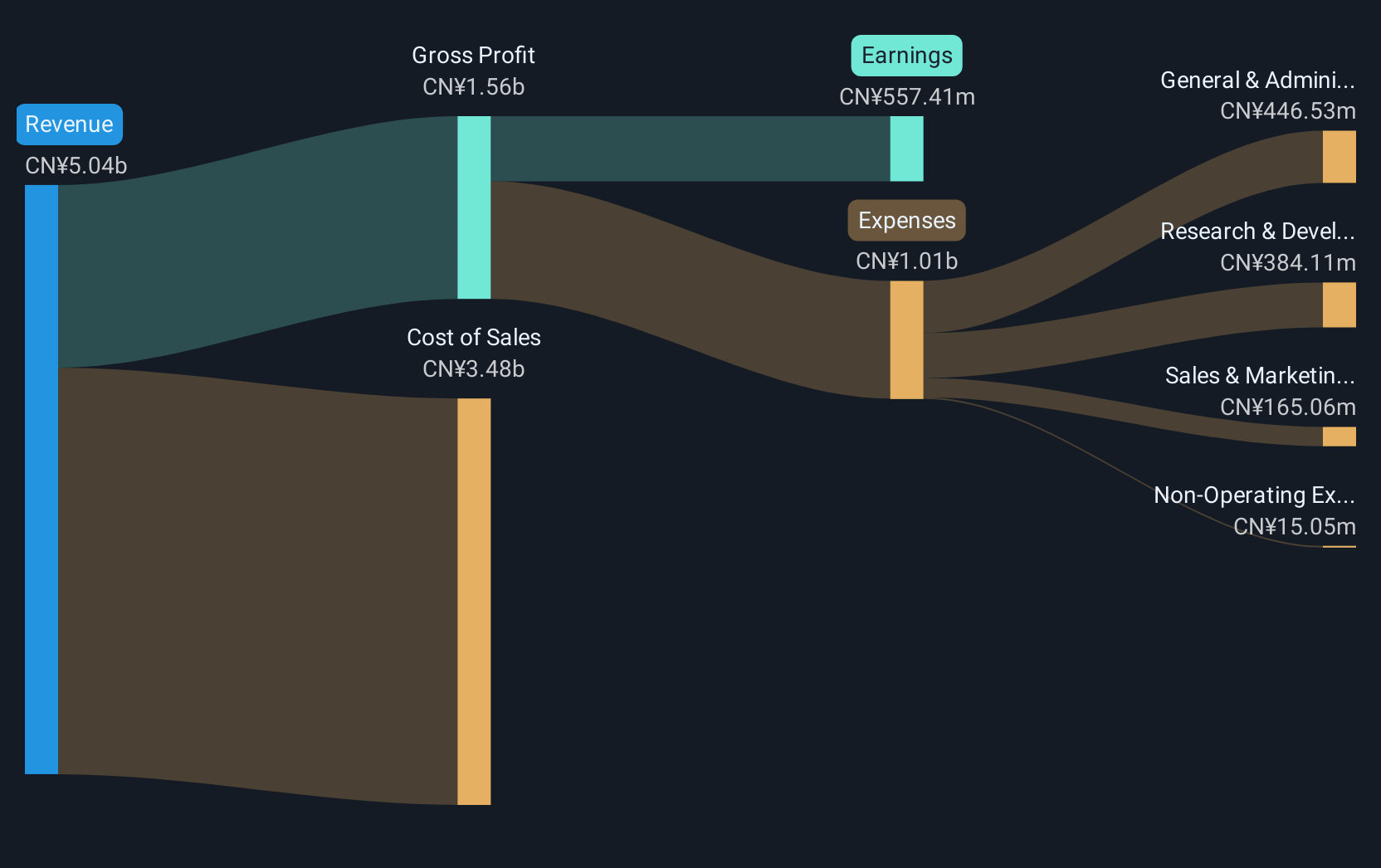

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system products globally, with a market cap of CN¥21.64 billion.

Operations: The company focuses on producing micro electronic connectors and interconnection system products, serving markets in China, North America, Europe, Japan, and the Asia Pacific.

Electric Connector Technology has demonstrated robust financial performance, with a notable increase in sales and revenue, rising to CNY 2,524.05 million this year from CNY 2,144.22 million the previous year. Despite a dip in net income and earnings per share—CNY 242.66 million and CNY 0.57 respectively compared to last year's CNY 307.57 million and CNY 0.73—the company is poised for significant growth with expected annual revenue and earnings growth outpacing the Chinese market at rates of 22.8% and 30.4% respectively. Recent corporate governance enhancements further align with its strategic initiatives to bolster future prospects amidst a competitive electronic sector landscape.

- Get an in-depth perspective on Electric Connector Technology's performance by reading our health report here.

Gain insights into Electric Connector Technology's past trends and performance with our Past report.

CareNet (TSE:2150)

Simply Wall St Growth Rating: ★★★★☆☆

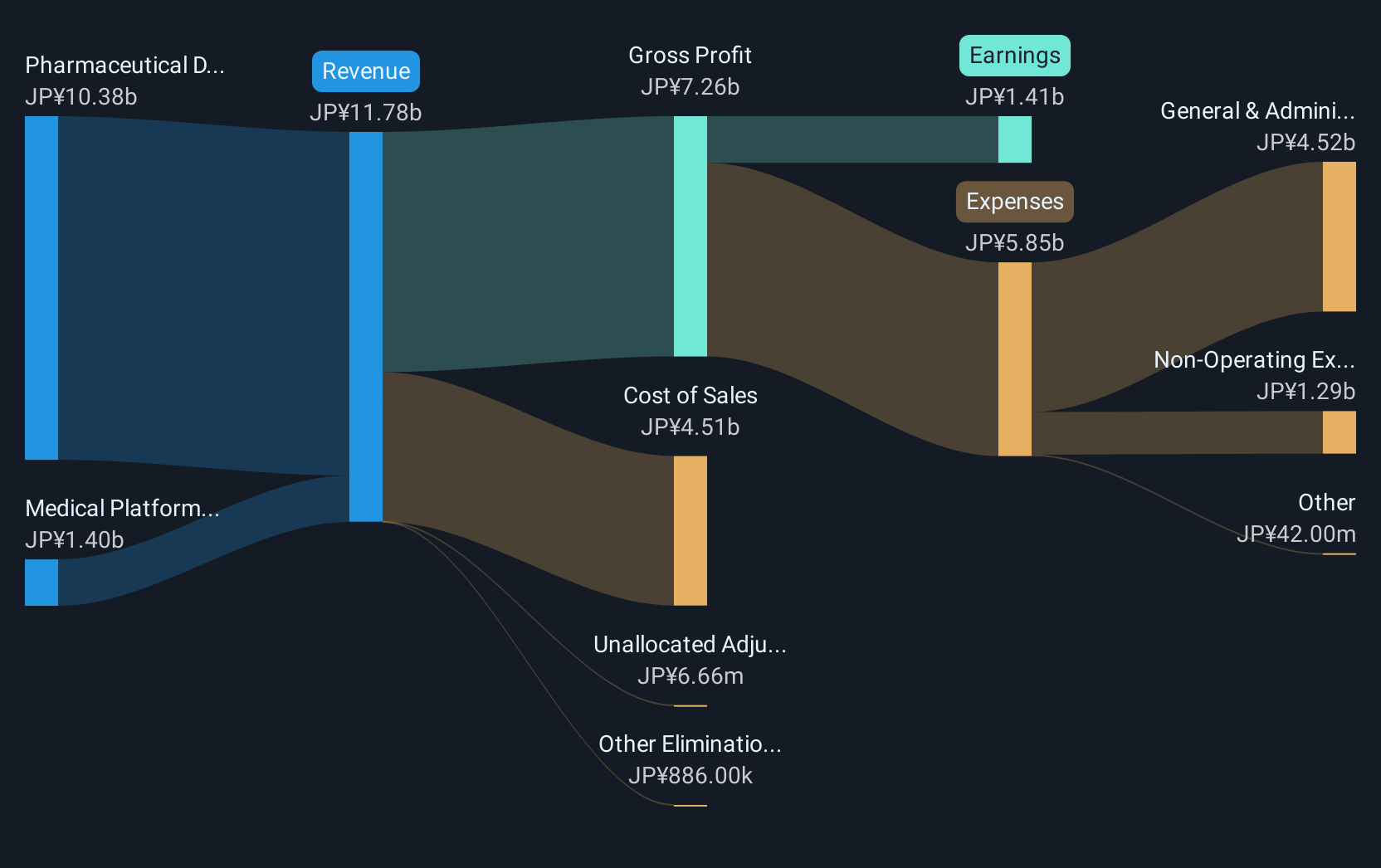

Overview: CareNet, Inc. operates in Japan through its pharmaceutical digital transformation and medical platform businesses, with a market cap of ¥46.67 billion.

Operations: CareNet, Inc. generates revenue primarily from its Pharmaceutical DX Business, accounting for approximately ¥10.38 billion, and its Medical Platform Business, contributing about ¥1.40 billion.

CareNet, a key entity in Asia's tech sector, reported a revenue growth of 11.4% annually, underpinned by robust demand for its healthcare solutions. Its earnings are also on an upward trajectory with a forecasted annual increase of 21.4%. Notably, the firm invested ¥347.61 million in share repurchases from July to August 2025, enhancing shareholder value and reflecting confidence in its financial health. This strategic financial maneuver accompanies news of a potential acquisition by BPEA EQT Mid-Market Growth Partnership for ¥48 billion, signaling strong future prospects and market confidence in CareNet’s innovative offerings and leadership within the healthcare technology space.

- Take a closer look at CareNet's potential here in our health report.

Gain insights into CareNet's historical performance by reviewing our past performance report.

m-up holdings (TSE:3661)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: m-up holdings, Inc. is involved in the development and distribution of mobile and PC content as well as e-commerce businesses in Japan, with a market cap of ¥87.11 billion.

Operations: The company focuses on developing and distributing mobile and PC content alongside its e-commerce operations in Japan. With a market cap of ¥87.11 billion, it leverages these segments to drive its business activities.

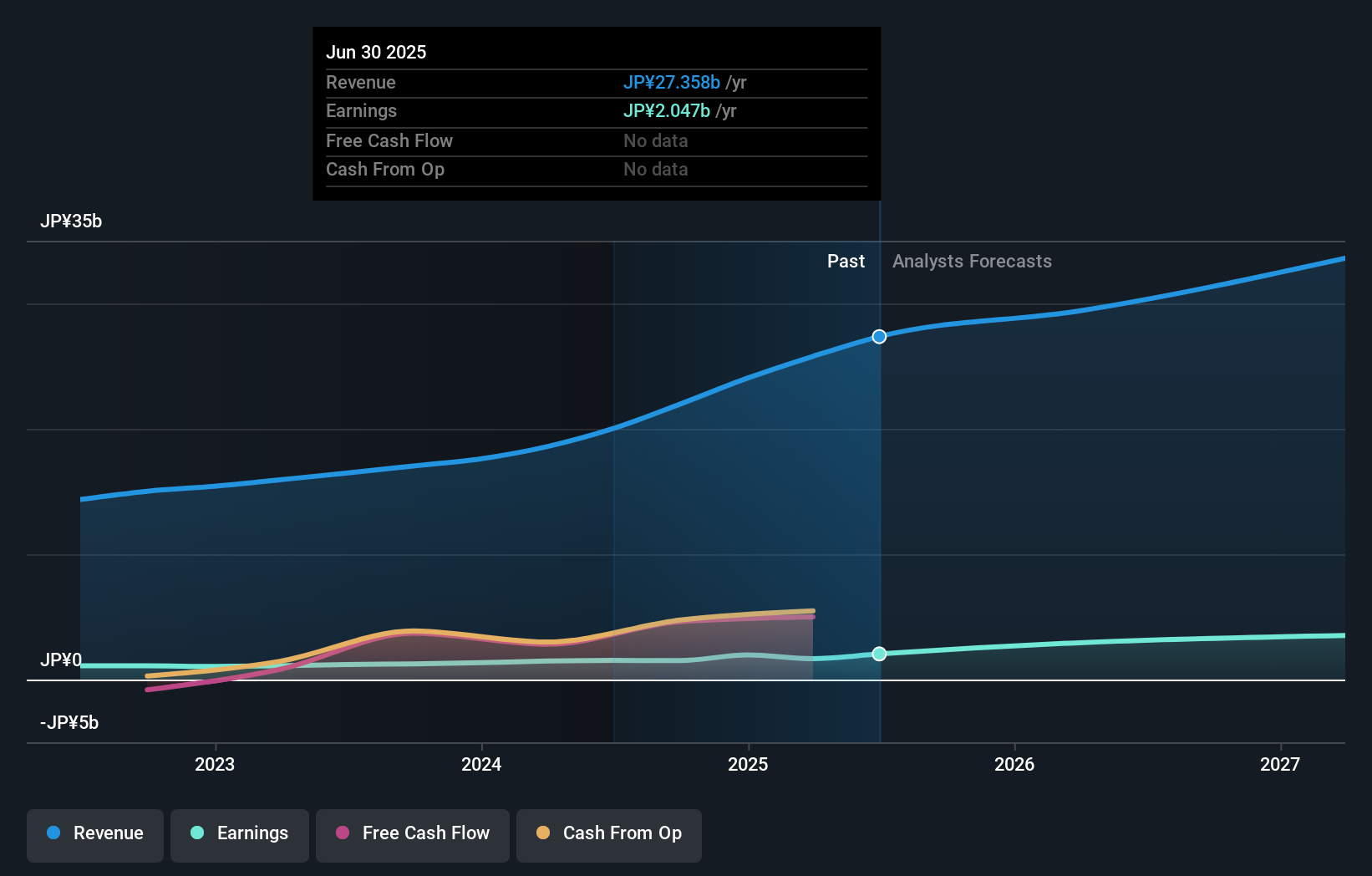

M-up Holdings, demonstrating robust growth in a competitive tech landscape, has recently committed to enhancing shareholder value through a strategic share repurchase program. From August 19 to 21, 2025, the company bought back shares worth ¥299.79 million, signaling strong confidence in its financial health and future prospects. This move complements its impressive earnings growth of 29% annually and revenue acceleration at 12% per year, outpacing the Japanese market average of 4.3%. With earnings having surged by 34.1% over the past year—significantly ahead of the industry's 14.9%—m-up Holdings is positioning itself as a dynamic player in Asia's tech sector, adeptly navigating market demands and capital management strategies to foster substantial growth trajectories.

Seize The Opportunity

- Embark on your investment journey to our 178 Asian High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3661

m-up holdings

Engages in the development and distribution of mobile and PC content, and e-commerce businesses in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives