- Japan

- /

- Semiconductors

- /

- TSE:7729

Tokyo Seimitsu (TSE:7729): Valuation in Focus After Earnings and Dividend Guidance Cut Despite Strong Sales

Reviewed by Simply Wall St

Tokyo Seimitsu (TSE:7729) shook up investors with a fresh revision to its full-year guidance, cutting net profit and earnings per share projections and announcing lower dividends for both interim and year-end periods. The move highlights how added costs tied to product countermeasures are affecting overall profitability. At the same time, sales forecasts have been raised due to unexpectedly strong orders in the SPE business.

See our latest analysis for Tokyo Seimitsu.

Tokyo Seimitsu’s recent guidance revision and dividend cut have grabbed investors’ attention, but the bigger picture shows powerful underlying momentum. Despite a slip in the past week, the stock’s 40.96% year-to-date share price gain and 36.95% total return over the last year reflect surging optimism from longer-term investors.

If you’re wondering what else is gaining traction lately, now is an ideal time to discover fast growing stocks with high insider ownership.

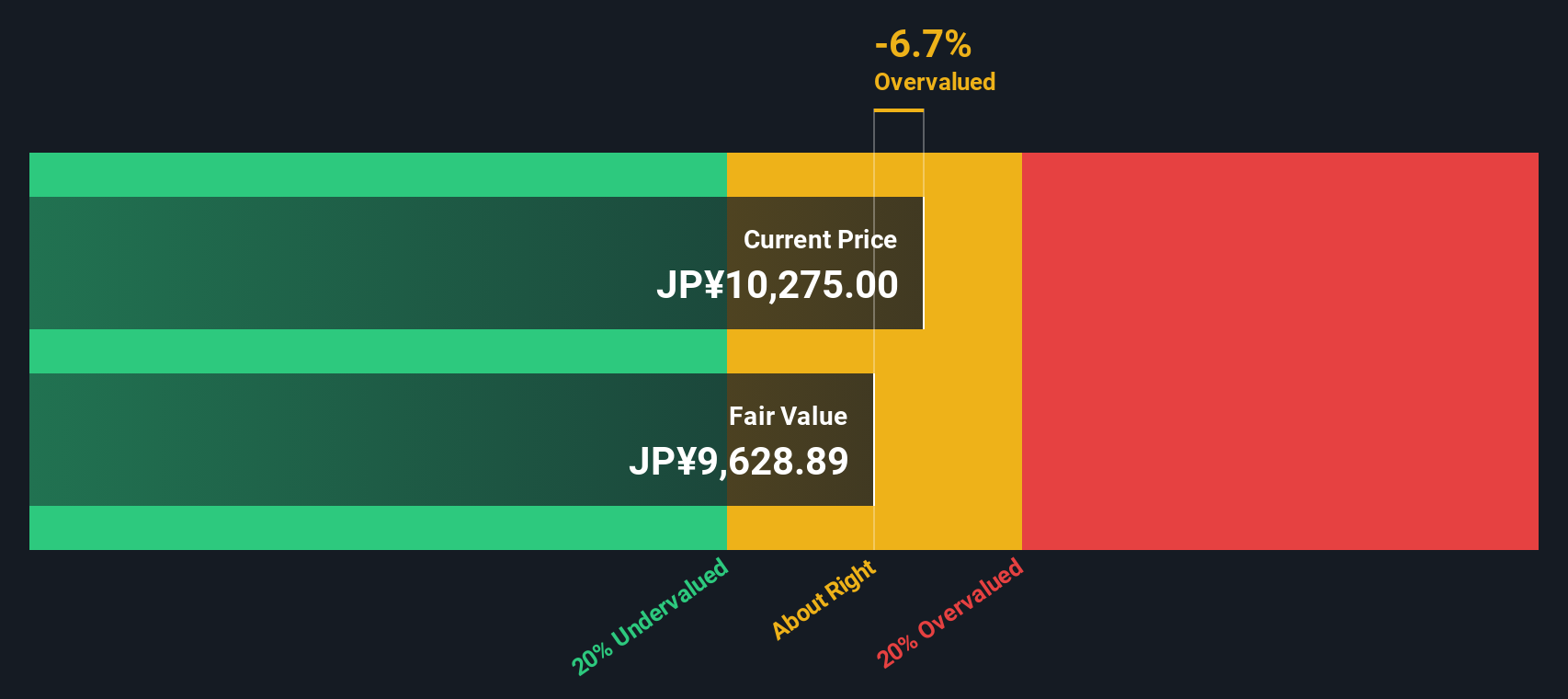

The sharp rebound in the share price raises a key question. With guidance now cut and dividends lower, is Tokyo Seimitsu undervalued at today’s levels, or has the market already priced in further growth ahead?

Price-to-Earnings of 19.4x: Is it justified?

Tokyo Seimitsu’s shares are trading with a price-to-earnings ratio of 19.4x, which is below the semiconductor industry average and peer group. This suggests that the current market price reflects a discount compared to rivals.

The price-to-earnings (P/E) ratio helps investors see how much they are paying for a company’s earnings. In capital-intensive industries like semiconductors, the P/E is a widely followed yardstick to gauge if the market is optimistic or cautious about future profits. A lower P/E may indicate undervaluation or simply lower growth expectations.

In this context, Tokyo Seimitsu’s P/E of 19.4x is not only below the sector average of 20.7x but also significantly below the peer group’s 62.4x. This means investors are paying less for each yen of this company’s earnings compared to peers, despite the company’s solid record of multi-year profit growth. Additionally, when measured against our fair price-to-earnings ratio estimate of 23.9x, the current multiple is at a level the market could eventually re-rate toward if confidence remains steady.

Explore the SWS fair ratio for Tokyo Seimitsu

Result: Price-to-Earnings of 19.4x (UNDERVALUED)

However, added costs from product countermeasures and lower-than-expected profit growth could make it challenging for a sustained valuation rebound in the future.

Find out about the key risks to this Tokyo Seimitsu narrative.

Another View: DCF Perspective Adds Complexity

While the price-to-earnings ratio paints Tokyo Seimitsu as undervalued compared to its industry, the SWS DCF model offers a different perspective. According to our DCF assessment, the current share price is actually above our estimate of fair value. This brings up a critical question for investors: Is the stock's recent momentum sustainable, or does it reflect overly optimistic expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyo Seimitsu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyo Seimitsu Narrative

If you think there’s more to the story or want to chart your own conclusions, it’s easy to dig into the details and shape your own view in just a few minutes. Do it your way

A great starting point for your Tokyo Seimitsu research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the opportunity to grow your portfolio with stocks at the forefront of their fields, each offering a distinct edge for savvy investors.

- Boost your income potential by targeting stable companies offering attractive yields with these 15 dividend stocks with yields > 3%.

- Capture upside from innovative firms driving breakthroughs in healthcare by checking out these 31 healthcare AI stocks.

- Get ahead of the market and uncover value opportunities others might miss through these 870 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Seimitsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7729

Tokyo Seimitsu

Manufactures and sells semiconductor manufacturing equipment and measuring instruments in Japan, China, Taiwan, South Korea, rest of East Asia, Southeast Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives