As global markets reach new heights, buoyed by favorable trade deals and a surge in business activity driven by the services sector, investors are keenly observing the small-cap landscape for potential opportunities. In this vibrant environment, identifying stocks with strong fundamentals and growth potential becomes essential, as these undiscovered gems may offer unique advantages amid the broader economic momentum.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| DINE. de | 78.90% | 35.52% | -13.75% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jinzi HamLtd (SZSE:002515)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinzi Ham Co., Ltd. is involved in the research, development, production, and sale of fermented meat products both in China and internationally, with a market capitalization of CN¥7.95 billion.

Operations: Jinzi Ham derives its revenue primarily from the production and sale of fermented meat products. The company's net profit margin is a key financial metric to watch, as it reflects its profitability after accounting for all expenses.

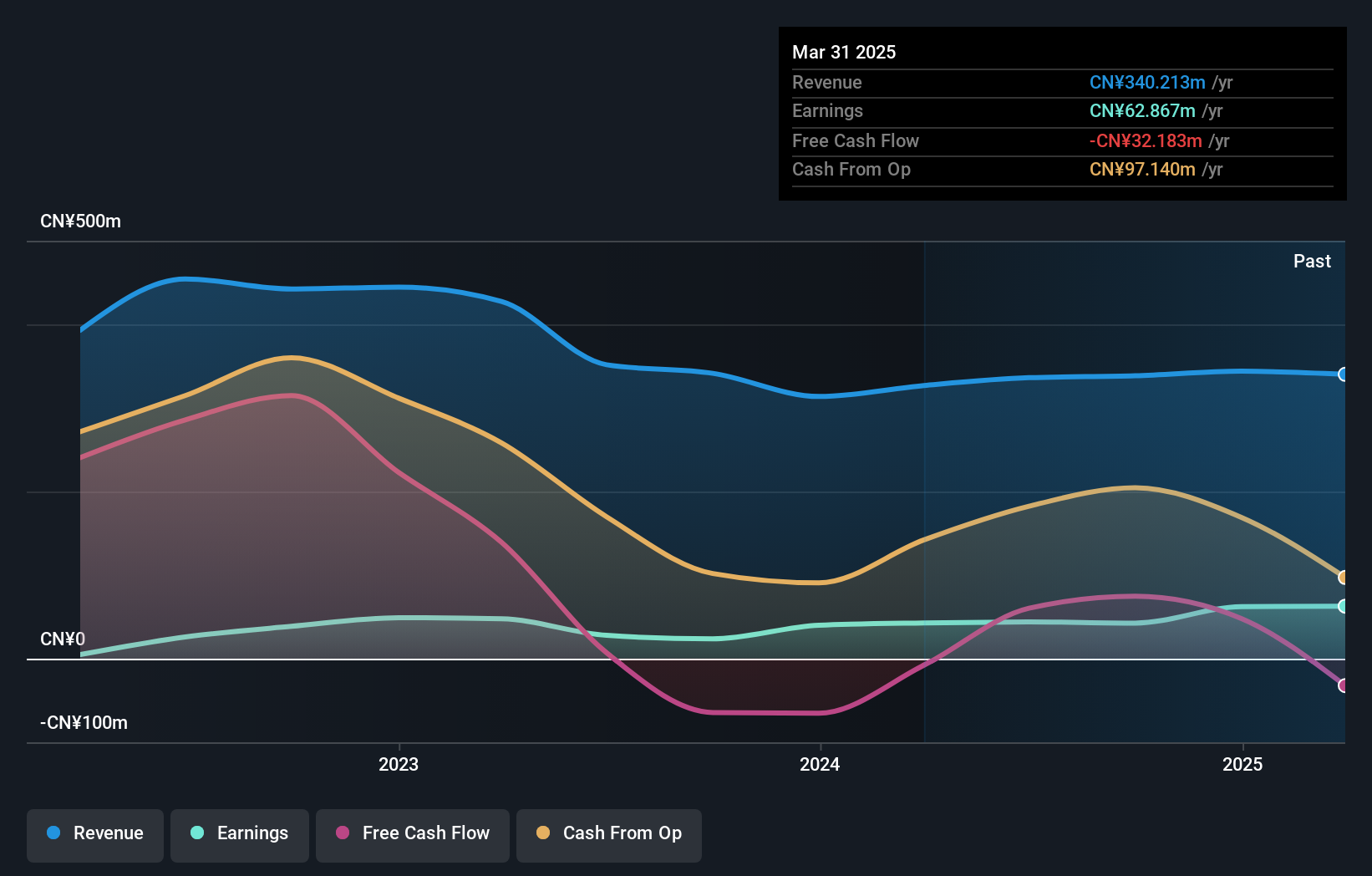

Jinzi Ham Ltd. stands out with its recent earnings growth of 46.7%, significantly outperforming the food industry's -4.7% performance over the past year, highlighting its potential in a competitive market. Despite a 5% annual decline in earnings over the last five years, Jinzi Ham's debt-free status and high-quality earnings provide stability and resilience. The recent acquisition by Zheng Qingsheng, acquiring an 11.98% stake for CNY 870 million (US$), underscores investor confidence in this company’s prospects. However, free cash flow remains negative, suggesting room for improvement in financial management strategies moving forward.

- Click here to discover the nuances of Jinzi HamLtd with our detailed analytical health report.

Gain insights into Jinzi HamLtd's past trends and performance with our Past report.

Shenzhen Microgate Technology (SZSE:300319)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Microgate Technology Co., Ltd. specializes in providing passive electronic components and has a market cap of approximately CN¥10.07 billion.

Operations: The company generates revenue primarily from the Electronics Manufacturing Industry, amounting to CN¥3.24 billion.

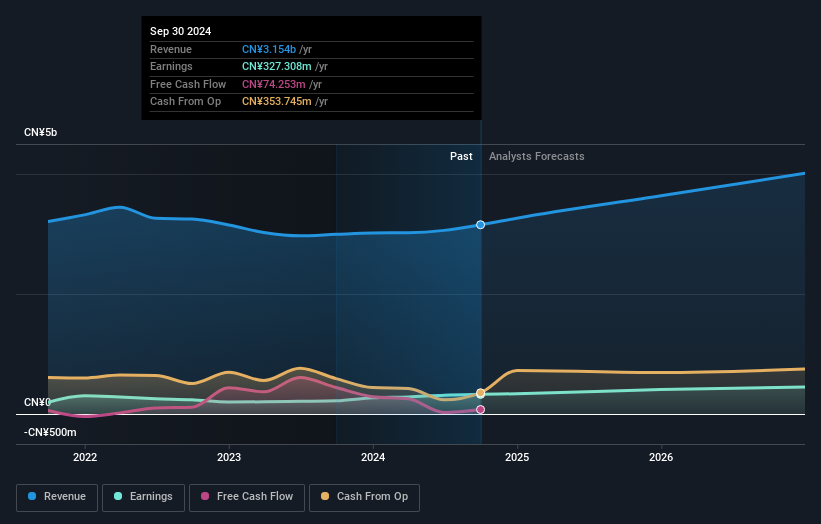

Shenzhen Microgate Technology, a nimble player in the electronics sector, shows promising potential with its earnings growth of 17% over the past year, outpacing the industry's 2.8%. The company boasts high-quality earnings and maintains a price-to-earnings ratio of 31.6x, which is favorable compared to the CN market's average of 41.7x. With more cash than total debt and free cash flow consistently positive, financial stability seems assured. Furthermore, its debt-to-equity ratio has impressively decreased from 27.4% to just 5.1% over five years, indicating prudent financial management and positioning it well for future growth prospects in an evolving market landscape.

Systena (TSE:2317)

Simply Wall St Value Rating: ★★★★★★

Overview: Systena Corporation operates in Japan, providing services in solution and framework design, IT service, business solutions, and cloud businesses with a market capitalization of approximately ¥144.05 billion.

Operations: Systena's primary revenue streams include the Business Solution Business, generating ¥29.73 billion, and the IT & DX Service Business, contributing ¥19.75 billion. The company's net profit margin displays a noteworthy trend at 10%, reflecting its operational efficiency across diverse segments.

Systena, a small player in the tech scene, has shown robust financial health with its debt to equity ratio dropping from 6.8% to 4.7% over five years. The company is trading at a value 6.4% below its estimated fair price, indicating potential upside for investors. Earnings surged by 17%, outpacing the software industry average of 11%. Recent leadership changes include Seiichiro Nishikawa's appointment as Director and Yoichi Narikawa's role expansion, which might drive strategic growth in digital and mobility sectors. With free cash flow positive and a solid profit margin outlook, Systena seems well-positioned for continued performance improvement.

Key Takeaways

- Navigate through the entire inventory of 3140 Global Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002515

Jinzi HamLtd

Engages in the research and development, production, and sale of fermented meat products in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives