- Japan

- /

- Semiconductors

- /

- TSE:6941

Yamaichi Electronics Co.,Ltd. (TSE:6941) Shares Slammed 27% But Getting In Cheap Might Be Difficult Regardless

Yamaichi Electronics Co.,Ltd. (TSE:6941) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 15%.

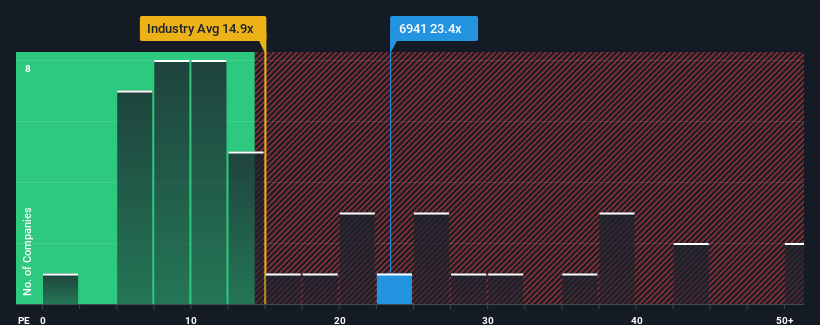

Although its price has dipped substantially, Yamaichi ElectronicsLtd may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 23.4x, since almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Yamaichi ElectronicsLtd's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Yamaichi ElectronicsLtd

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Yamaichi ElectronicsLtd's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 71% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 17% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 46% per annum as estimated by the dual analysts watching the company. With the market only predicted to deliver 9.6% per year, the company is positioned for a stronger earnings result.

With this information, we can see why Yamaichi ElectronicsLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate Yamaichi ElectronicsLtd's very lofty P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Yamaichi ElectronicsLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Yamaichi ElectronicsLtd is showing 3 warning signs in our investment analysis, and 1 of those is concerning.

If you're unsure about the strength of Yamaichi ElectronicsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6941

Yamaichi ElectronicsLtd

Manufactures and sells test, connector, and optical-related products in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives