We Think That There Are Issues Underlying Morpho's (TSE:3653) Earnings

Despite announcing strong earnings, Morpho, Inc.'s (TSE:3653) stock was sluggish. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

Check out our latest analysis for Morpho

Examining Cashflow Against Morpho's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

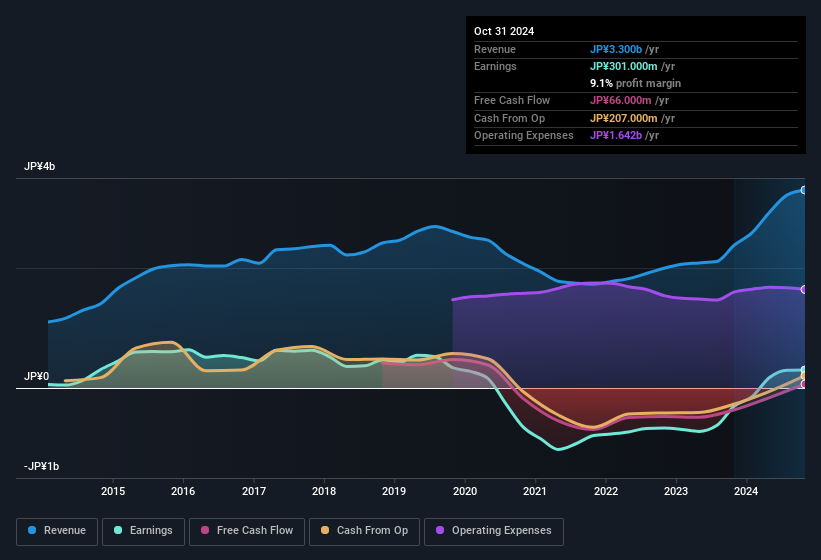

For the year to October 2024, Morpho had an accrual ratio of 0.41. Ergo, its free cash flow is significantly weaker than its profit. As a general rule, that bodes poorly for future profitability. Indeed, in the last twelve months it reported free cash flow of JP¥66m, which is significantly less than its profit of JP¥301.0m. Given that Morpho had negative free cash flow in the prior corresponding period, the trailing twelve month resul of JP¥66m would seem to be a step in the right direction.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Morpho.

Our Take On Morpho's Profit Performance

As we discussed above, we think Morpho's earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that Morpho's underlying earnings power is lower than its statutory profit. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Our analysis shows 3 warning signs for Morpho (1 is a bit unpleasant!) and we strongly recommend you look at these before investing.

Today we've zoomed in on a single data point to better understand the nature of Morpho's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3653

Morpho

Engages in the research and development of artificial intelligence (AI) and image processing technologies in Japan, the United States, China, South Korea, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion