- Japan

- /

- Semiconductors

- /

- TSE:6963

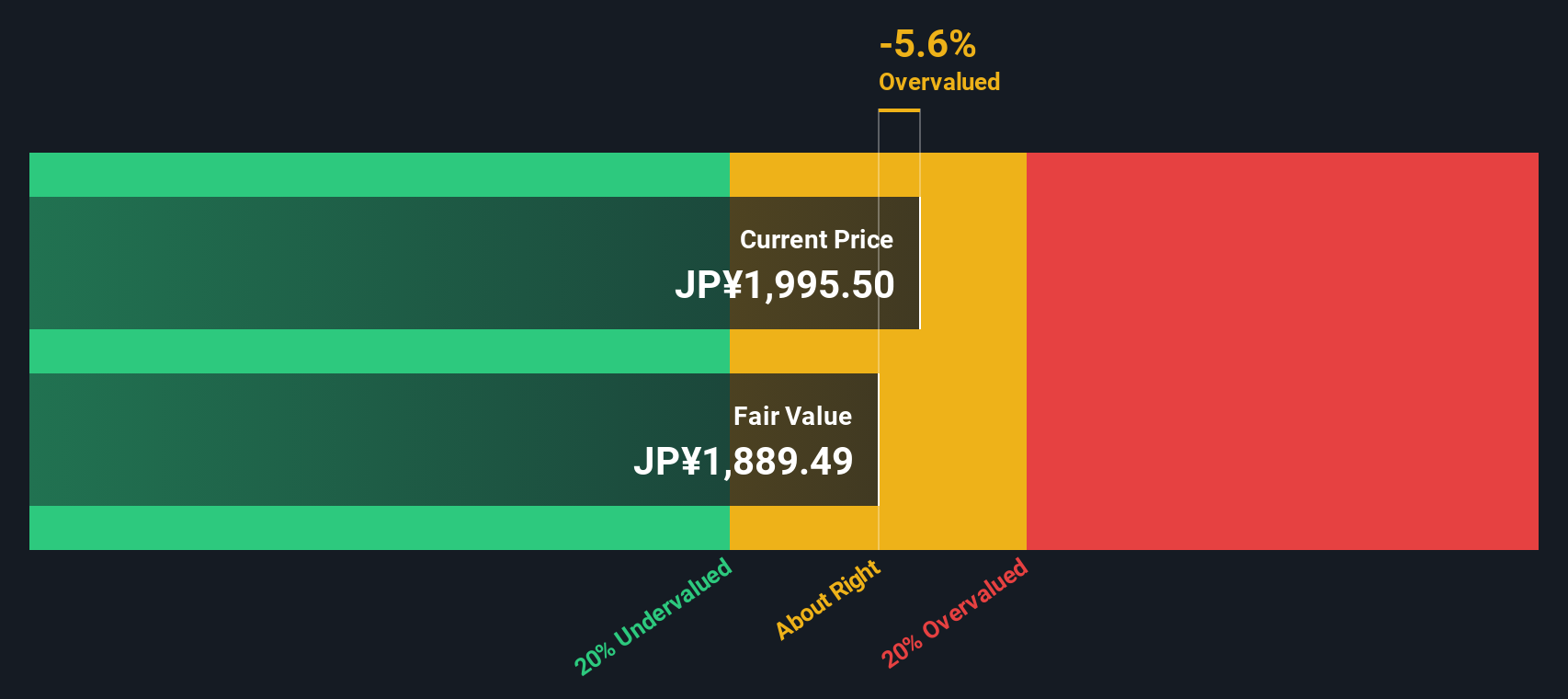

ROHM (TSE:6963) Valuation in Focus After Upgraded Financial Guidance and Strong First-Half Demand

Reviewed by Simply Wall St

ROHM (TSE:6963) lifted its financial projections for the current fiscal year, driven by stronger first-half demand and ongoing investments in digitalization and factory automation. These upward revisions have captured the attention of investors.

See our latest analysis for ROHM.

ROHM’s renewed outlook and recent innovations, such as integrating its TriC3 gate drive technology to boost energy efficiency in motors, have contributed to strong investor sentiment despite some near-term volatility. After a stellar run earlier this year, highlighted by a year-to-date share price return of nearly 34% and a remarkable one-year total shareholder return of over 42%, the stock has cooled off in the past month but still stands well ahead of where it started the year. Momentum is cooling a bit in the short term, yet these developments could set the stage for longer-term optimism as the company navigates shifting industry and macro trends.

If you’re curious to see where else cutting-edge tech is moving the market, discover See the full list for free..

With performance trending ahead of forecasts but short-term momentum showing signs of slowing, is ROHM’s recent dip a rare buying opportunity, or are today’s prices already factoring in all the future growth?

Most Popular Narrative: 8.9% Undervalued

ROHM's most widely followed narrative places its fair value at ¥2,204, about 9% higher than the last close at ¥2,007.5. This creates a compelling comparison between the projected potential and current market pricing.

ROHM is planning to increase its production capacity and efficiency for SiC (silicon carbide) power devices, correlating with expected battery EV market growth, which should enhance revenue and earnings as demand eventually picks up. The company is implementing a new organizational structure to better cater to customer needs and market applications. This aims to improve sales and potentially increase net margins by offering more integrated, solution-based proposals.

Curious which hard-hitting assumptions drive ROHM’s estimated upside? The future hinges on ambitious earnings targets, bold margin recovery, and a fresh approach to customer alignment. Wonder which forecast really tips the scales? The full narrative unpacks the sharp quantitative bets that underpin this “undervalued” claim.

Result: Fair Value of ¥2,204 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in industrial demand or ongoing inventory adjustments could challenge bullish expectations. This may limit near-term gains for ROHM's stock.

Find out about the key risks to this ROHM narrative.

Another View: What Does the SWS DCF Model Reveal?

Looking through the lens of our DCF model, ROHM’s shares trade above this model’s estimated fair value of ¥742.68. While the earlier projection suggests the stock is undervalued, the DCF calculation offers a conflicting view, implying ROHM is in fact overvalued on a cash flow basis. Which story will investors believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ROHM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ROHM Narrative

If the story above doesn’t match your own view, or you prefer to dig into the facts yourself, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your ROHM research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investing Opportunities?

Act now to sharpen your portfolio strategy with proven ideas that go beyond just one company. These handpicked opportunities might be exactly what you need for your next move.

- Tap into the power of reliable income with these 15 dividend stocks with yields > 3% to find companies delivering yields above 3% and strong cash flow fundamentals.

- Spot tomorrow’s tech leaders early by using these 27 AI penny stocks to filter innovative firms advancing artificial intelligence and automation breakthroughs.

- Step ahead of the market by tracking these 3579 penny stocks with strong financials, where hidden gems with solid financials are reshaping growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6963

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives