- China

- /

- Electronic Equipment and Components

- /

- SHSE:688627

Shenzhen SEICHI Technologies And 2 Other High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As global markets experience fluctuations driven by trade deals and economic indicators, Asian tech stocks have been capturing attention with their potential for high growth amidst these dynamic conditions. In this environment, identifying promising stocks like Shenzhen SEICHI Technologies involves looking for companies that demonstrate resilience and innovation in the face of shifting trade policies and evolving market demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Ugreen Group | 20.48% | 26.28% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. focuses on the research, development, production, and sale of new display device testing equipment in China, with a market capitalization of CN¥8.40 billion.

Operations: SEICHI Technologies specializes in the development and sale of testing equipment for new display devices, primarily serving the Chinese market. The company generates revenue through its product offerings in this niche sector.

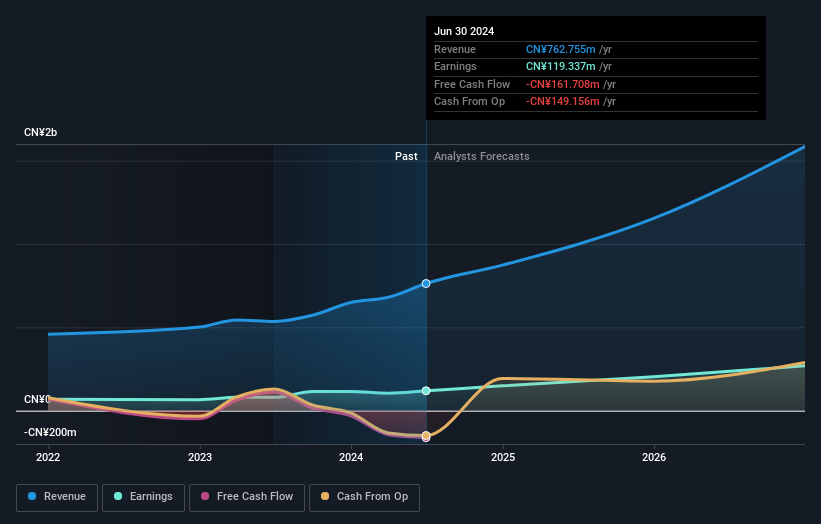

Shenzhen SEICHI Technologies, despite a challenging year with earnings shrinking by 25.1%, projects a robust rebound with expected annual earnings growth at an impressive 48.3%. This optimism is underpinned by their significant R&D commitment, which saw expenditures rise to CN¥19.9M, reflecting the company's focus on innovation in a competitive tech landscape. However, it's crucial to note that their profit margins dipped from last year’s 15.4% to 9%, influenced partly by substantial one-off items which skewed recent financial results. Looking forward, the firm is poised for substantial revenue growth at 30.1% annually, outpacing the broader Chinese market forecast of 12.5%. This suggests potential for market share gains and enhanced competitive positioning in Asia's high-growth tech sector.

- Take a closer look at Shenzhen SEICHI Technologies' potential here in our health report.

Learn about Shenzhen SEICHI Technologies' historical performance.

Long Young Electronic (Kunshan) (SZSE:301389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Long Young Electronic (Kunshan) Co., Ltd. operates in the packaging and containers industry and has a market capitalization of approximately CN¥10.20 billion.

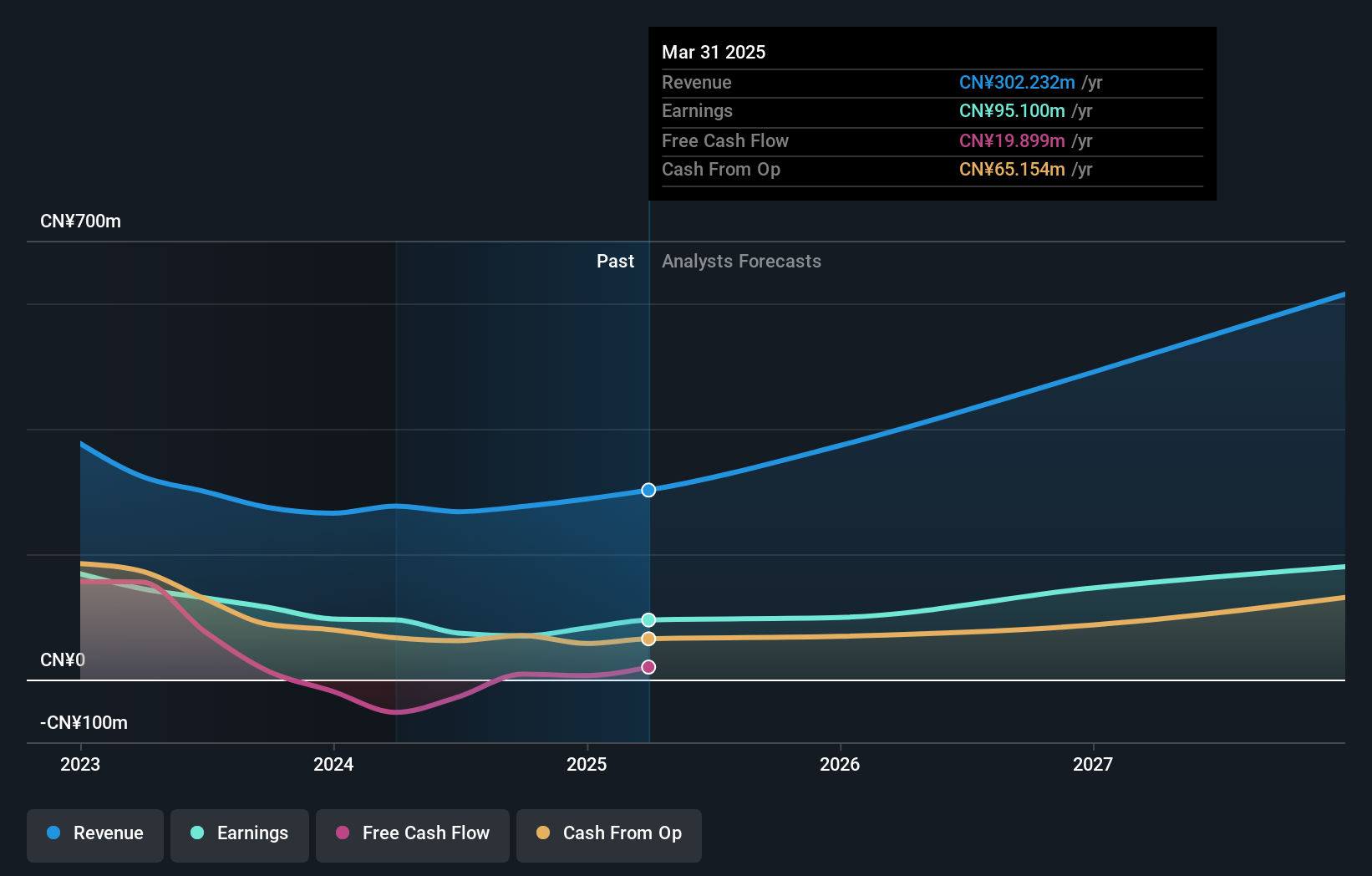

Operations: The company generates revenue primarily from its Packaging & Containers segment, amounting to approximately CN¥302.23 million.

Long Young Electronic (Kunshan) demonstrates a dynamic trajectory in Asia's tech landscape, with anticipated revenue and earnings growth rates of 25.7% and 25.4% per year, respectively, outstripping the broader market forecasts. This growth is supported by robust R&D investments which align with its strategic focus on advancing technological capabilities in electronic components—a sector critical for the region's tech evolution. Despite a volatile share price recently, these financial indicators combined with a positive free cash flow position suggest strong underlying fundamentals. The company’s significant engagement in high-stakes markets like electronic manufacturing services could further solidify its competitive stance, especially considering its role in supplying major industry players.

FRONTEO (TSE:2158)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FRONTEO, Inc. offers artificial intelligence solutions and services both in Japan and internationally, with a market capitalization of ¥39.36 billion.

Operations: The company generates revenue through two primary segments: AI Solution and Legal Tech AI, with the latter contributing more significantly at ¥3.49 billion compared to ¥2.61 billion for AI Solution.

FRONTEO stands out in Asia's tech sector, demonstrating a robust growth trajectory with a 13% annual revenue increase and an even more impressive 19.5% rise in earnings per year. This growth is underpinned by significant R&D investments, totaling ¥297 million last fiscal year, which not only fuel innovation but also enhance its competitive edge in AI and data analysis solutions. Despite recent market volatility impacting its share price, FRONTEO's strategic focus on leveraging advanced technologies for complex data challenges positions it well within the high-growth tech landscape of Asia. The company’s recent transition to profitability highlights its potential for sustainable growth amidst fierce industry competition.

- Dive into the specifics of FRONTEO here with our thorough health report.

Examine FRONTEO's past performance report to understand how it has performed in the past.

Make It Happen

- Click this link to deep-dive into the 168 companies within our Asian High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688627

Shenzhen SEICHI Technologies

Engages in the research and development, production, and sale of new display device testing equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives