NS Solutions (TSE:2327): Evaluating Valuation Following Exclusive Digital Twin Partnership with Basetwo

Reviewed by Simply Wall St

NS Solutions (TSE:2327) has just partnered with Basetwo, taking on the exclusive role of distributing Basetwo’s digital twin platform across Japan. This move opens the door for NS Solutions to broaden its presence in the digital transformation space for manufacturing clients.

See our latest analysis for NS Solutions.

With news of the Basetwo partnership making headlines, NS Solutions has seen a fresh wave of interest, particularly as its 1-month share price return stands at a strong 7.9%. Even though its total shareholder return over the past year is still down 11%, the impressive 129% return over three years reminds investors why the stock is on so many radar screens. While recent momentum appears to be building, today’s share price of ¥3,743 may reflect shifting optimism around the company’s digital transformation strategy.

If this surge in digital transformation has you thinking broader, now might be the ideal moment to discover fast growing stocks with high insider ownership

With strong recent gains and new partnerships fueling investor sentiment, the question now is whether NS Solutions’ stock still offers value, or if the current price has already accounted for its digital transformation potential.

Price-to-Earnings of 25.5x: Is it justified?

NS Solutions currently trades at a price-to-earnings (P/E) ratio of 25.5x, slightly above its estimated fair P/E ratio of 26.1x and notably higher than many industry peers. The last close price of ¥3,743 reflects this premium, prompting the question of whether the higher multiple is warranted in today's market.

The price-to-earnings ratio measures how much investors are willing to pay for every ¥1 of earnings, offering insight into market expectations for future profitability and growth. For a technology-driven company like NS Solutions, a higher P/E can suggest optimism about earnings potential and sector positioning.

However, compared to its peer average P/E of 22.3x and the broader JP IT industry average of 17.2x, NS Solutions' premium is hard to ignore. Although its fair P/E ratio of 26.1x suggests the market is somewhat in line with projections, the current price reflects a level of confidence that could shift if growth underdelivers.

Explore the SWS fair ratio for NS Solutions

Result: Price-to-Earnings of 25.5x (ABOUT RIGHT)

However, an earnings miss or a loss of momentum in digital adoption could quickly dampen recent optimism surrounding NS Solutions' growth story.

Find out about the key risks to this NS Solutions narrative.

Another View: What About the DCF?

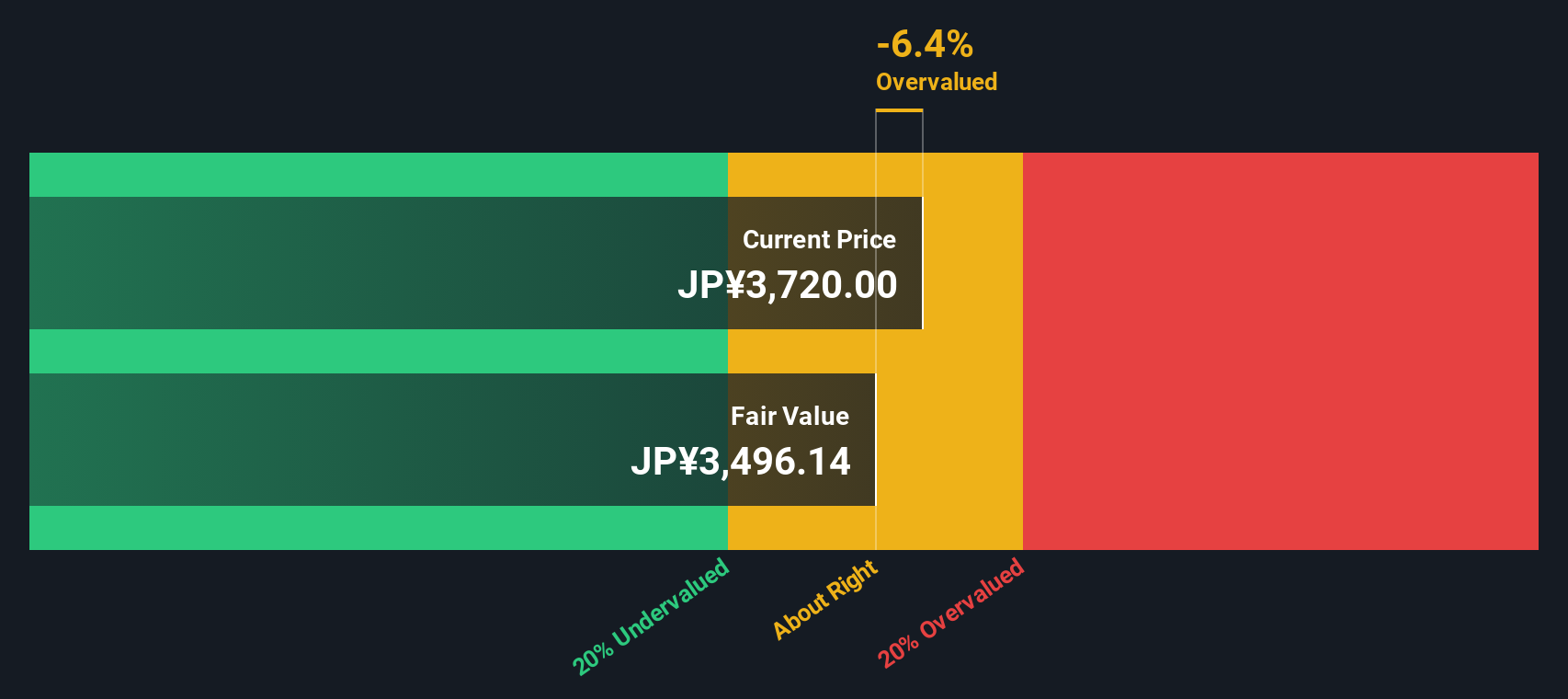

While the price-to-earnings ratio suggests NS Solutions' shares are fairly valued, our DCF model tells a different story. According to this approach, the current stock price of ¥3,743 is above our DCF estimate of fair value at ¥3,642. In plain terms, the market is pricing in optimism that may not be fully supported by projected cash flows. Could this indicate a potential downside risk if expectations shift?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NS Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NS Solutions Narrative

If you’re looking to dig into the numbers yourself or shape your own perspective, you can build a custom narrative in just a few minutes. Do it your way

A great starting point for your NS Solutions research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop scouting fresh opportunities. Relying on old favorites can mean missing out on tomorrow's winners. Use these hand-picked ideas to level up your portfolio:

- Capture game-changing returns by targeting these 879 undervalued stocks based on cash flows that score highly on cash flow and financial fundamentals.

- Strengthen your income strategy by reviewing these 16 dividend stocks with yields > 3% offering attractive yields above 3% for stable, long-term growth.

- Seize the future of healthcare by searching these 31 healthcare AI stocks leading advancements in medical artificial intelligence and biotech innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NS Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2327

NS Solutions

Provides information technology solutions in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives