Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Forside Co., Ltd. (TYO:2330) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Forside

What Is Forside's Debt?

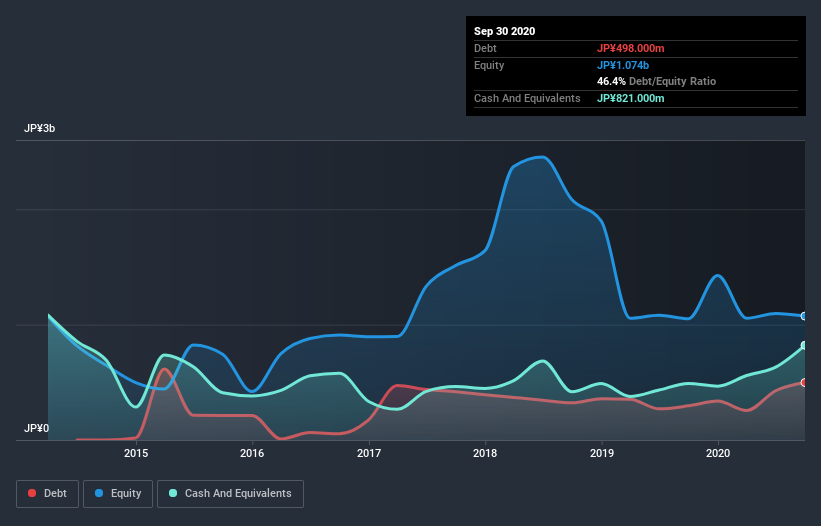

As you can see below, at the end of September 2020, Forside had JP¥498.0m of debt, up from JP¥296.0m a year ago. Click the image for more detail. However, its balance sheet shows it holds JP¥821.0m in cash, so it actually has JP¥323.0m net cash.

How Healthy Is Forside's Balance Sheet?

The latest balance sheet data shows that Forside had liabilities of JP¥2.12b due within a year, and liabilities of JP¥426.0m falling due after that. Offsetting this, it had JP¥821.0m in cash and JP¥1.11b in receivables that were due within 12 months. So it has liabilities totalling JP¥617.0m more than its cash and near-term receivables, combined.

Since publicly traded Forside shares are worth a total of JP¥4.13b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Forside also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Forside's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Forside had a loss before interest and tax, and actually shrunk its revenue by 4.8%, to JP¥3.9b. We would much prefer see growth.

So How Risky Is Forside?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Forside had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through JP¥190m of cash and made a loss of JP¥393m. But the saving grace is the JP¥323.0m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Forside (including 1 which is significant) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Forside, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:2330

ForsideLtd

An investment holding company, engages in prize, real estate, content, event, and master rights businesses in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives