Even With A 38% Surge, Cautious Investors Are Not Rewarding Techfirm Holdings Inc.'s (TSE:3625) Performance Completely

Techfirm Holdings Inc. (TSE:3625) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

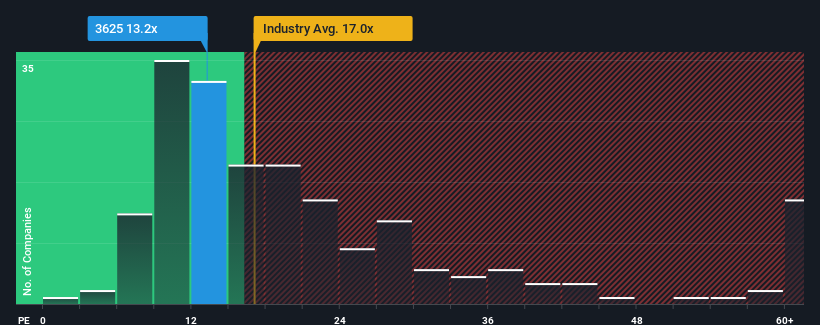

Although its price has surged higher, you could still be forgiven for feeling indifferent about Techfirm Holdings' P/E ratio of 13.2x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Techfirm Holdings certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Techfirm Holdings

How Is Techfirm Holdings' Growth Trending?

Techfirm Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 417% gain to the company's bottom line. The latest three year period has also seen an excellent 578% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 9.3% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's curious that Techfirm Holdings' P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Techfirm Holdings' P/E

Its shares have lifted substantially and now Techfirm Holdings' P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Techfirm Holdings revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Techfirm Holdings (1 is significant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Techfirm Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3625

Techfirm Holdings

Develops, operates, and maintains system solutions for business support activities.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026