Forside Co.,Ltd. (TSE:2330) Stock Rockets 38% As Investors Are Less Pessimistic Than Expected

Forside Co.,Ltd. (TSE:2330) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. The last month tops off a massive increase of 203% in the last year.

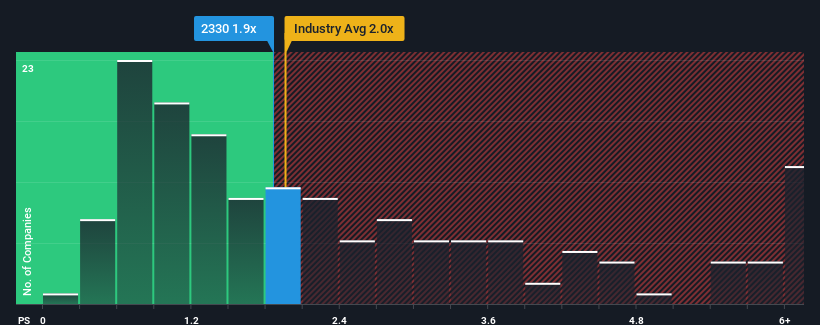

Although its price has surged higher, it's still not a stretch to say that ForsideLtd's price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Software industry in Japan, where the median P/S ratio is around 2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for ForsideLtd

How Has ForsideLtd Performed Recently?

It looks like revenue growth has deserted ForsideLtd recently, which is not something to boast about. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ForsideLtd's earnings, revenue and cash flow.How Is ForsideLtd's Revenue Growth Trending?

ForsideLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that ForsideLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

ForsideLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of ForsideLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you take the next step, you should know about the 4 warning signs for ForsideLtd (1 is a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on ForsideLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2330

ForsideLtd

An investment holding company, engages in prize, real estate, content, event, and master rights businesses in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives