- Japan

- /

- Semiconductors

- /

- TSE:7725

Inter Action Corporation's (TSE:7725) P/E Is Still On The Mark Following 32% Share Price Bounce

Inter Action Corporation (TSE:7725) shares have continued their recent momentum with a 32% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

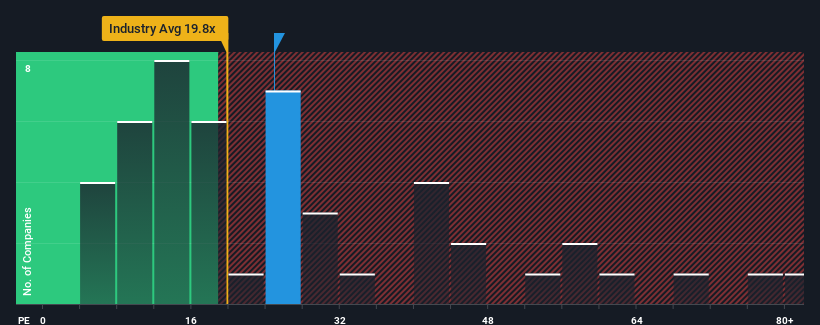

Following the firm bounce in price, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider Inter Action as a stock to avoid entirely with its 24.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Inter Action's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Inter Action

How Is Inter Action's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Inter Action's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. As a result, earnings from three years ago have also fallen 45% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 51% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 11%, which is noticeably less attractive.

In light of this, it's understandable that Inter Action's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has got Inter Action's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Inter Action maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Inter Action that we have uncovered.

If these risks are making you reconsider your opinion on Inter Action, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7725

Inter Action

Engages in the develops, manufactures, and sells inspection illuminators for applications in imaging semiconductors manufacturing processes in Japan.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives